This post was originally published on this site

During the pandemic bull market, a lot of money has been made by investors who were able to buy shares of companies as they went public and could benefit from the “pop” from the IPO price.

For many companies, the easiest way to go public has been to sell the company to a special acquisition purpose company (SPAC) that was formed just for that purpose. A SPAC deal circumvents the arduous traditional IPO process and requires less disclosure by the company going public.

But this week Tonya Garcia, who writes the IPO Report, profiles Allbirds, which is going through a traditional IPO and Warby Parker, which will go public through a direct listing of shares. She also updates her profile of Authentic Brands, which plans a traditional IPO:

Following up on an August IPO: Burn in the USA — Why grill maker Weber has a big supply-chain advantage over its competitors

Profiting from overlooked stocks

Michael Brush interviews Amelia Weir, co-manager of the Paradigm Select Fund

PFSLX,

which has the highest rating from Morningstar. Weir shares five lessons she has learned during a successful investing career that point to these nine stock picks.

More about stock selection: Worried about ‘value traps’ in stocks? GMO says ‘growth traps’ are even more painful

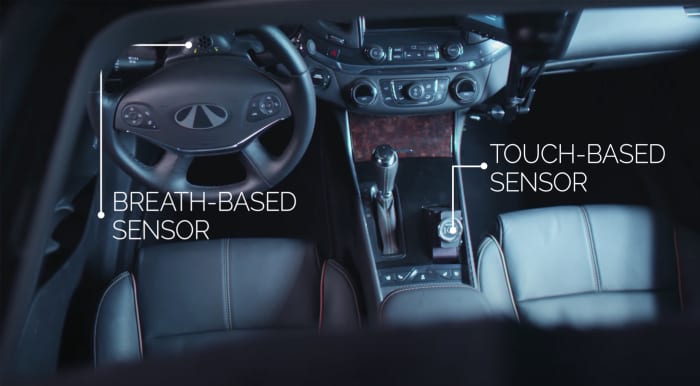

The massive infrastructure bill includes new tech to prevent drunken driving

DADSS Research Program

The trillion-dollar-plus bipartisan infrastructure bill being negotiated in Congress includes 2,700 pages of text. One overlooked area is new technology for cars and trucks that would automatically test drivers for breath and blood alcohol content.

Robinhood and meme-stock mania

It has been about a year since meme-stocks became a widely covered phenomenon. The most famous of these has been GameStop Corp.

GME,

which traders often scooped up using the Robinhood trading app.

Robinhood Markets Inc.

HOOD,

completed its initial public offering on July 29. The company’s business model may be threatened if the Securities and Exchange Commission sets new rules against “gamification” — features of smartphone apps that may encourage investors to make foolhardy investing or trading decisions.

Thornton McEnery describes new meme-stock trends while also considering whether or not Robinhood itself is a meme stock.

Looking beyond investment fads: five tech-stock picks for the long term

Jeff Reeves explains the difficulties of tactical investing — that is, reacting quickly to headlines or to social-media trends driving meme stocks — while selecting five stocks of rapidly-growing tech companies for long-term investors.

More: 14 dividend stocks from a winning value manager as the broader market hits record highs

The ins and outs of a wild real-estate market you may have overlooked

Heart Lake and surrounding mountains in Adirondack Park, New York.

Getty Images

Nancy Trejos describes the booming housing market in upstate New York.

Social Security — spousal benefits even if you are divorced

A married couple may have one spouse who earns much more than the other, which means the higher-paid spouse will receive much larger Social Security benefits upon retirement. But Social Security is designed to allow the lower-paid spouse to receive up to 50% of the higher-paid spouse’s benefit. Jim Blankenship explains how this process works and the rules under which divorced people are allowed the same benefit.

Coverage of the Social Security system:

- Opinion: Congress will eventually bail out Social Security – but that will create another set of problems

- Social Security to become unable to pay full benefits sooner than previously estimated

The job market, good and bad

Getty Images

On Thursday, the Labor Department said U.S. unemployment claims had fallen to a pandemic low. But on Friday, the Bureau of Labor Statistics said the U.S. economy had added 235,000 job during August, which was far below the consensus estimate of 720,000, among economists polled by the Wall Street Journal. Here’s what economists think it means for any tapering by the Federal Reserve and more.

More about the economy: The economy slowed in August, ISM shows, but shortages are a bigger snag than delta

Ida and flood risk

The damage from Hurricane Ida in Louisiana and the devastating flooding from the storm when it hit the Northeast spotlighted a risk many homeowners haven’t considered.

If your home is in a FEMA-designated Special Flood Hazard Area and you have a mortgage, your loan servicer will require you to have flood insurance. This is because most homeowner’s insurance policies don’t protect you from damage caused by rising water.

But if you live outside a Special Flood Hazard Area you might still be at risk for flood, and flood insurance may be relatively inexpensive. Call your insurance agent.

Jacob Passy surveys the flood insurance landscape in the wake of Ida.

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.