This post was originally published on this site

Shares of General Electric Co. surged Tuesday, after long-time non-bull John Walsh, an analyst at Credit Suisse, said the recent selloff has presented an opportunity to buy into the cyclical aerospace recovery play.

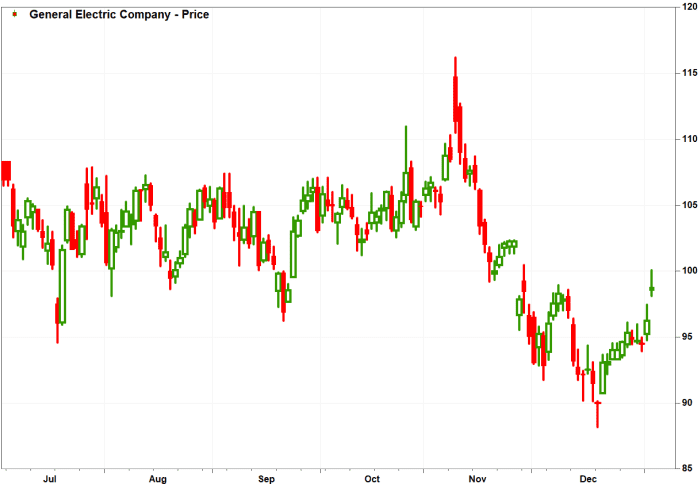

The industrial conglomerate’s stock

GE,

opened at $98.78, well above Monday’s intraday high of $97.44, and was up 2.5% in morning trading toward the highest close in six weeks. The stock has now run up 9.7% in two weeks, since it closed at a 10-month low of $89.98 on Dec. 20.

Through Monday, however, the stock had dropped 13.5% since Nov. 9, when GE announced plans to split into three separate, publicly traded companies.

Credit Suisse’s Walsh upgraded GE to outperform, after being at neutral for at least the past three years. He kept his stock price target at $122, which implied about 24% upside from current levels.

“The 14% pullback since the separation announcement on November 9 has created an opportunity for both absolute and relative price appreciation as GE should benefit from a cyclical recovery in 2022,” Walsh wrote in a note to clients. “We also see potential for a ‘rush to propulsion’ as airline customers have managed green time throughout the pandemic.”

FactSet, MarketWatch

He said he still believes there are some strategic, long-term uncertainties hanging over the stock, and that’s why he doesn’t consider it a “top pick,” but he does believe the split plans come from “a position of strength.”

Walsh raised his estimate for adjusted earnings per share in 2022 to $4.00 from $3.80 and his 2023 forecast to $5.53 from $5.00. That compares with the FactSet EPS consensus for 2022 of $4.00 and for 2023 of $5.66.

GE’s stock has gained 17.8% over the past 12 months, while the SPDR Industrial Select Sector exchange-traded fund

XLI,

has climbed 23.7% and the S&P 500 index

SPX,

has advanced 29.4%.