This post was originally published on this site

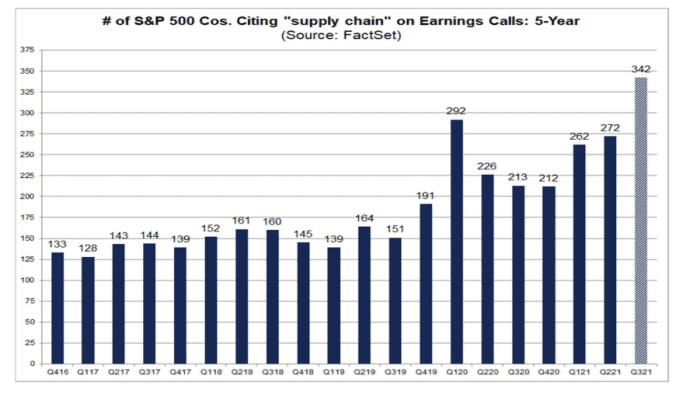

S&P 500 companies that have reported third-quarter earnings so far this year, have mentioned the term “supply chain,” and “inflation” at the highest clip in at least a decade, according to John Butters, a senior analyst at FactSet.

So far, 475 companies have reported quarterly results and 342 of those, or 72%, have mentioned “supply chain,” setting a record for the most frequent mention by S&P 500

SPX,

companies, according to data compiled by FactSet’s Butters, in a review of transcripts of company calls with analysts to discuss quarterly results that took place from Sept. 15 through Nov. 19.

The previous record was set in the first quarter of last year when 292 companies referenced the term “supply chain,” according to FactSet’s records which date to 2010.

“In terms of inflation, we’re also seeing the highest number of S&P 500 companies discussing ‘inflation’ on earnings calls in at least 10 years as well,” said Butters, citing a FactSet report from last week. The analyst said that an updated review shows that 295 companies have referenced “inflation,” as of Friday.

The FactSet report comes as supply-chain disruptions are wreaking havoc on global business and helping to amplify pricing pressures as the world-wide economy attempts to recover from the worst pandemic in over a century. The fitful reopening of economies from COVID-19 restrictions here and abroad are fostering a surge in demand for goods and services that can’t easily be met.

But nagging supply-chain issues are contributing to inflation.

One measure of inflation currently, the consumer-price index, stands at 31-year record high — up 6.2% from last year and is headed higher by some trader estimates.

Read: This is how America’s booming demand for goods shattered the supply chain

At the sector level, the highest share of supply-chain mentions came from material

XLB,

and consumer staples

XLP,

Some 96% of the companies in the two respective industries have mentioned “supply chain” during earnings calls.

Don’t miss: This is how America’s booming demand for goods shattered the supply chain

Source: FactSet

In the second quarter this year, inflation dominated earnings calls — when a record share of S&P 500 companies, 44%, mentioned the term.

Federal Reserve Chairman Jerome Powell acknowledged that supply-chain disruptions are driving inflation well above the Fed’s 2% target but said “our tools cannot ease supply constraints.”

Powell, however, added that he expects that the supply-chain turbulence will eventually resolve itself.

Despite the extra expenses associated with supply-chain issues — which have led some companies such as Target

TGT,

Walmart

WMT,

and Home Depot

HD,

to charter their own cargo ships — companies have been reporting relatively healthy earnings per share.

Some 82% of companies reported EPS above average estimates, according to FactSet.