This post was originally published on this site

Abraxas Petroleum’s (AXAS) longer-term future appears grim. It is very well hedged on oil in 2020 and 2021, which should allow it to pay down some of its credit facility debt. However, it is challenging to see a way that it can deal with its second-lien credit facility debt (maturing in November 2022) without oil returning into at least the $60s, if not reaching the $70s.

Abraxas’ second-lien debt also comes with a high interest rate (LIBOR + 9%), which means that a significant amount of cash flow is going towards paying that interest.

Delayed Reporting And Other Notes

Abraxas is currently still working on filing its 10-K for 2019 and its 10-Q for Q1 2020, with the delay blamed on disruption from the coronavirus. It has also been working on cutting costs (such as by reducing the size of its Board of Directors from 10 to 4) and estimates that it has lowered G&A by 40%.

The April 2020 re-determination on its credit facility may still cause Abraxas some issues due to its significant working capital deficit. It had a $135 million borrowing base on its credit facility in November 2019, versus $94 million of borrowings. The impact on cash flow of a narrowing working capital deficit could result in a borrowing base deficiency if its borrowing base is reduced substantially, though.

Strong Hedges And Declining Production

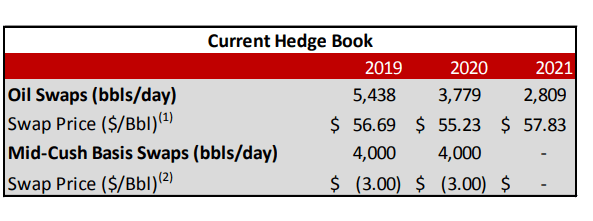

Abraxas mentioned that it had 95% of its estimated production for the rest of 2020 hedged at around $55 per barrel and 100% of its estimated 2021 production hedged at around $58 per barrel. Abraxas last updated its hedging position in December.

Source: Abraxas Petroleum

This would point to Abraxas potentially averaging around 4,500 barrels of oil production per day in 2020 (assuming a solid first few months, then some shut-in production and no new wells coming online). It could potentially average as little as 2,800 barrels of oil production per day in 2021 due to its cessation of development activities.

Debt Situation

With a minimal capex budget and its strong hedges, Abraxas should be able to pay down some of its debt over the next couple years at strip prices. Abraxas had $94 million in credit facility debt at the end of Q3 2019 and was expecting $8 million in asset sale proceeds. It may be able to reduce its debt by another $30 million to $40 million by the end of 2021 at strip prices. However, it also had a $30 million working capital deficit (excluding derivatives) at the end of Q3 2019.

This results in a projection of $51 million in credit facility debt at the end of 2021, plus however much its working capital deficit gets reduced (for a total of up to $81 million in credit facility debt). Abraxas’ ability to pay its credit facility down more rapidly is hampered by its high second-lien term loan interest costs (which add up to over $9 million per year).

Abraxas had a $135 million borrowing base, but this is likely to be reduced significantly due to the oil price crash. Abraxas borrowing base is probably going to be a limiting factor going forward even if oil prices rebound to a level where it can generate decent well-level returns. Unless oil prices reach the $60s or $70s, Abraxas likely won’t have the ability to grow its production substantially (due to a need to avoid cash burn).

This leaves Abraxas’ $100 million second-lien term loan (maturing November 2022) as a very challenging problem. If Abraxas’ oil production is only 3,000 or 4,000 barrels per day then, it won’t be able to refinance that term loan. The second-lien term loan lenders may end up in control of Abraxas at that point.

Conclusion

Abraxas is now spending minimal capex due to poor well-level economics at current oil prices for both the Bakken and the Delaware Basin. This decision makes sense, and Abraxas should be able to pay down part of its debt with the help of its hedges.

Abraxas’ problem is that its production is going to go down much faster than its debt though. By the end of 2021, Abraxas’ oil production may be down 50+% from end of 2019 levels. However, it may only be able to reduce its total debt (including working capital deficit) by around 20% during that time period. While Abraxas has attempted to reduce its fixed costs, its second-lien term loan interest is a considerable burden that it can’t eliminate without restructuring. As its production decreases, that interest cost becomes more significant, potentially reaching $9 or $10 per barrel of oil by late 2021.

Free Trial Offer

We are currently offering a free two-week trial to Distressed Value Investing. Join our community to receive exclusive research about various energy companies and other opportunities along with full access to my portfolio of historic research that now includes over 1,000 reports on over 100 companies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.