This post was originally published on this site

Value stocks have greatly outperformed growth stocks this year as the Federal Reserve has turned off the money spigot. But investors have slim pickings if they want to buy an environmental, social or governance fund that tilts to that style.

Many ESG investors are underperforming the broader market for a few reasons: Funds in that niche are underweight the sectors that are driving market dominance, mainly fossil-fuel energy companies, which are considered value plays because of their low valuations. ESG funds are often overweight the technology sector, which is in a bear market.

When it comes to value ESG funds, their options are severely limited.

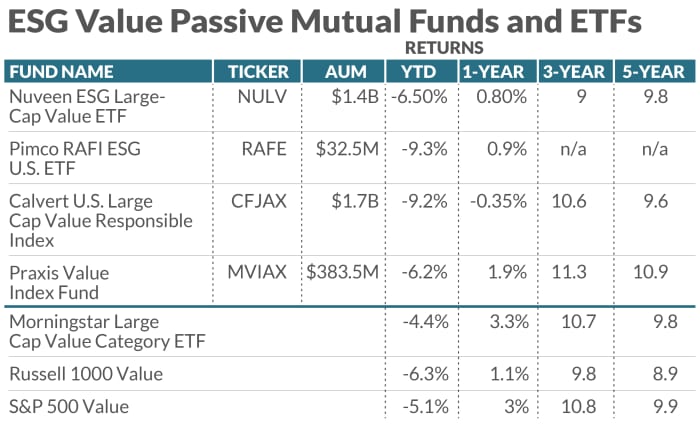

There are only five mutual funds and exchange traded funds that are expressly value-oriented, and four are index funds: Nuveen ESG Large-Cap Value ETF

NULV,

Pimco RAFI ESG U.S. ETF

RAFE,

Calvert U.S. Large Cap Value Responsible Index

CFJAX,

and Praxis Value Index Fund

MVIAX,

A fifth, Parnassus Endeavor

PARWX,

is an actively managed mutual fund.

There are more than 550 sustainable funds available to U.S. investors, according to Morningstar, but the vast majority are growth-oriented strategies or are a blend of growth and value, but tilted to growth because of market-cap weighting.

The meager supply of ESG value funds isn’t surprising, given the style was out of favor for so long. Todd Rosenbluth, head of research at ETF Trends, says value ETFs were unpopular for the past several years as the Fed kept rates low, boosting technology stocks. He says the ESG ETF universe is still a relatively young category in terms of product development.

A cross-check of sector holdings of the four index-based value funds show they all are underweight energy versus their peers, with the large value category’s energy weighting at around 7%. The biggest performance laggards of these funds are the Pimco and Calvert funds, which hold less than 0.5% in energy.

Credit: Morningstar

Giving up performance for values?

Traditional value sectors such as energy and utilities often are heavily weighted to fossil-fuel companies or companies that emit high carbon emissions. When those sectors are performing well, such as now, ESG investors who shun those types of companies may have to settle for underperformance.

Rosenbluth is quick to point out that doesn’t mean those sectors will always be in favor even in value-oriented market cycles.

“There’s likely to be market rotation, even within the value sphere,” Rosenbluth says. “But if you own one of these, you might be disappointed that they’re not holding up as well, in this environment because of what they’re missing.”

But the short-term performance drag may not matter to ESG investors.

“I think investors in ESG products should be willing to miss out on some of the upside because they prioritize companies that adhere to certain standards from all three of those pillars of ESG. If they wanted benchmark-like performance, they could just own the traditional benchmarks,” he says.

Jordan Farris, head of ETF products at Nuveen, says the firm’s ESG value fund has the most assets under management (AUM) of their total of 18 ETFs, both ESG and non-ESG. This year alone, through May 1, the ESG value fund saw $200 million in flows.

Their suite of ESG ETFs were built to include names that scored in the top 50% in each sector and Nuveen overlaid a low-carbon criteria to reduce the weighted average carbon emissions intensity relative to non-ESG products. Additionally, sector weights are optimized to be plus or minus 4% relative to the parent index to reduce tracking error. That helps the ESG ETFs hew relatively close to sector representation compared to non-ESG ETFs.

Nuveen’s ESG value ETF has 3.8% weighting to energy, and includes names such as Halliburton

HAL,

and Sempra Energy

SRE,

Even so, Farris says the weighted average carbon intensity of their ESG value fund is less than peers. Morningstar computes a carbon-risk score for funds, which runs from zero to 100, with 100 the highest risk. It shows Nuveen’s ESG value fund’s carbon risk score at 7.28 versus the category average of 10.28.

“I would consider this an improvement product, rather than an absolute product. What we’re striving for here is a higher ESG score and a lower carbon emissions intensity with a very similar risk and return profile as a standard non ESG value index,” Farris says.

Looking outside of funds

Jeff Finkelman, managing director of sustainable investments at Fiduciary Trust International, says while ESG funds are underperforming now, it’s important to keep a long-term time horizon in mind when thinking about sustainable investing as the trends related to social issues, climate change and the inevitability of an energy transition aren’t going away.

Rather than look at funds, investors may need to consider individual sectors, Finkelman says, suggesting companies in recycling, waste management, chemicals or industrial processes.

“Those are the areas where ESG issues are perhaps even more financially material over time, as these as these long-term trends play out,” he says.