This post was originally published on this site

Revenue grew 70% year-over-year to $6.6 billion, compared to the consensus estimate of $6.53 billion, driven by growth across all segments and the inclusion of Xilinx (NASDAQ:XLNX) revenue.

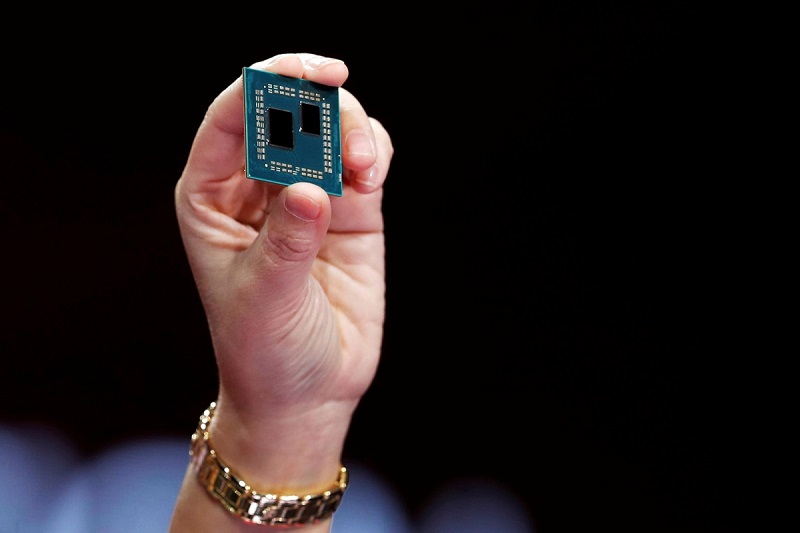

According to Dr. Lisa Su, Chair and CEO of AMD, the company delivered its eighth straight quarter of record revenue based on its strong execution and expanded product portfolio, with each segment growing significantly year over year. “We see continued growth in the back half of the year highlighted by our next generation 5nm product shipments and supported by our diversified business model,” added Su.

Data Center segment revenue grew 83% year-over-year to $1.5 billion, driven by strong sales of EPYC™ server processors. Client segment revenue grew 25% year-over-year to $2.2 billion, driven by Ryzen™ mobile processor sales. Gaming segment revenue grew 32% year-over-year to $1.7 billion, driven by higher semi-custom product sales, partially offset by a decline in gaming graphics revenue. Embedded segment revenue grew 2,228% year-over-year to $1.3 billion, driven by the inclusion of Xilinx embedded revenue.

The company expects Q3/22 revenue to be in the range of $6.5-6.9 billion, compared to the consensus estimate of $6.82 billion. Non-GAAP gross margin is expected to be approximately 54%.

For the full 2022 year, the company expects revenue of $26.3 billion, compared to the consensus estimate of $26.1 billion. Non-GAAP gross margin is expected to be approximately 54%.

By Davit Kirakosyan