This post was originally published on this site

As a response to the Covid-19 outbreak, the United States unveiled a $2 trillion package in March – the largest of its kind. Aside from the expansion of debt, potential inflation has been a cause for concern. But several factors ensure that broad inflationary pressures will almost certainly be absent during the lockdown and likely in the immediate period after.

What does the coronavirus mean for inflation?

Inflation is the rise in the general level of prices where a unit of currency effectively buys less than it did in prior periods. Like most things, it is good in moderation. Close to, but below, 2 percent is the universal threshold.

In our case, there is fear that the sudden injection of mass liquidity may cause severe inflation. Indeed, $2 trillion is not a trivial figure. But the effects of and responses to the coronavirus will limit inflationary pressures. Here’s how.

Coronavirus is deflationary

The quarantine measures have depressed demand, triggering a deflationary effect – a decline in prices. Between January and April, the US headline inflation rate was negative 1.1 percent. But this is largely due to the diminishing price of oil. The decline would have likely been steeper had it not been for rising food prices – which partially alleviated some of the downward pressure.

The core inflation rate, which removes food and energy prices, fell by .4 percent. Indeed, it is less significant of a drop, but remains a cause for concern nevertheless.

With consumers on lockdown, fiscal stimulus can do little to reverse this trend. However, the goal of the current package is to cushion the financial blow to households and corporations via payments. The actual stimulus will come later.

Given the squeeze on revenue streams, households have instead been covering fixed costs like rent and food. As a result, sectoral inflation has occurred. Prices for “food at home” shot up by 4 percent in April compared to a year prior. But this is largely unrelated to the stimulus. A combination of shutdowns and consumer stockpiling have outpaced rigid supply chains.

Moreover, increasing unemployment negates headline inflationary pressures. US unemployment has hit a postwar high of 14.7 percent and will almost certainly increase. With less people spending, prices tend to fall. The savings rate has also increased from 8 percent in February to 13.1 percent in March, the highest since November 1981. If this trend persists, so too will the deflationary spiral. An increase in aggregate savings may also hamper future growth.

Post-corona inflationary concerns

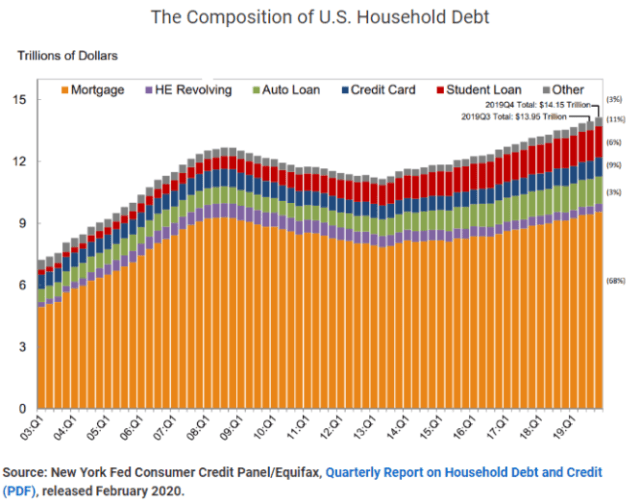

Once the current crisis is resolved, there is fear that inflation may rise rapidly. But demand-driven inflation isn’t guaranteed. Consumers will gradually re-enter public life, which may stifle simultaneous splurges of spending. A lot of households and corporations will also be looking to deleverage, just like they did after 2008 (see below). Households might also be reluctant to participate in the real economy for a while out of fear of public contact.

For inflation to take off, the payouts – $1,200 per adult (with annual incomes less than $75,000) plus $500 for children under the age of 17 – would have to be spent in the real economy, such as buying consumer goods. But as was mentioned, this money has already been spent covering fixed expenses.

The recovery of the demand-side also depends on the resilience of the labor market. Large-scale business failures will exacerbate the recovery of employment.

Structural issues will also come into play. The labor force participation rate has been generally decreasing since 2008, which is part of the reason why US unemployment figures recorded such historic lows before covid-19. A smaller workforce will stifle the return of aggregate demand.

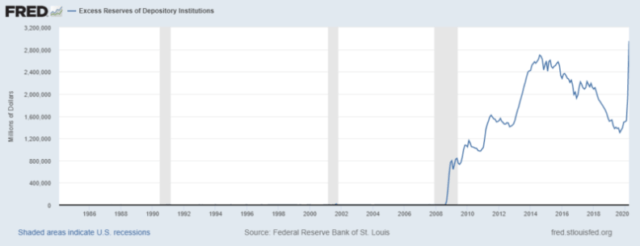

Moreover, banks will not necessarily lend. This is a cause for concern. Since 2008, the excess reserves of depository institutions in the US have substantially increased, greatly reducing the money multiplier effect. After all, inflation occurs when money actually reaches consumers. Widespread defaulting may also deter banks from lending. Moreover, they too will likely go through a deleveraging process and focus on improving capital conditions.

Additional packages will likely be deployed once the virus settles in order to kick start the economy. If aggregate demand soars, prices will rise across the board. But by that point, the US economy will be operating sub-optimally. In the first quarter of 2020, real GDP decreased at an annual rate of 4.8 percent. Predictions for Q2 are grimmer. Further contractions in GDP will widen the output gap. In that light, roaring demand may theoretically incentivize companies that are currently under-producing to increase their supply of goods. Severe inflation occurs when economies reach full-capacity.

However, this depends on the recovery of the supply-side. For example, food services will likely be in high demand. But dislodged supply chains may keep prices high temporarily. For example, virus outbreaks at several American slaughterhouses have cut pork supplies by a quarter. It also depends on the scale of corporate failures. A low supply of businesses may drive prices up, either as a result of declining competition or an inability to meet growing demand. Reaching full-capacity is undoubtedly easier said than done.

Long-term implications

Inflation will be a more pressing matter in the mid to long term. The money supply will have been increased. The US economy will have, hopefully, recovered and closed the output gap, provided it doesn’t initiate a radical decoupling from international supply chains. But even then, neither distortionary nor stable inflation is guaranteed.

Over the past decade, inflationary pressures have been modest even in a low-interest rate environment – a phenomenon that runs counter to economic orthodoxy. The concern is that the US may soon undergo the Japan experience – negative interest rates and perhaps even deflation. Indeed, there is evidence that the US is in a liquidity trap. There are, broadly speaking, two prerequisites: extremely low interest rates and ineffective OMOs. The US checks both. But this is a topic for another day.

In any case, future inflationary pressures will not be rooted in today’s stimulus packages. Indeed, an over-reliance on fiscal policy during the post-lockdown phase may set off headline inflation, but politics will limit it. The federal debt stands at just over 100 percent of GDP. As GDP contracts, this figure will increase significantly. Additional expansions of debt will likely be unpopular, irrespective of the economic rationale. Hence, the Fed will probably resort back to monetary policy.

Even if inflation reaches undesirable levels, the US has tools at its disposal. The Fed will likely raise the federal funds rate through open-market operations (OMOs), such as selling Treasuries. This influences all other interest rates for everything from home mortgages to savings deposits. However, this will come at its own cost. Higher interest rates slow growth, which has already been sluggish in a low-interest rate environment. The US can also raise taxes, though this is politically sensitive.

Additional rounds of payments will almost certainly be deployed in the second quarter. Democrats are hoping to push through a $3 trillion stimulus package. Jerome Powell, Chairman of the Fed, pressed the White House and Congress not to take the foot off the fiscal pedal. But again, the direct checks will be, in essence, survival payments and will not be spent across the real economy. So, for now, forget about inflation. The US has a deflationary matter on its plate.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.