This post was originally published on this site

ETF Overview

Vanguard Short-Term Bond ETF’s (BSV) focus on investment-grade corporate bonds and U.S. treasuries makes it an attractive choice for investors seeking funds with low credit risk. Its interest rate risk is also low due to its short average duration to maturity years. However, BSV’s higher exposure to U.S. treasuries makes it a less appealing choice for investors seeking yield. Therefore, we recommend investors to find ETFs with higher exposure to investment-grade corporate bonds, especially given the fact that the Federal Reserve is now also buying these bonds.

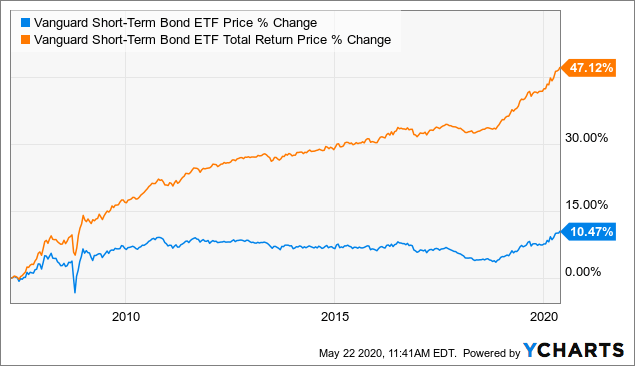

Data by YCharts

Data by YCharts

Fund Analysis

Low credit and low interest rate risks

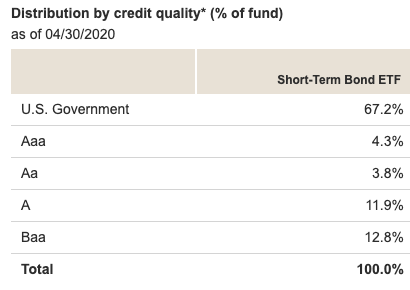

We like the fact that about 67% of BSV’s portfolio are treasuries issued by the U.S. government. This is one of the safest bonds to hold on earth right now as they have superior credit rating. The remaining bonds in BSV’s portfolio are investment-grade corporate bonds. As can be seen from the table, Aaa, Aa, and A-rated bonds represent about 20% of BSV’s portfolio. We understand that in the current environment, many bond issuers’ credit ratings may be downgraded. Therefore, investors should take comfort that Baa-rated bonds, the lowest grade of investment-grade bonds, represent only about 12.8% of the total portfolio. For readers’ information, investment-grade bonds’ default rate is only about 0.10% per year (based on a 32-year period measured). On the other hand, default rate for below-investment-grade bonds was 4.22% per year.

Source: Vanguard Website

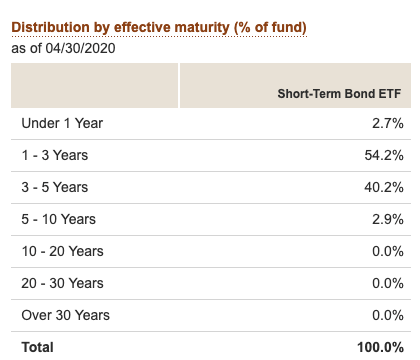

We like the fact that most bonds in BSV’s portfolio will mature within 5 years (see table below). In fact, BSV’s average effective maturity year is 2.9 years. This is advantageous because short-term bonds are less impacted by the changes in interest rate as these bonds only have several years before reaching maturity. On the other hand, long-term bonds’ market value can be significantly impacted by the change in interest rate. Given the fact that the interest rate is already at a historical low and that the Federal Reserve will likely not have negative interest rate, interest rate can only stay the same or move upward if the economy shifts to the recovery mode. Therefore, holding a short-term fund like BSV is actually a better choice because it is insulated from interest rate risk.

Source: Vanguard Website

Low exposure to investment-grade corporate bonds is disadvantageous

The problem with owning BSV is not about credit and interest rate risk. It is the lower interest return investors will receive. This is due to the fact that it has a high exposure to U.S. treasuries (about 67% of BSV’s portfolio). The outbreak of COVID-19 has caused the Federal Reserve to lower the interest rates to near zero. This has resulted in very low treasury yield. At the moment, 2-year U.S. treasury yield is only 0.17%. This is significantly lower than the yield of 1.6% back in January 2020. Since BSV has higher exposure to short-term U.S. treasuries, its average yield to maturity is only 0.7%.

In order to receive a higher return, investors may want to seek funds that have higher exposure to investment-grade corporate bonds as these bonds offer higher yields. While there are some that might be concerned about possible downgrade of many bonds from investment grade to non-investment-grade ratings, investors should not be concerned. In fact, investors should take comfort especially after the Federal Reserve announced on April 9 that it will also purchase bonds downgraded from investment-grade ratings as of March 22 or later that are now rated at least BB-/Ba3. Therefore, the overall credit risk of owning investment-grade corporate bonds is still low.

Investors may want to consider other ETFs such as iShares Short Maturity Bond ETF (NEAR) that has higher exposure to investment-grade corporate bonds. Like BSV, NEAR also has low interest rate and credit risks. In addition, it has an average yield to maturity of 1.8%. Therefore, it may be a better choice for investors wanting higher yield.

Investor Takeaway

If your goal is to receive a stable dividend income, BSV may still be an okay choice for you. However, the average yield to maturity of 0.7% is low in our opinion. We would prefer ETFs that have higher exposure to investment-grade corporate bonds as they offer better return than BSV.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.