This post was originally published on this site

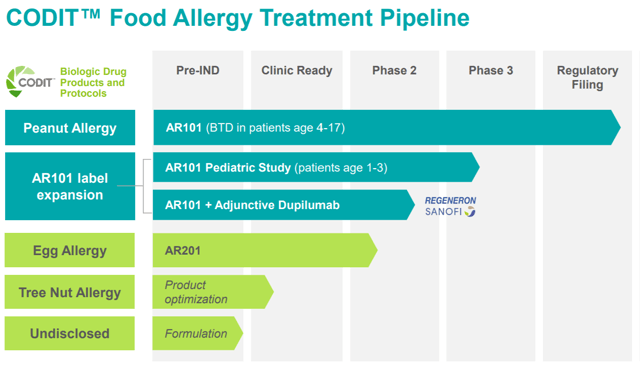

Aimmune Therapeutics (NASDAQ:AIMT) is a newly commercial-stage biopharma developing a line of drugs designed to desensitize patients with common food allergies. Aimmune’s first drug, Palforzia, was approved by the FDA to treat peanut allergies at the end of January 2020 and had just gotten out on the market when the COVID-19 crisis started. While the pandemic will certainly delay Palforzia’s ramp-up, I don’t see that anything has changed with the company’s long-term trajectory. Aimmune is also developing other drugs for egg and tree nut allergies that are in earlier stages of development. In this article, I discuss why I think Aimmune is a compelling value at present.

Palforzia Is A Potential Blockbuster That Will Drive Value Growth Over The Next Few Years

Though the timing of the pandemic was certainly poor for Palforzia’s launch, the magnitude of the drop in Aimmune’s stock is totally out of proportion to the headwinds created by these delayed sales.

Figure 1: Aimmune Stock Chart (source: finviz)

As you can see from Figure 1, Aimmune has declined over 50% from its recent highs, a drop that is way overdone in my view. Palforzia is a likely blockbuster, and Aimmune currently trades for a little under some of the estimates of Palforzia’s peak sales. There is one other therapy for peanut allergy, Viaskin, that is being developed by DBV Technologies (NASDAQ:DBVT) that has yet to be approved, but it looks like the lesser of the 2 products to me anyway. Vas Research did a great write-up on the reasons why Palforzia is likely the superior treatment recently that I suggest you check out if you want more detail.

Palforzia has a good jump on Viaskin in getting to market. Although the ramp-up of Palforzia is going slower due to the pandemic, Viaskin doesn’t even have a target action date until August 2020, and it’s never a guarantee that the therapy will receive approval. Factoring in the efficacy and timing differences, one would certainly expect Palforzia to keep well over a 50% share of the market for peanut allergies. Peak sales estimates I’ve seen for Palforzia are in the blockbuster territory, from $1.2 billion to $1.28 billion. Given that Aimmune’s current market cap is only $1.1 billion, these peak sales projections alone are suggestive that Aimmune could be a great value for a patient, long-term investor.

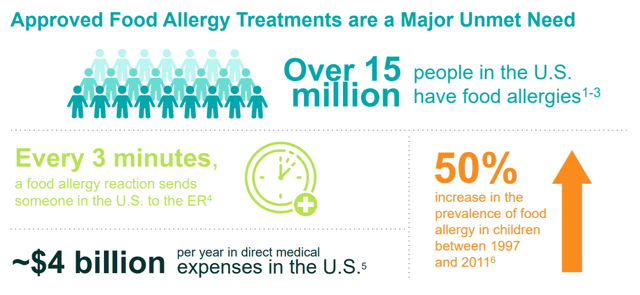

The Allergy Market That Aimmune Is Targeting Presents A Serious Unmet Need That Has Shown Tremendous Growth

Aimmune is using the technology platform that spawned Palforzia to develop therapies for egg and tree nut allergies. Allergies like these are a big deal.

Figure 2: Diagram about Food Allergy Treatments (source: corporate presentation)

Figure 2: Diagram about Food Allergy Treatments (source: corporate presentation)

Anaphylaxis, the side-effect of allergic reaction that leads to most of these hospital visits, is a justifiably scary thing for parents. I personally experienced an anaphylactic reaction as a child that led to an ER visit, and while I obviously ended up okay, it was a traumatic thing to go through for both me and my parents. Anaphylaxis can kill a child if left untreated for too long, through causing swelling that shuts off airways.

One could speculate as to the reason why, but there is no debate that allergy rates have increased tremendously over the last 2 decades. Given the lack of approved treatments and the prevalence and potential severity of these reactions, Aimmune’s therapies are targeting an important unmet need. Aimmune’s therapies are simple and easy to use – Palforzia is just a pill that is opened and the contents are poured onto food.

The idea is that this exposure to a small but increasing amount of peanut, egg, or tree nuts will build up a tolerance in the patient over time which would prevent accidental exposures and their medical consequences. Similar things have been done by a minority of allergists for years which gives further proof to the underlying concept, but such treatments have remained uncommon due to fears of potential liability if something were to go wrong. Having an FDA-approved product removes liability fears and will allow desensitization therapies like Palforzia to go more mainstream.

Aimmune’s decision to target peanut allergies first with Palforzia makes sense, given that peanut allergies are one of the more common types of food allergies, and peanuts are extremely difficult to avoid entirely.

Figure 3: Aimmune’s Food Allergy Pipeline (source: corporate presentation)

2.2% of kids are diagnosed with peanut allergy, up from just 1% before the 2010s. 20%-25% of those diagnosed will outgrow them, with the majority (80%) doing so by age 8, if they ever will. That means somewhere around 1.65% of kids develop and do not outgrow a peanut allergy.

Egg allergies are a little less common, but they are still one of the most prevalent food allergies and can lead to anaphylaxis, just like peanut allergies. 1.5%-3.2% of kids are diagnosed with food allergies, and for the purposes of this article, I use the midpoint of 2.35%. 45% of those diagnosed will outgrow it by age 5, so somewhere around 1.29% of kids develop and do not outgrow an egg allergy. This is roughly 78% of the addressable market that Palforzia has for peanut allergies.

Tree nut allergies afflict 0.5%-1.0% of children, and again, I will use the midpoint, 0.75%, for the purposes of this article. Only 9% of kids that are diagnosed will go on to outgrow a tree nut allergy, far less than the amount that could be expected for peanut or egg allergies. This leaves about 0.68% of the population suffering from tree nut allergies even into adulthood. This is roughly 41% of the total addressable market that Palforzia has for peanut allergies.

Aimmune has an ongoing Phase 2 trial for its egg allergy therapy. Enrollment has already closed, and data is expected in the first half of 2021. Aimmune also just had a positive pre-IND meeting with the FDA on tree nut allergies, and the company is currently planning what its path forward will look like.

In total, just eight foods make up more than 90% of all food allergies: egg, milk, wheat, soy, peanuts, tree nuts, fish and shellfish. In addition to the 3 that Aimmune is already targeting, it would present good potential upside were Aimmune to announce that it intends to cover some of these other common food allergies. Aimmune’s food-allergy products, both marketed and in the pipeline, look very promising right now. This outlook could change though and result in more downside for the stock if Palforzia underperforms, or if the other pipeline therapies have trouble getting to market.

Palforzia’s Commercialization Strategy Will Pay Dividends For Future Marketed Products

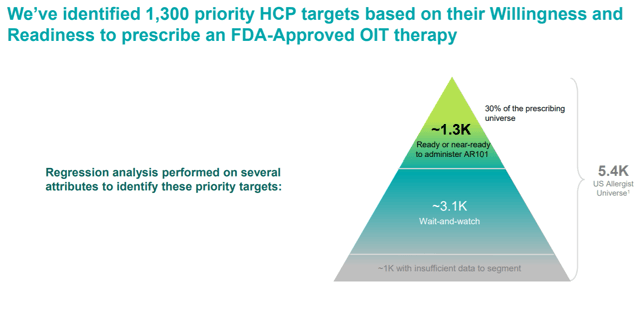

Another important part of Aimmune’s value proposition is that the same doctors will be the targets of marketing for any therapies Aimmune gets to market in the food allergy space.

Figure 4: Aimmune’s Palforzia Strategy (source: corporate presentation)

For the Palforzia roll-out, Aimmune has targeted 1,300 allergists for its initial marketing efforts. These were targeted in particular as the most likely to prescribe an FDA-approved desensitization therapy like Palforzia. Obviously then, the same reasons that make them likely to prescribe Palforzia would also make these same allergists more receptive to Aimmune’s future egg and tree nut allergy therapies. While it remains to be seen how successful this strategy will be as Aimmune gets Palforzia out onto the market – a risk that is always present with an early commercial-stage biopharma – any success that it had will likely be more enduring than the normal case due to these similarities with Aimmune’s later pipeline assets.

Also, just as a side-note, I like Aimmune’s recent move to in-license an add-on product to complement Palforzia and its future food allergy treatments. I don’t have any way to really estimate what that will add sales-wise, but I think it’s a good sign that the company is continuing to look for ways to monetize and complement its technology platform.

Aimmune’s Balance Sheet Is Strong Enough To Handle The Initial Palforzia Launch But More Cash Will Likely Be Necessary Before The Company Is Profitable

Aimmune’s balance sheet shows a lot of cash at present – $371 million in cash, cash equivalents, and investments – $200 million of which came from a recent investment by Nestle Health Science. It’s noteworthy to me that a big company like Nestle thought it worthwhile to invest in Aimmune.

While this is a decent amount of cash, it’s not enough to make me think they won’t need additional funding before getting Palforzia sales to a high enough level to support the rest of the business. Cash burn was about $248 million in 2019, implying a cash runway through mid-2021 at that level.

Aimmune also has $125 million in long-term debt, which is through a credit facility with KKR. Aimmune can potentially tap up to $170 million in funding, with 50% having to be paid back on December 31, 2023, and the rest being paid incrementally between then and January 3, 2025. All of that combined makes me think Aimmune will need to raise cash probably one more time, and it’s certainly possible that will be through a dilutive stock sale. A downside risk for the company is that Palforzia sales are underwhelming or just very slow to pick up, and the company has to raise far more capital than currently expected.

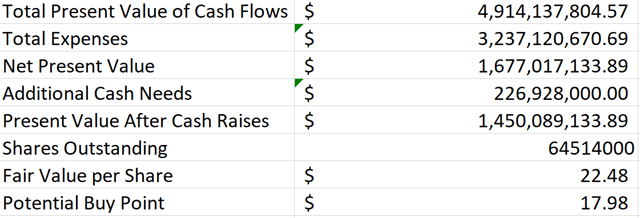

Aimmune Looks Undervalued Based On My Discounted Cash Flow Analysis

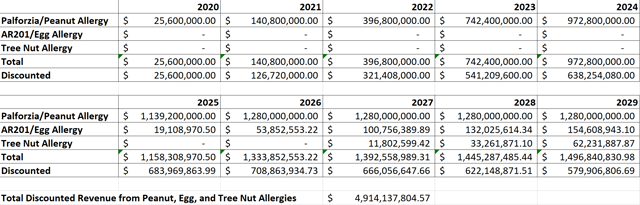

I’ve been an Aimmune shareholder for several months now, but I updated my discounted cash flow model for the purposes of this article. Although Palforzia should get a 12-year exclusivity based on the FDA’s acceptance of its BLA, I only valued the company based on discounted cash flows over the next 10 years. In my mind, this more appropriately accounts for the unknowns that can always pop up in the biopharma space. Just look at what has happened recently to Amarin (AMRN) with their adverse patent decision for Vascepa if you’re not sure what I’m talking about.

I estimate SG&A expenses as 35% of revenue, marketing expense at 5% of revenue, and cost of goods sold at 10%, at the point where the company has substantial cash flow in a few years, and I scale the numbers up fairly evenly from present values for the years in between. I also adjusted for future cash flow needs based on continuing cash burn for what will likely be the next 2+ years. It’s also worth noting that no Phase 1 trials are required for Aimmune’s food allergy drugs because they are derived from foods that have never shown any toxicity in humans, so R&D expenses will likely be a little less for Aimmune’s pipeline therapies than normal.

Figure 5: Aimmune Discounted Cash Flow Analysis (source: Aimmune’s First Quarter Update and my calculations based off of it)

I estimated the egg and tree nut allergy drugs as having peak sales equivalent to 78% and 41% of Palforzia’s for the reasons discussed above. Because I only included the next 10 years’ worth of cash flow in my model to be conservative, these two additional drugs don’t make a huge cash flow contribution in my model.

As you can see in Figure 5, my model shows a potential fair value of $22.48 per share, right about 30% above where Aimmune is currently trading. In my view, this shows that Aimmune has a wide margin of safety for long-term investors at this level. I recently added some additional Aimmune stock to my portfolio, so I now own a full position in the stock. I intend to hold on to most of my position long term, although I could see paring some of it if Aimmune were to have a substantial short-term rally from these current low levels.

Conclusion

I view Aimmune as a quality company that offers good value for the long-term investor at present. Aimmune has a novel and much-needed technology platform to combat food allergies, and the company has done a good job so far at bringing along multiple therapies at a decent pace. How the Palforzia launch goes after the pandemic starts to subside will be important to watch, but I feel safe owning the stock at present.

Disclosure: I am/we are long AIMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor the timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself without notification. The thesis that I presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance as financial circumstances are individualized.