This post was originally published on this site

On Tuesday, Armour Residential REIT (ARR) announced a common share dividend of $.09.

The company stated:

Armour Residential REIT, Inc. (ARR) (“Armour” or the “Company”) today announced the resumption of monthly dividends for the Company’s common stock. In response to the economic disruption related to the COVID-19 pandemic, Armour previously announced that the Company would move to a quarterly dividend on its common stock for the second quarter of 2020. With today’s announcement, the Company is returning directly to its policy of paying common stock dividends monthly. Armour anticipates announcing July common dividends in late June.

June 2020 Common Stock Dividend Information

Month Dividend Holder of Record Date Payment Date June 2020 $0.09 June 15, 2020 June 29, 2020

If we take those words literally, the company is resuming monthly dividends effective immediately. We do take those words literally.

A payout of 9.73% on estimated book value is within a reasonable range. At this point, we should clarify that a few terms may be used interchangeably when discussing a mortgage REIT like ARR. Those terms are BV (book value) and NAV (net asset value).

To compare that 9.73% payout on NAV, we can look at AGNC Investment Corp. (AGNC). AGNC has its payout at 8.97% on NAV.

Outlook

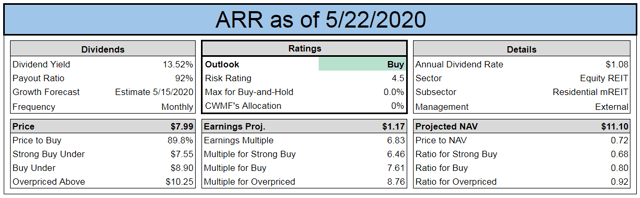

Our view on ARR, including several relevant metrics, is summed up in the index card below:

Source: The REIT Forum

While we were writing the price climbed to $7.99 (from $7.93), which puts the price to NAV at .72. That’s still low enough to be within the range for bullish ratings. They aren’t the best bargain in the sector, but they are still pretty attractive. We’re willing to give ARR the bullish rating here.

As a quick note on that NAV estimate, ARR’s book value at the end of Q1 2020 was $11.10. Based on modeling assets and hedges, it appears ARR’s book value may be relatively flat. Some mortgage REITs have reported significant gains, others have been relatively quarter to date.

Dividend Commentary

Scott Kennedy leads the mortgage REIT research for The REIT Forum. Following the announcement, Scott wrote:

Hi subscribers, quick thoughts on ARR’s dividend announcement. So, ARR is declaring a June 2020 monthly dividend of $0.09 per common share. Since ARR didn’t declare an April or May 2020 dividend, this is the equivalent to a Q2 2020 dividend of $0.09 per common share. Moving forward, it would appear the new “run rate” will be the $0.09 per common share each month. So, a $0.27 per common share Q3 2020 dividend in total. On ARR’s new monthly dividend rate, I projected a $0.10 per common share dividend with a larger range of $0.08 – $0.12 per common share.

As such, a slight / minor disappointment. Almost a (50%) reduction from the previous $0.17 per common share rate in March 2020 which, while certainly better than some hybrid / multipurpose mREITs, less attractive vs. say AGNC, DX, and likely NLY. First thoughts are this WILL NOT impact my BUY, SELL, or HOLD recommendation ranges, relative to my/our ESTIMATED BV (already incorporated a large decrease).

I hope this helps with readers’ assessments / strategies.

Given Scott’s commentary, we can feel quite comfortable that ARR is indeed looking at this as a reasonable dividend rate for the near future.

Net Interest Margin

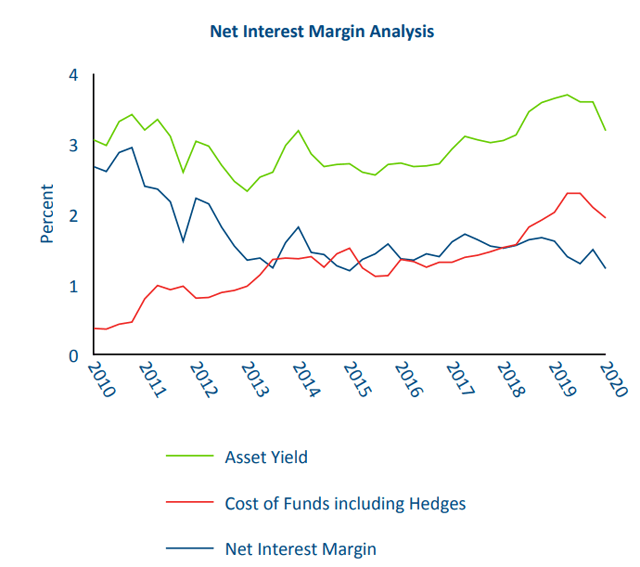

We can support the idea by simply glancing at the net interest margin. It’s slightly down for ARR:

Source: ARR

With NIM having only a small change, it would be reasonable to think that dividends and book value should change by a similar amount. That’s precisely what happened.

Do Investors Know Much About ARR?

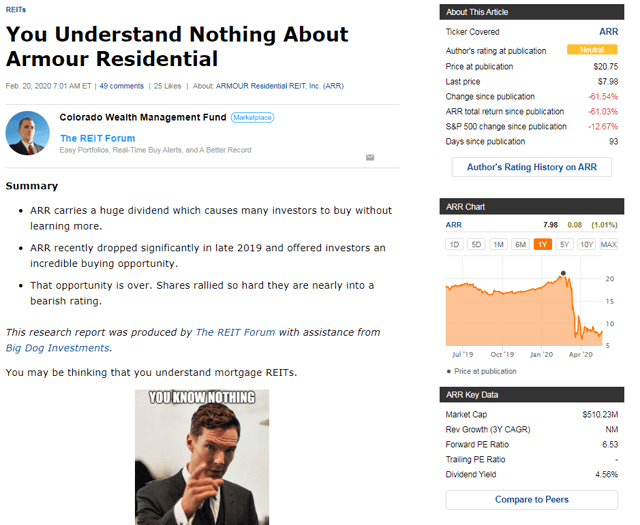

In February 2020, we published an article on ARR telling investors the opportunity was over and shares were nearly into the bearish rating:

Source: Seeking Alpha on ARR

In hindsight, of course we would’ve loved to have shares in the bearish rating.

- We prepared the article when shares were at $20.31.

- Our trigger price for a bearish rating was $20.70.

- When the article was published, shares had rallied up to $20.75.

- That was only $.05 into the bearish rating, so we just left it at a neutral rating.

So what are the main things you need to know? Let’s run through a list:

- The most effective valuation technique is using targets based on price-to-book.

- The dividend rate is up to the board of directors, but a large increase or decrease in NAV would have significant implications.

- Mortgage REITs take on significant risk to achieve their high yields. Occasionally risk has negative consequences. That is why it is “risk.”

- The most effective way to handle those risks is to take an active approach to the common shares by using tax-advantaged accounts to buy and sell using price-to-book ratios throughout the sector.

How Can You Find Smart Critiques?

I read more on Seeking Alpha than most people. I enjoy articles and comments. I’ll impart some observations to help investors separate the useful comments from the garbage. A smart critique will narrow in on one or two fundamental aspects contained in the article and make a compelling argument that those aspects are either not presented well or simply wrong.

When you see the vast majority of the words in the critique are either:

- An anecdote that somehow turns out to be rude.

- A direct or indirect attack on the author, rather than the idea.

You’ll know that you’re reading a comment from someone who doesn’t understand the content you just read.

Conclusion

Investors should expect that the most likely monthly dividend rate in the near future is $.09. If it doesn’t come in precisely at $.09, it would most likely be close. The price-to-book ratio is low enough to be moderately bullish. There are still risks, but there’s plenty of upside as well. If you want to learn more about which other REITs are attractively priced, please click the follow button beside my name.

We are the only large REIT Research service on Seeking Alpha with:

- A CPA on the team.

- A record going back to the start of 2016.

- A real-money portfolio worth over a quarter-million with full disclosure on every trade.

- Real-time notifications on every purchase and every sale, including exact share count, purchase price, dividends earned, and sale price.

- Scott Kennedy’s exclusive coverage on BDCs.

Disclosure: I am/we are long AGNCO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.