This post was originally published on this site

Introduction

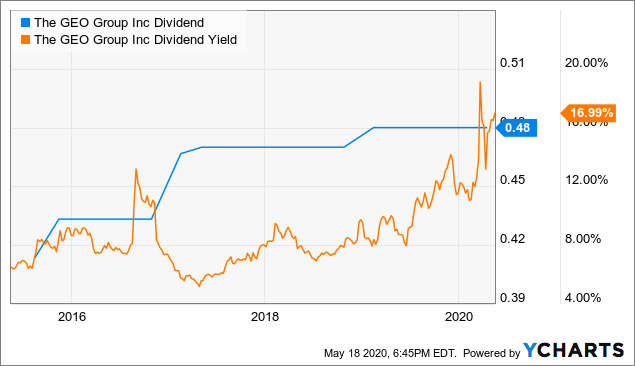

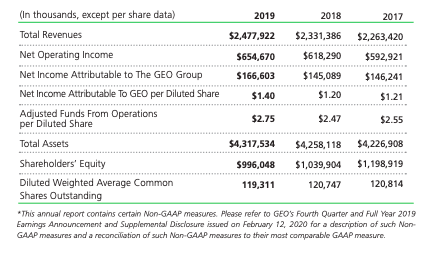

Let me tell you the story of a REIT called GEO Group Inc. (GEO) that had raised its quarterly dividend from $0.39/share in 2014 to $0.48/share in 2019 (a CAGR of 4%), had a dividend yield of at least high-single digits over that time, maintained an adequate (although not incredible) liquidity position, and the best part about the REIT was it arguably had more stable cash flows than most other REIT classes as its main customers were the U.S. state/federal governments as well as some foreign government entities that were subject to long-term contracts (5-15 years).

The stock ticked most of the boxes for income-oriented investors and could very well have been a staple in their portfolios. However, many institutions shunned this stock as it was far from what they considered socially responsible investing, more so even than the commodity stocks they held that would fill the ozone with carbon and contribute to global warming. Only the very bold income and small cap funds were willing to hold it.

Data by YCharts

Data by YCharts

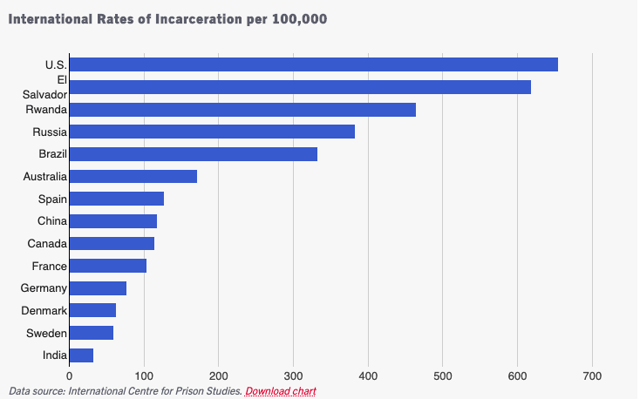

Why was this stock treated like such a pariah within the investment community? The same reason as CoreCivic Inc. (CXW), a similar company. GEO profits greatly off of the extremely high incarceration rate in the U.S. which is world-leading and more than 6x that of all G7 nations.

Source: The Sentencing Project

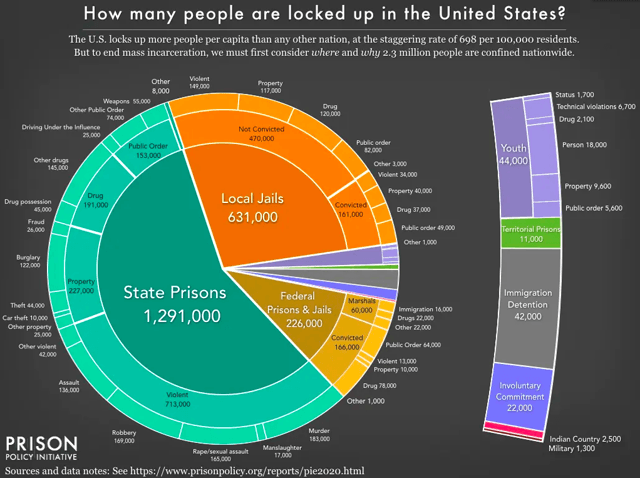

According to the Prison Policy Initiative:

The American criminal justice system holds almost 2.3 million people in 1,833 state prisons, 110 federal prisons, 1,772 juvenile correctional facilities, 3,134 local jails, 218 immigration detention facilities, and 80 Indian Country jails as well as in military prisons, civil commitment centres, state psychiatric hospitals, and prisons in the U.S. territories.

Source: Prison Policy Initiative

Source: Prison Policy Initiative

Why so high?

Also according to the Prison Policy Initiative:

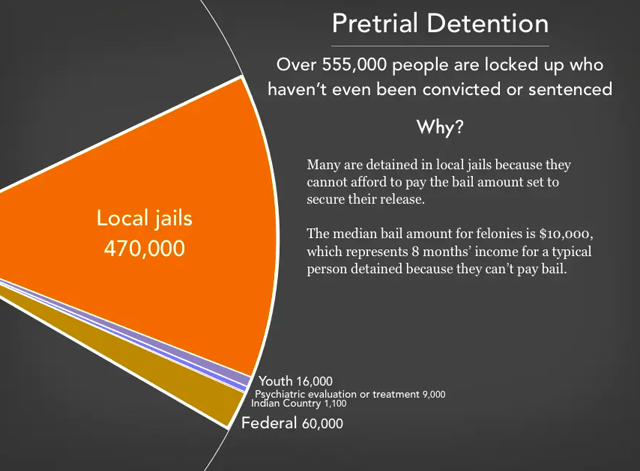

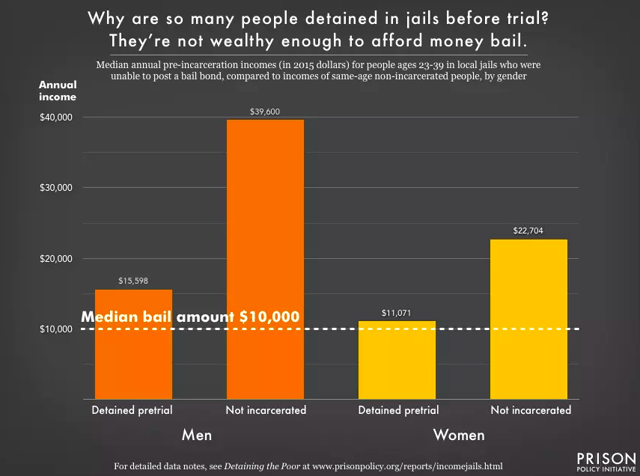

Every year up to 600,000 people enter the premises of a prison but people go to prison 10.6 million times each year. Most people in prisons have not been convicted as some are will make bail within hours or days, while many others are too poor to make bail and remain behind bars until their trial as the median bail amount is $10M (a quarter of the median annual income per person in the U.S.). Only a small number of inmates (about 160,000 on any given day) have been convicted, and are generally serving for misdemeanours which carry sentences of under a year.

Source: Prison Policy Initiative

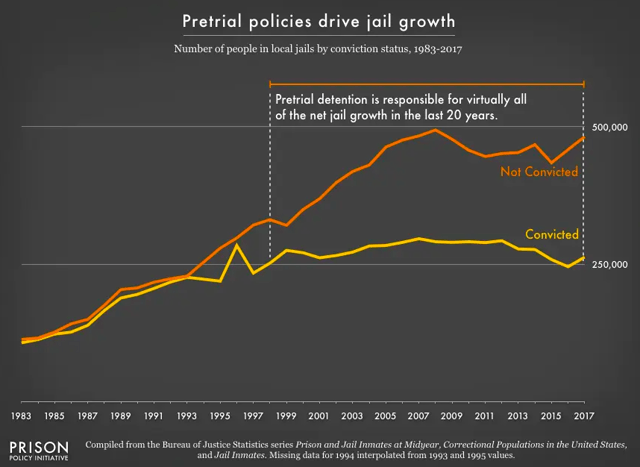

The reason that so many are in prison at any one time is that bail is too expensive for most people and therefore have to remain detained while they await their hearing. In fact, it is pretrial policies that have driven essentially all incarceration growth.

Source: Prison Policy Initiative

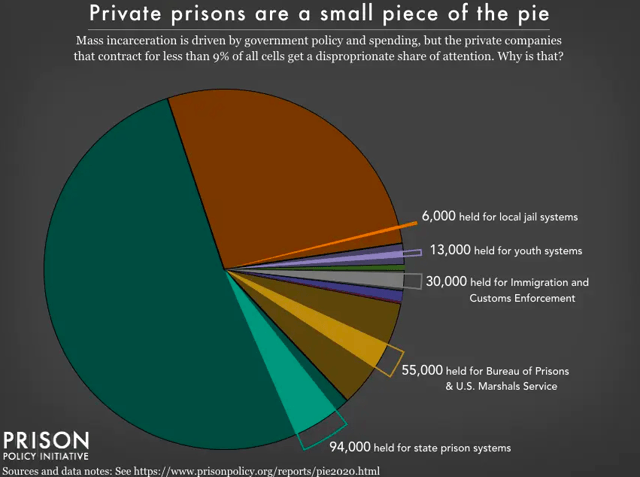

But do federal and state governments in the U.S. have the capacity for all these prisoners? According to the Prison Policy Initiative, state prisons are at 98% capacity and federal prisons at 140% capacity. Which has led to the emergence of private prisons.

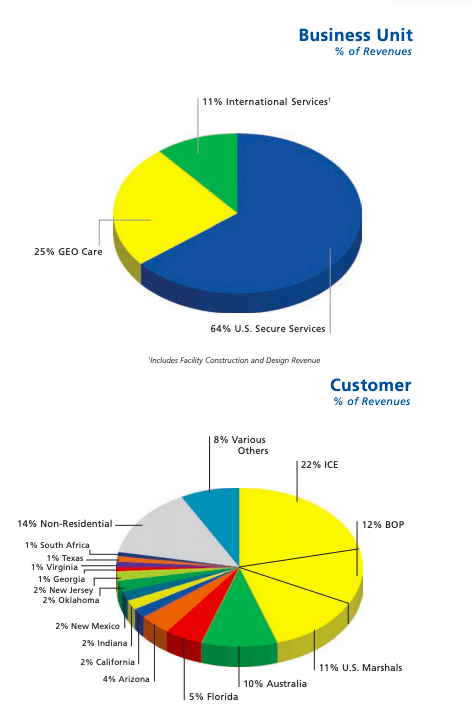

GEO is based in Boca Raton, FL and has greatly capitalized on its nation’s “problem” with over 64% of its revenues coming at 2019 YE from U.S. Secure services with its largest clientele being U.S. Immigrations and Customs, the Federal Bureau of Prisons and U.S. Marshalls which combined account for ~45% of its revenue.

Source: 2019 YEFS

However, the stock has steadily declined more recently and experiencing a double whammy with it being an election year and the democratic party at the forefront in expressing major moral qualms about the use of private prisons, and more recently amid COVID-19 concerns which has reduced sentencing to promote social distancing activity which will certainly impact 2020 FYE results.

Our ICE Processing Centers and U.S. Marshals Service facilities began experiencing lower overall occupancy in late March 2020 as a result of declines in crossings and apprehensions along the U.S. Southwest border, as well as, a decrease in court and sentencing activity at the federal level in the United States due to the COVID-19 pandemic. Additionally, the U.S. federal government recently issued COVID-19 operational guidance recommending a reduction to 75 percent of capacity at ICE Processing Centers where possible to promote social distancing practices.

Our GEO Secure Services contracts typically contain fixed-price or minimum guarantee payment provisions intended to ensure adequate staffing levels and consistent service delivery. Our ICE Processing Centers and U.S. Marshals Service facilities are currently operating at or around the capacity level tied to the fixed-price or minimum guarantee payment provisions. While it is possible that we may experience an improvement at these facilities later this year, our updated full-year 2020 guidance assumes a continuation of lower occupancy levels through the end of the year, resulting in an estimated revenue decline of approximately 8% for the full-year 2020.

Our GEO Reentry Services business also began experiencing a decline in occupancy in late March 2020 at our residential reentry centers and non-residential day reporting programs due to lower levels of referrals by federal, state and local government agencies because of the COVID-19 pandemic. While it is possible that referral levels for our GEO Reentry Services business may increase later this year, our updated full-year 2020 guidance assumes lower occupancy levels for our residential reentry centers and day reporting programs through the end of the year, resulting in an estimated revenue decline of approximately 4% for the full-year 2020.

Source: 2020 Q1 Press Release

In addition, GEO will certainly see increased operating costs due to the greater needs for personal protective equipment, diagnostic testing, and higher medical expenses resulting in several million dollars in non-recurring costs during 2020. Management has revised 2020 AFFO guidance downwards by 13% from $2.57-$2.67 per diluted share to $2.25-$2.35 per diluted share. This would be a 15-19% drop in AFFO from 2019 YE.

The market has clearly overreacted as the stock is at its cheapest level in years trading at an attractive ~4x P/AFFO ratio relative to its normal 7-10x AFFO, and almost a unicorn as far as REITs go.

This current situation has called into question the ability of GEO to sustain the $0.48/share quarterly dividend given that its leverage already appeared excessive at 2019 YE as net debt/adjusted EBITDA was ~7x which is by no means low even for a REIT and will likely increase at 2020 FYE.

I am a strong advocate that a multiple year DCF approach should be used as I am a long-term investor and making investment decisions by taking a one-year multiple on one-to-two years of subpar performance is faulty. Especially as these near-term revenue losses and expense increases are non-recurring. I think any belief that COVID-19 or political eschew will cripple the company in the near term is preposterous.

Investment Thesis

Not only is this company’s business controversial, but its investment case on the Seeking Alpha platform is too, as I have seen few companies that have gotten such a polar stance in that regard. When I first looked at this company’s financials, there was one thing that stood out to me like a fly in a cereal bowl and despite all the rhetoric on this company, I am so surprised it has never been alluded to.

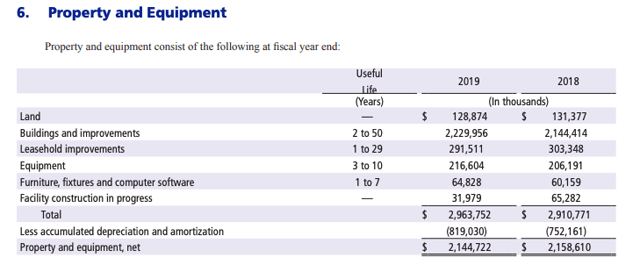

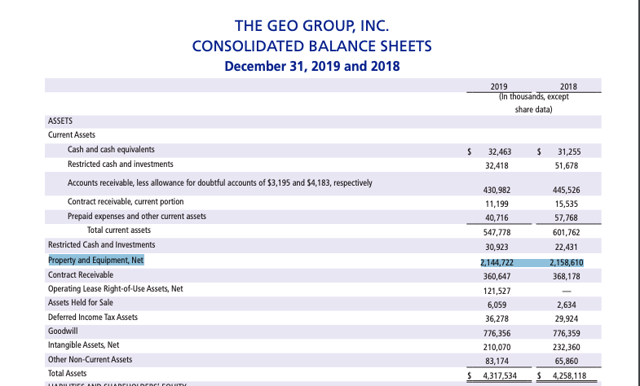

PP&E has a valuation of just over $2 Billion on the balance sheet and this includes a lot of equipment that has to be depreciated over 3-10 years. This seems woefully small given that there are 67 secure service facilities, 45 residential reentry centres, 68 non-residential centres, 10 youth services residential centres. Granted not every single facility is owned by GEO, as 25% of their revenue comes from management only contracts.

Source: 2019 YEFS

As you dig down the rabbit hole further, you do find how much the combined land value is (a meager $129 million).

Source: 2019 YEFS

This is because U.S. GAAP requires companies to report properties at cost. Consider the Canadian apartment REIT Northview Apartment REIT (OTC:NPRUF) which reports its investment properties at over $4 billion and doesn’t even do $400MM in revenue (one fifth of GEO’s revenue), as they have the privilege of reporting under IFRS.

On the surface, it may appear as though leverage at 2019 YE may appear high when using long-term debt and BV of equity (2.9) and really high when using the TBV (13) with $776MM in goodwill. But is leverage really that high?

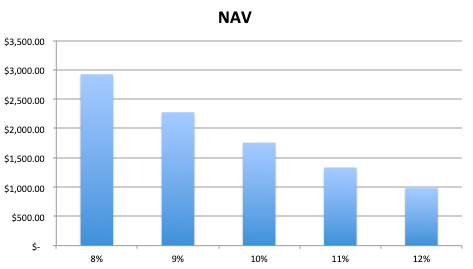

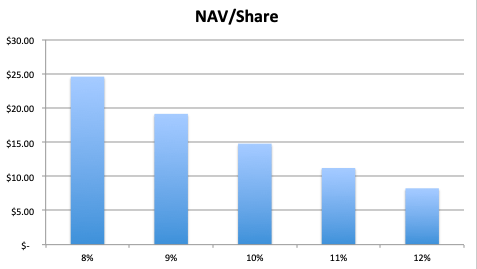

We can roughly estimate NAV using reasonable assumptions. Over the past 3 years, GEO has averaged NOI of $622MM, with 25% of revenues coming from managed only properties.

Source: 2019 YEFS

The cap rate to use is a little tricky to decide as the infrastructure is somewhat specialized but between GEO and CXW they do control nearly half of the infinitesimally small market. I would suggest a cap rate of 8-12%.

Source: Prison Policy Initiative

| NOI | $466.50 |

| Debt | $2,906.00 |

| Shares Outstanding | 119 |

*** Figures in millions except price per share

Source: Author’s Tables

Wow! Worst-case scenario this REIT is fairly valued right now, and I didn’t even consider the potential of the Golden State Facilities as management has chosen not to include in their guidance.

GEO’s full-year 2020 guidance assumes no contribution from GEO’s 700-bed Central Valley, 750-bed Desert View, and 700-bed Golden State facilities in California, which will be transitioning during 2020 from California state corrections contracts to the previously announced new 15-year contracts, inclusive of option periods, which GEO entered into with U.S. Immigration and Customs Enforcement (“ICE”) on December 20, 2019.

As GEO previously announced, the State of California completed the ramp-down of the Central Valley facility at the end of September 2019, and the Desert View and Golden State facilities are in the process of ramping down during the first half of 2020. The discontinuation of the California corrections contracts for the three company-owned facilities represents an annualized revenue loss of approximately $47 million.

Source: 2020 Q1 Press Release

With the current price at $11/share, the stock is as much as 50% below NAV when using a high 10% cap rate.

NAV may be as little as 10% above BV using extremely conservative assumptions but as much as 3x if not more using more reasonable assumptions. I am certain GEO has capacity to take on more debt as a result of the understated BV and was a large reason for the extension of the $900MM senior revolving credit facility to 2024 in June 2019. This would also explain the high goodwill balance as acquisitions were likely occurring closer to fair value.

The banks may have been wagging the stick at GEO by implementing covenants such as the following from their 2019 YEFS:

- Create, incur or assume any indebtedness

- Engage in mergers, acquisitions and asset sales

As the bankers were likely getting uncomfortable with the debt being consumed as a result of acquisitions over the past few years.

GEO is still well within their financial covenants according to the 10-Q:

- Allow the total leverage ratio to exceed 6.25 to 1.00 – 5.0 at 2020 Q1

- Allow the senior secured leverage ratio to exceed 3.50 to 1.00 – 2.6 at 2020 Q1

- Allow the interest coverage ratio to be less than 3.00 to 1.00 – 4.0x at 2020 Q1 (using operating income)

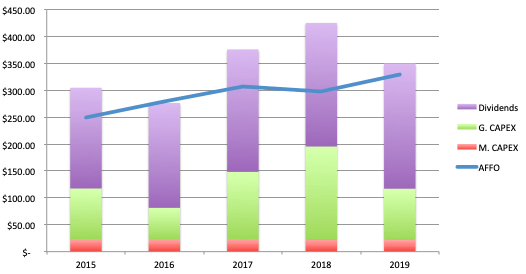

There has been some concerns that GEO has had to finance their dividend with debt. Personally, I believe AFFO is a more suitable means to gauge cash flow for the company given the high level of stock compensation and large amount of non-real estate-related depreciation expense realized from managed-only contracts, international operations, electronic monitoring services, and other non-residential and community-based facilities. As we can see below since 2015, GEO has used at least some debt to finance their dividend and on average 25% of the dividend has been financed by that means.

Source: Author’s Tables, Company Filings

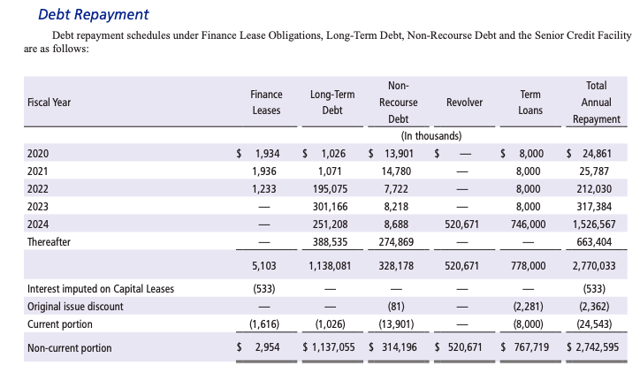

This is not uncommon for REITs as they are required to pay out 90% of taxable income which does not always perfectly align with cash flow. However, when a company is having to draw on their credit line year-after-year to finance the dividend that does become concerning. In this case, I would be more concerned if the revolving LOC were close to being maxed out which in this case it is not even close as there is $350MM remaining as of Q1 2020, in addition to an accordion feature of $450 million under the senior credit facility. There are no large debt repayments scheduled until 2024 which is in large part because that is when the revolver expires, but in all likelihood we should be beyond this current market turmoil by then and there should be little issue with renewing the loans and LOC that are set to expire.

Source: 2019 YEFS

Management has also pulled back on CAPEX guidance for 2020:

For the full-year 2020, we have reduced our planned capital spending by deferring capital expenditure projects where possible and closely managing our working capital. We expect capital expenditures in 2020 to total approximately $85 million, including $19 million in maintenance capital expenditures.

Source: 2020 Q1 Press Release

This is below what has normally been in excess of $100M in total CAPEX (which was originally planned for 2020) and with AFFO guidance of $267MM for 2020 FYE, there should be no need to draw down on the LOC this year to fund the dividend. As previously mentioned, this guidance does not consider the potential impact of the 50-bed Desert View, and 700-bed Golden State facilities in California.

Remember, GEO still resolved to pay the regular $0.48/share dividend in early April for the end of that month when uncertainty was arguably at its highest and at a time where it would have been the easiest to proceed with a cut given that many other REITs proceeded to do so and looked smart for doing so to preserve capital given the market uncertainty, when under normal circumstances a dividend cut signals financial struggle.

The last issue put forth about this stock is massive negative political rhetoric on the part of the Democrats which has been magnified recently with it being an election year. Although, COVID-19 has eased up incarceration rates in the U.S. and will likely do so until a vaccine is found, I see it as highly unlikely that the levels seen in previous years will not be realized after that point as amending the laws surrounding the underlying reasons for the high incarceration rates will take years of court battles to obtain the required bill amendments and therefore there will be a need for the excess prison infrastructure that GEO and CXW provide in the immediate future.

Remember state and the federal government have now spent billions and may get to trillions in fiscal stimulus when the disease is eradicated, meaning they will likely be more concerned with balancing the budget over the next few years versus building new prisons that will take a long time to build anyway. It would make more sense for them to buy the existing private prisons, which would still be prohibitively expensive but likely a profitable exit for shareholders.

All in all the Democrats can wag their finger at the issue all they want but pose no real threat to GEO’s business model in the near term.

Conclusion

I consider myself to have good ethical standards, but when a risk-reward is this attractive even I will throw ethical qualms out the window with an 18% yield with a historically low valuation at just over 4x forward AFFO.

The stock has typically traded at 7-10x AFFO, and most of their expected revenue loss and increasing expenses over the next year or two will be non-recurring as they are all in association with COVID-19. The company could easily get back to at least $19/share in two years assuming a 7x FFO multiple and using 2019 YE AFFO of $2.75/share, which would imply a 44% annualized return when including dividends (assuming the 18% yield is maintained).

Leverage may increase slightly over the next year or two by means of drawing down on the credit line, but I believe they have more capacity to do so than initially perceived due to the understated BV.

The best part is this is a recession-resilient stock where you should get a juicy 18% yield while you wait for it to realize its upside potential.

Disclosure: I am/we are long GEO, CXW. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.