This post was originally published on this site

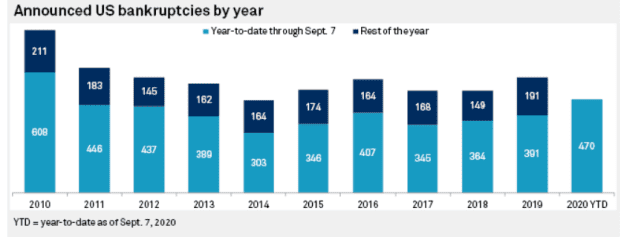

U.S. corporate bankruptcies are on their way to hitting a decade long high, underlining the economic pain inflicted by the COVID-19 pandemic and efforts to limit the disease’s spread.

Total bankruptcies announced by U.S. companies so far this year stand at 470, the most for any comparable year-to-date period since 2010, according to S&P Global Market Intelligence.

S&P’s analysis took into account both public and private companies with public debt.

S&P Global Market Intelligence

Most of the bankruptcies were concentrated in retail, energy and manufacturing, with larger defaults such as J.C. Penney and Chesapeake Energy occurring exclusively in these industries. Analysts say many of these businesses were already facing significant headwinds before the coronavirus struck.

This goes a long way in explaining why the elevated number of bankruptcies hasn’t dampened investor optimism in corporate credit markets, where larger U.S. businesses raise cash.

Even for bonds from sub-investment grade issuers, or “junk” debt, their yields were at 5.62% on Tuesday, half of where they stood at their mid-March peak, according to ICE Data Services.

Much of the resilience among companies with access to public capital markets is down to the Federal Reserve swiftly deploying its emergency lending facilities. The U.S. central bank’s support helped to prop up bond issuance, allowing companies to raise cash to get through the coronavirus crisis.

But companies more reliant on bank lending and other forms of credit have been left in the cold as financial institutions retrenched to protect their balance sheet, according to an August report from the Bank of International Settlement.