This post was originally published on this site

A paper co-authored by former U.S. Treasury Secretary Larry Summers argues a “super-tight” U.S. jobs market means it’s unlikely the Federal Reserve will successfully engineer a soft landing.

Summers, himself at one point a candidate to head the central bank, has been for some time a critic of Fed policy, as well as the Biden administration’s stimulus policy.

In a paper circulated by the National Bureau of Economic Research, Summers and Alex Domash, a research fellow at the Harvard Kennedy School, say the idea inflation can fall dramatically without a corresponding rise in labor market slack runs counter to standard economic theory as well as historical evidence.

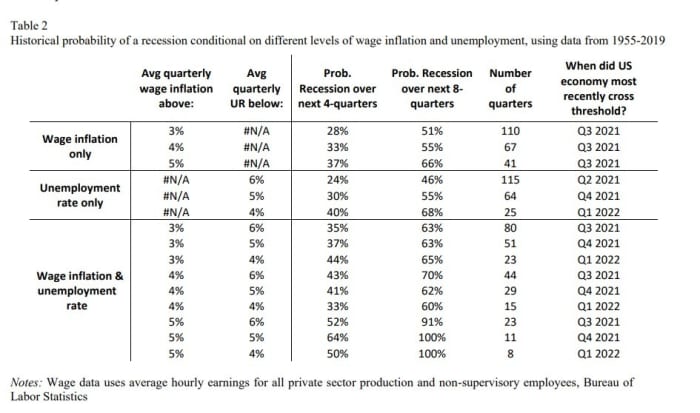

Since 1955, there’s been a quarter with price inflation above 4% and unemployment below 5% that was not followed by a recession within two years, they note.

On Friday, the Labor Department said the unemployment rate dropped to 3.6%, while the Commerce Department said the Fed’s preferred inflation gauge, the PCE price index, was running at 6.4%.

Summers and Domash turn to a different report on the jobs market, the job openings and labor turnover survey, to make the claim of a super-tight labor market. The number of job vacancies per uneployed is higher than it’s been in 70 years, while worker quits remain significantly elevated.

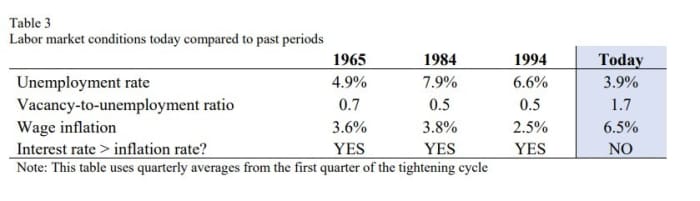

They use the Atlanta Fed’s three-month average of median wage growth — which was 6.5% in February — to show the highest levels of wage growth in 40 years.

Historically, they note, the likelihood of a soft landing is very low based on current conditions. And the unemployment rate and wage inflation data is much different now than in the soft landings of 1965, 1984 and 1994.

Fed Chair Jerome Powell in a speech in March used those three periods as evidence of soft landings.

To bring the inflation rate down to 2.3% by 2024 and wage inflation down to 3%, the unemployment will have to surge to 8.4%, according to Summers and Domash economic model. Wage inflation of 4% would require a less painful 5.4% unemployment rate, according to their model.

The yield curve, at the 2-year

TMUBMUSD02Y,

and 10-year

TMUBMUSD10Y,

level, inverted on Friday, which is historically a strong recession signal.