This post was originally published on this site

As the lights literally go out across parts of China, Wall Street’s wall of worry about the second largest economy in the world keeps rising.

“Recent sharp cuts to production in a range of high-energy-intensity industries add to the already significant downside pressures in the growth outlook,” said a team of analysts at Goldman Sachs led by Hui Shan, in a note to clients on Tuesday.

Citing “yet another growth shock” from a growing energy crisis that has been shuttering Chinese factories in recent weeks, the bank cut its growth forecast for 2021 to 7.8% year over year from 8.2%, and to 5.5% from 5.6% for 2022. On a quarterly basis, the biggest cut came in the third quarter, where the bank sees no growth from a prior forecast of 1.3%.

Goldman sees the final quarter of the year rebounding 6%, down from 8.5%, but with deep caveats.

“Considerable uncertainty remains with respect to the fourth quarter, with both upside and downside risks relating principally to the government’s approach to managing the Evergrande stresses, the strictness of environmental target enforcement and the degree of policy easing.” said the analysts.

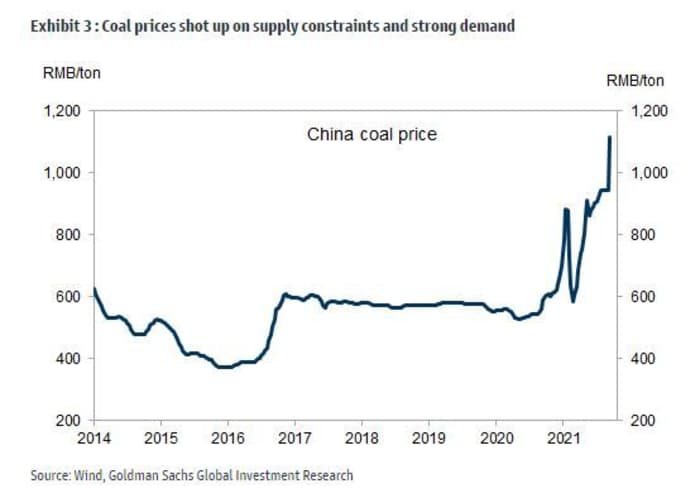

Production cuts in China stem from increased regulatory pressure on provinces to meet energy use targets for 2021, but also reflect surging energy prices in some cases. China and Asia are now competing for such resources as natural gas with Europe, which is also struggling with high power and electricity prices. China’s energy woes come with concerns over indebted property giant China Evergrande

3333,

that gripped global markets last week still fresh.

While investors haven’t taken their eyes off heavily leveraged Evergrande and its potential to cause problems beyond China’s shores, reports of closed factories and homes without power have led to fresh supply chain worries in a world that is already scrambling for everything from glass to semiconductors due to COVID shutdowns.

Read: The surge in European gas prices is tied to the Asian shortfall in coal supply, strategist says

The “peculiar nature of the COVID shock has made the economy more energy-intensive, at least temporarily,” said Hui. That’s complicated by an export boom that has boosted energy-intensive manufacturing industries and COVID-related restrictions have also affected interaction-intensive service businesses. And the country’s efforts to cut coal-fired related emissions and lower coal imports have weighed on supply levels and caused prices to climb.

China’s power shortages come a month after its macroeconomic agency, the National Development and Reform Commission, issued ratings showing nine provinces performing poorly due to energy usage, with a plan to bring them in line by mid-September. Estimating that hit to industrial production and economic activity, Goldman sees a roughly 1 percentage-point annualized hit to Q3 GDP growth and double this impact on Q4 growth.

“While the third quarter is nearly over, uncertainty around the Q4 pace remains very large, and a lot of this comes down to the stance of both macro and regulatory policy,” added the Goldman team.

Key drivers of the fourth-quarter outcome will include the timing and extent of government measures to stabilize housing sector activity and stretch out deleveraging in the property sector; any temporary relaxation of regulatory pressures to meet energy use targets, and/or macro policy support.

“Each of these factors could materialize on either the positive or negative side relative to our current expectations,” said the analysts.

Goldman’s downgrade comes days after Nomura analysts cut their second-half growth outlook for China to for 2021 to 7.7% from 8.2%, warning that the world may have “underestimated or even missed,” another supply-side shock over the factory shutdowns due to energy consumption mandates. They see shocks on both the demand and supply side as possible.

“Based on available high-frequency data and news flows, we believe this ongoing double shock will very likely lead to a growth double dip in Q3 (the first dip was the 8.7% q-o-q decline in Q1 2020),” said a team of economists led by Ting Lu.

Nomura also cut its 2022 growth forecast to 4.8% from 5.1%, with 2023 expected to see growth of 4.7%. “Even with these cuts, we see the risks to our forecasts skewed to the downside,” said the team.

In August, the bank warned that markets may be ignoring an elephant in the room in the form of Beijing’s curbs on the property sector that contributes up to 25% of its economic growth. “However, markets now are so perplexed by the fallout of the property sector that they may ignore Beijing’s unprecedented curbs on energy consumption and energy intensity,” said Lu and the team.