This post was originally published on this site

Nearly 25,000 people had traditional and Roth individual retirement account balances of at least $5 million and $10 million in 2019, according to recent data obtained by the Senate Finance Committee — in total, these accounts amount to $160 billion.

Of those investors, 2,175 people have Roth IRAs and almost 22,000 have traditional accounts. Roth accounts are funded with after-tax dollars, which means when it is time to distribute (and if done correctly) the money will be withdrawn tax-free.

The Senate Finance Committee, which requested this data from the Joint Committee on Taxation, also found almost 500 investors had at least $25 million in their IRAs — 156 of these taxpayers had Roths, which had an aggregate balance of $15.6 billion, and 303 of them had an aggregate balance of $53.1 billion.

These “mega-IRAs” have faced significant scrutiny in recent months, after ProPublica reported Peter Thiel, co-founder of PayPal PYPL

PYPL,

had amassed $5 billion in his Roth IRA. Legislators are reconsidering how these accounts are managed and taxed, and proposing ways to restrict the ultrawealthy from using Roth accounts to harbor tax-free investments.

See: How to invest in a Roth IRA like — and unlike — PayPal co-founder Peter Thiel

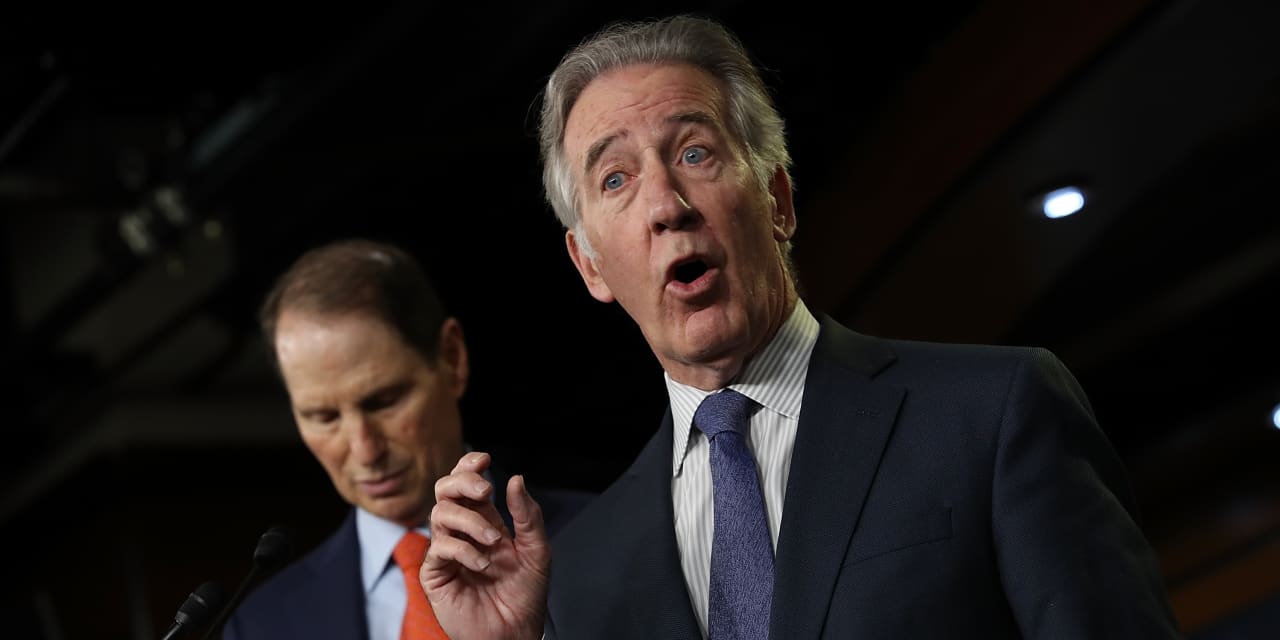

“These data indicate that the exploitation of IRAs is a growing problem,” House Ways & Means Committee Chair Richard E. Neal, a democrat from Massachusetts, said in a statement. “IRAs are intended to help Americans achieve long-term financial security, not to enable those who already have extraordinary wealth to avoid paying their fair share in taxes and deepen existing inequalities in our nation. The Ways and Means Committee is already looking at strategies to ensure that this retirement savings tool isn’t misused as a tax shelter for folks at the very top.”

The latest data reflects a drastic change in the number of taxpayers with account balances of at least $5 million — prior to this report, a 2014 Government Accountability Office report using 2011 tax data found 8,000 investors had aggregate IRA balances of $5 million or more, the Senate Finance Committee stated.

“It is shocking, but not surprising, to see how the use of mega-IRA accounts by mega-millionaires and billionaires has exploded,” Senate Finance Committee Chair Ron Wyden, a Democrat from Oregon, said in a statement. “IRAs were designed to provide retirement security to middle-class families, not allow the super wealthy to avoid paying taxes.”