This post was originally published on this site

The housing market is finally catching a breath after a two-year sprint. A new report breaks down how the frenzy unfolded.

The report, called the ‘State of the Nation’s Housing 2022’ by Harvard Joint Center for Housing Studies, reveals the steep rise in costs associated with owning or renting a home, and how competition among buyers has intensified.

With median home prices zooming past $400,000, owning a home has become a lot less affordable for the average prospective buyer.

The national median listing price for active listings was $447,000 in May 2022, up 17.6% compared to last year, and an increase of 35.4% vs. May 2020, according to Realtor.com.

To afford a median-priced home, a buyer would have to put down more than 38% of their income, according to the Atlanta Fed’s Home Ownership Affordability Monitor.

Some 67 of the top 100 housing markets experienced record-high appreciation rates at some point over the last year, the report said.

The median home now costs upwards of $400,000. (TERRENCE HORAN/MARKETWATCH/HARVARD)

And this environment is likely to persist for a bit, given how tight inventory is. In May, homes remained on the market for just 16 days on average, which is the lowest figure on record, according to the National Association of Realtors.

“Unlike the previous run-up when loose credit and speculative buying fueled a housing bubble, the current home-price surge largely reflects years of under-building,” the report explained.

Supply-chain constraints, labor shortages, regulatory constraints strangling home builders are all to blame for the slow pace of new construction.

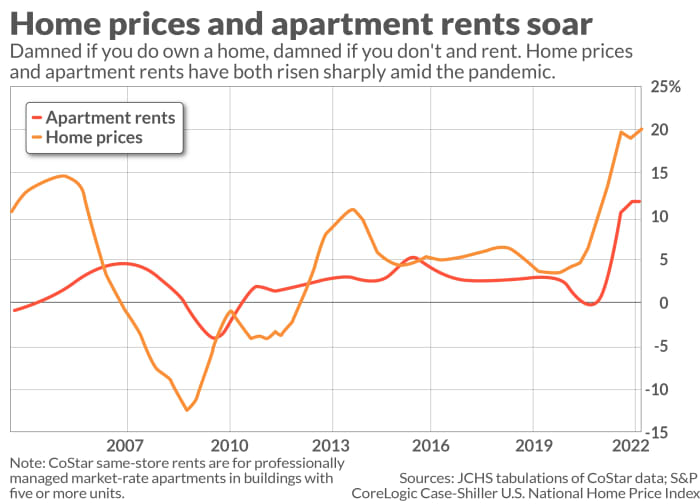

Home prices and rents have risen sharply amid the pandemic. (TERRENCE HORAN/MARKETWATCH/HARVARD)

Renting has also become less affordable. “The cost of both owner-occupied and rental housing continue to climb,” the authors of the Harvard report stated.

Rents were up 12% nationally in the first quarter of this year, and higher in some metro areas.

Though rents did fall in big cities like New York during the pandemic, the rebound amid the return-to-work environment has been sharp. In the first quarter of 2022, rents for apartments in NYC rose by 20%, compared to the year before.

Rents for single-family homes rose even faster, by 14% in March 2022 as compared to the previous month.

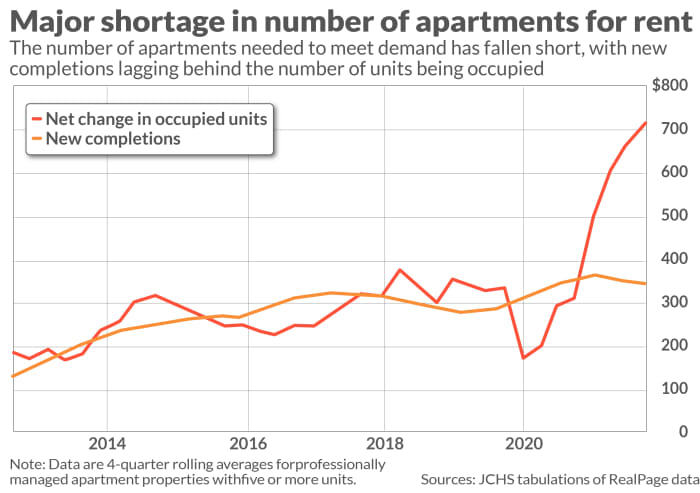

The number of apartments needed to meet demand has fallen short. (TERRENCE HORAN/MARKETWATCH/HARVARD)

Demand for rental units has really surged in the last year.

“A number of temporary factors helped to buoy rental demand in 2021,” the report explained.

“Federal cash supports, student-loan payment deferrals, and the pickup in employment likely boosted the incomes of many young adults enough so that they could afford to form their own households,” the authors stated.

“Other government interventions protected millions of renters [who were] behind on their rents from eviction. The high prices and tight supply of for-sale homes also played a role in driving up demand by keeping many would-be buyers in rental housing,” they added.

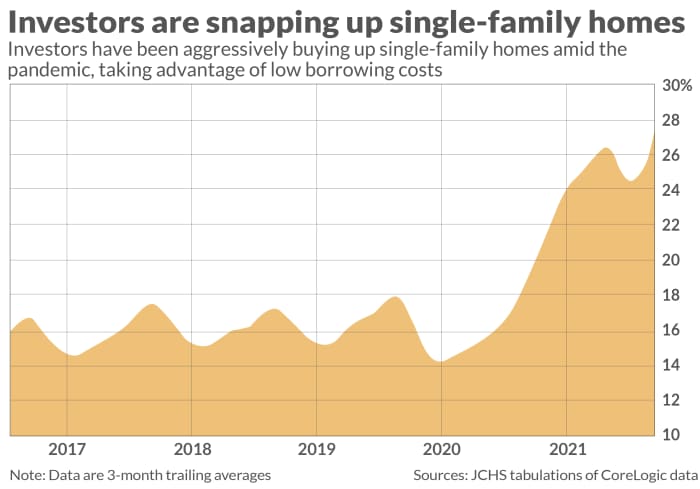

Investors are taking advantage of low borrowing costs. (TERRENCE HORAN/MARKETWATCH/HARVARD)

Part of the pressures in both markets comes from increasing investor share of the rental market.

Investors’ share of the sale of single-family homes in the first quarter of this year hit 28%, the report noted, citing CoreLogic data, which was up from 19% a year ago. Between 2017 and 2019, investors’ share of the sale of single-family homes was 16% on average.

Investors have been focused on the South and West, the report stated. In the last quarter of 2021, the highest investor share of home sales was posted in Atlanta, at 41%, followed by San Jose at 38%, Phoenix and Las Vegas at 36%.

To make matters worse, investors are targeting lower-priced homes, edging out first-time buyers.

“In September 2021, investors bought 29% of the homes sold that were in the bottom third by metro-area sales price, compared with 23% of homes sold in the top third,” the report stated. “Investor-owned homes are typically converted from owner-occupied units to rentals or upgraded for resale at a higher price point.”

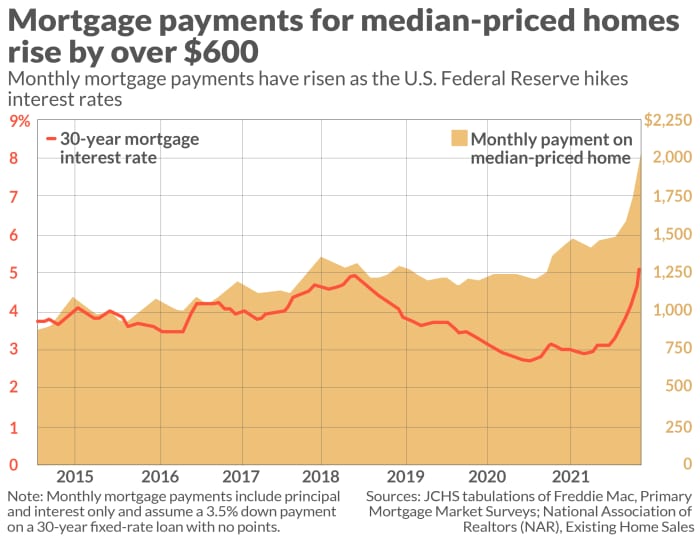

The U.S. Federal Reserve’s interest-rate hikes add to mortgage costs.(TERRENCE HORAN/MARKETWATCH/HARVARD)

The Harvard report estimates that the payments for a median-priced home have gone up by over $600 a month.

In its efforts to combat rising inflation, the Federal Reserve hiked interest rates, which pushed mortgage rates up sharply. The average rate on a 30-year fixed-rate mortgage has gone past 6%, according to Mortgage News Daily.

“With prices continuing to rise along with interest rates, the savings and income needed to qualify for a home loan have skyrocketed, raising financial hurdles for first-time and middle-income buyers,” the report stated.

It’s an expensive proposition to own a home under the conditions today: If you’re a first-time buyer who’s putting down a 7% down payment on a median-priced home, that would have amounted to $27,500 in April 2022, the report said.

This amount “alone would rule out 92% of renters, whose median savings are just $1,500,” the authors added.

To afford a median-priced home, the minimum annual income required to afford the steep down payments is up from $79,600 in April 2021 to $107,600 in April 2022.

Write to MarketWatch reporter Aarthi Swaminathan: aarthi@marketwatch.com