This post was originally published on this site

With inflation rates sticking at 40-year highs, people keep getting pelted by the old chestnut about a dollar not going as far as it used to.

Just ask anyone who’s recently purchased a slab of bacon or a dozen eggs, among other household staples.

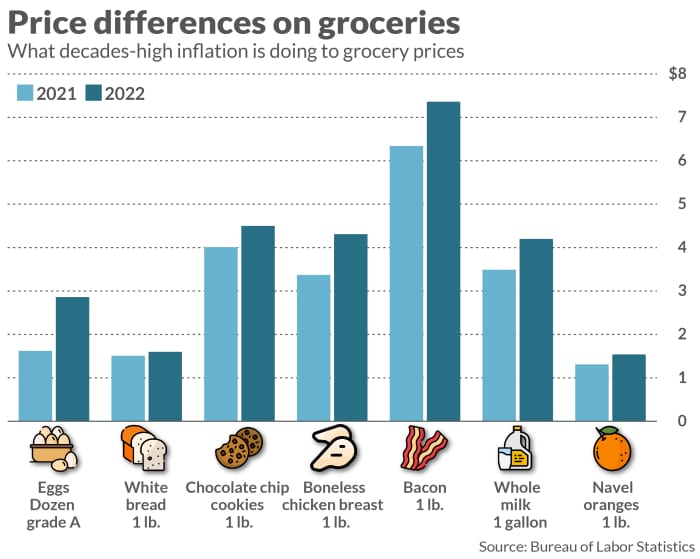

A person who paid for the breakfast products in May 2021 would need to pay an extra buck apiece to get the same amount of eggs and bacon in May 2022, according to Friday inflation data.

The Bureau of Labor Statistics’ closely-watched Consumer Price Index is mainly about price percentage increases — and Friday’s read showed steep ones for May.

There was a 1% increase in overall costs for consumers goods and services, month to month, surpassing analyst expectations, and an 8.6% increase year-over-year, according to the agency. All three stock market indices (

DJIA,

SPX,

and

COMP,

) were down sharply after the hotter-than-hoped May numbers landed.

The CPI data also included average dollar costs on certain commodities. A look through the numbers serves as a reminder that inflation may be about prices increasing — and it’s also about purchasing power decreasing. Especially at a time when wage growth isn’t keeping pace.

From May 2021 to May 2022, worker wage grew by 5.2%, the Bureau of Labor Statistics said last week.

As a whole, a person would need roughly $292 dollars last month to have the same purchasing power of $100 in a baseline period from 1982 to 1984, the most recent Bureau of Labor Statistics data showed. A year ago, that person would have needed about $269 to have the same purchasing power.

Which gets back to the eggs.

If a person bought a dozen Grade A eggs in May 2021, they paid $1.62 on average, according to federal data. Last month, that same carton of eggs cost $2.86.

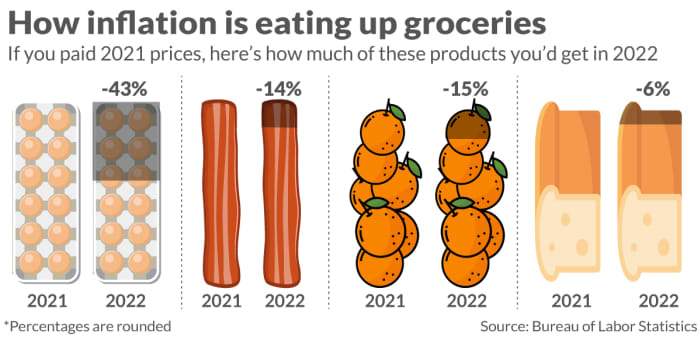

So if a customer tried paying $1.62 for eggs now, they’d be getting approximately 43% fewer eggs through their diminished purchasing power.

The breakfast-goer would be getting less bacon too. Last May, they paid an average of $6.34 per pound. This May, they were paying $7.36 on average. If they tried to spend only $6.34, they’d be getting 14% less bacon.

The same dynamic applies for other consumer staples, including white bread, chocolate chip cookies, chicken breasts, milk and oranges.

Overall, the cost of groceries climbed 12% from May 2021 to May 2022, the May inflation data show.

The faded purchasing power is even more stark for gasoline. The national average has now breached the $5 per gallon mark, according to GasBuddy. Friday’s national average, according to AAA, was just about $4.99. A year ago, it was $3.07 per gallon.

Though equal amounts of goods are costing more now than a year ago, consumers are increasingly coping with “shrinkflation” too, where packaging gets smaller while prices stay where they are. Manufacturers shrink packages in the hope that consumers won’t notice they’re essentially paying more for less.

To be sure, the story of inflation at this point is its spread to many parts of life beyond the grocery store.

The question is whether and when consumers are going to scale back their spending because the sticker price is simply too high.

One widely-watched consumer sentiment reached a record low on Friday as people braced for high inflation to stick around.

In the past, the low consumer expectations “would have been consistent with a hefty outright decline in real consumers’ spending,” according to a Friday note from Ian Shepherdson, chief economist at Pantheon Macroeconomics. “But we see no sign of that right now.”

Shepherdson has a theory for the split between consumer mood and spending. It’s “probably because consumers in aggregate are sitting on an extra $3.5 [trillion] in bank accounts and money market funds, relative to what we would have expected in the absence of the pandemic,” he said.