This post was originally published on this site

https://fortune.com/img-assets/wp-content/uploads/2024/03/GettyImages-1458276582-e1711452735644.jpg?w=2048

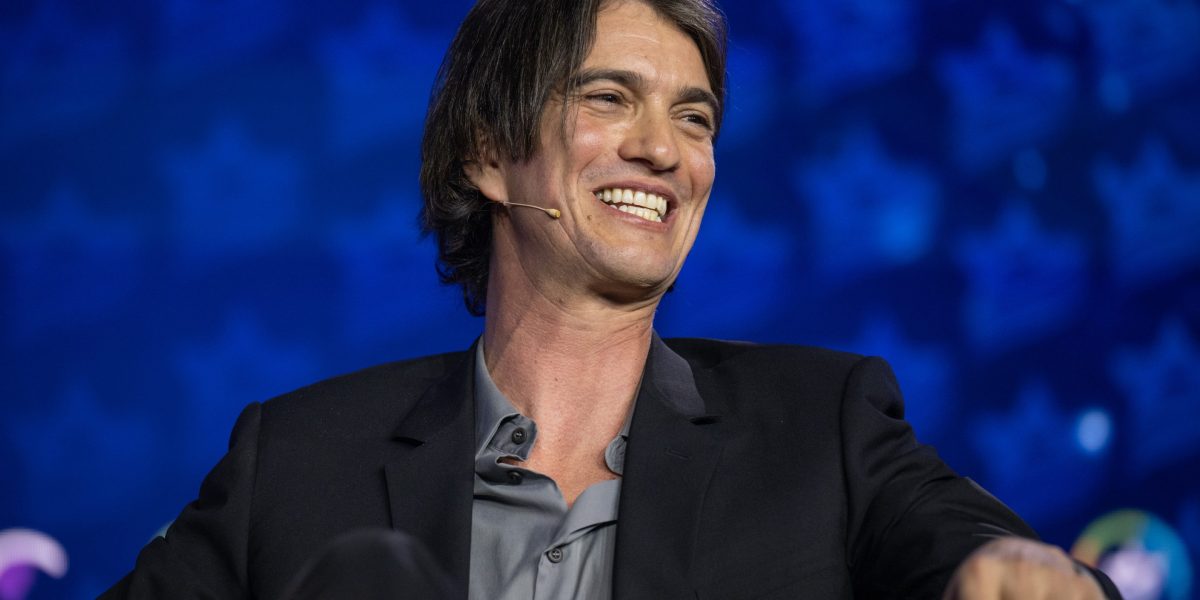

Adam Neumann is determined to prevent WeWork’s demise. Reports indicate he has assembled a $500 million financing package to salvage his old co-working venture from collapse.

Neumann has kept himself busy since his ousting from the office-sharing company, launching real estate business Flow in 2022 with a reported valuation of $1 billion.

Now, according to The Wall Street Journal, Neumann and several partners have submitted a bid to purchase WeWork for more than $500 million, citing people familiar with the matter.

A spokesman for the company told Bloomberg that Neumann’s proposed purchase price for WeWork is considerably higher than $500 million, saying: “Two weeks ago, a coalition of half a dozen financing partners—whose identities are known to WeWork and its advisers—submitted a potential bid for substantially more than The Wall Street Journal reported.”

It is unconfirmed how Neumann will finance the acquisition, and representatives for Flow did not respond to Fortune’s request for comment.

WeWork is assessing its options having filed for bankruptcy in the U.S. in November, listing nearly $19 billion dollar of debts.

The New York-based company revealed in a Chapter 11 filing it had $15 billion in assets and added it had struck a restructuring agreement with creditors representing roughly 92% of its secured notes.

A subsequent restructuring in the wake of the filing remains the company’s focus in light of Neumann’s offer, WeWork told Fortune.

“As we’ve said previously, WeWork is an extraordinary company and it’s no surprise we receive expressions of interest from third parties on a regular basis,” a spokesman said.

“Our board and our advisors review those approaches in the ordinary course, to ensure we always act in the best long-term interests of the company.

“WeWork remains intensely focused on finishing the important work we began back in November, and believe we will emerge from Chapter 11 in the second quarter as a financially strong and profitable company.”

The return of Neumann at WeWork

The potential return of Neumann to the corner office at WeWork—the company he founded in 2010—may prompt mixed reactions among staff.

The former CEO stepped down in 2019 citing scrutiny of his leadership as a “distraction” for the company after a stock exchange listing went awry over questions around finances and governance.

Neumann, who had built the company to a valuation of $47 billion within a decade, was also paid eye-watering sums upon his exit, namely a $185 million non-compete agreement, $106 million settlement payment and $578 million received for shares sold by Neumann to longtime investor SoftBank.

And while Neumann is worth approximately $2.3 billion according to Bloomberg, the 2019 IPO fumble meant many staff’s stock options were rendered worthless.

On top of that, the company once known for its lavish parties and mini summer camps cut 2,000 roles after it withdrew its IPO—leading many to question Neumann’s leadership while still at the helm.

For his part, Neumann has offered commentary but never apologized since his departure.

In 2021, his first public interview since leaving the company, Neumann told the New York Times DealBook Summit he had many regrets about his exit from the company and the subsequent decisions made to get the business back on track.

Regarding the job losses after his departure, he said: “I did not expect it, I didn’t want it, I feel tremendous regret for it even though it happened after I stepped down and it happened because the company is changing directions.”

Neumann, who said he remained silent in the years after stepping down to allow the business to take center stage, has more recently leveled criticism at those who took over after him.

In November, upon hearing the news of the business’s bankruptcy, Neumann said: “It has been challenging for me to watch from the sidelines since 2019 as WeWork has failed to take advantage of a product that is more relevant today than ever before.

“I believe that, with the right strategy and team, a reorganization will enable WeWork to emerge successfully.”

It seems Neumann, at least, believes he might be the man for the job.