This post was originally published on this site

Aquaculture is an interesting industry. Climate precludes it to only certain regions of the world, and managing the perils of sea lice and ulcers in a highly engineered process allows for excellent margins on highly priced products like trout and especially salmon. Moreover, barriers to entry are substantial due to very limited growth in licenses and the high technical barriers to entry. For long-term investors, it could become a well-exploited business for these reasons. But our interest in Austevoll Seafood (OTCPK:ASTVF), which is partially a fish farmer as well as an operator of pelagic trawlers, stems from what we predicted to be coronavirus resistance in our last article.

We believed that its substantial frozen fish volumes from pelagic would be resilient in a coronavirus environment, where we expected it to offset declines in salmon and trout, more premium products with food-service exposure. Although still harassed by a poor pelagic fishing season, the market still seems to be strong as anticipated, but most of Austevoll’s resilience came from outside the pelagic segment, which ended up even carrying the quarter. We reassess Austevoll in light of this resilience, highlighting the strength of both the pelagic and farmed fish businesses in a recessionary scenario and issuing an attractive rating on this stock. However, because of the resilience in the white-fish and salmon, perhaps Lerøy (OTCPK:LYSFF) as almost a pure-play is better given its lower multiple.

Salmon Resilience

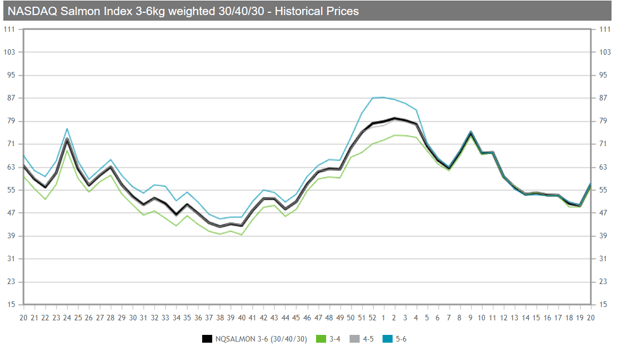

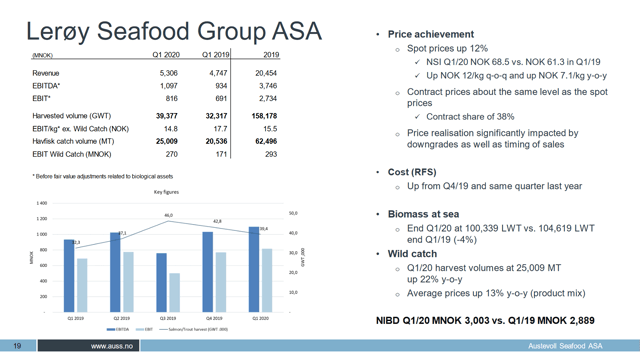

Austevoll holds a controlling interest in Lerøy, which operates both fish farming and wild-catch businesses. These businesses are rather asset intensive but generate substantial operating margins, with the salmon farming business consistently generating margins in the mid-30% range as seen with pure-play associate Br. Birkeland Farming. In Q1, volumes of salmon actually grew despite the closing of food service channels. Although there was a decline in the price of salmon, it was unexpectedly resilient, and even started recovery from its lows.

(Source: Nasdaq.com)

(Source: Nasdaq.com)

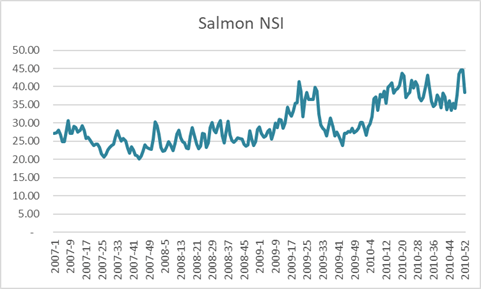

This resilience was surprising, as we were expecting weaker price performance for salmon due to the lack of restaurant demand. It indicates perhaps a loyal Norwegian market which accounts for 20% of salmon revenues. However, using the financial crisis as precedent, we actually saw that salmon generally has a history of being relatively resilient in crisis scenarios. Below is a chart of salmon prices between 2008 and 2010, where the limited growth in licenses and robust demand despite economic troubles allowed salmon prices to achieve new highs.

(Source: Fish Pool)

Pelagic and Whitefish

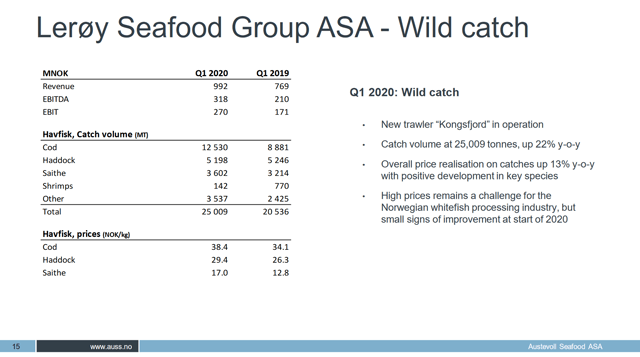

There was likewise growth in whitefish production, including trout in the farmed operations, with cod, haddock, saithe and shrimp in the wild-catch operations. Wild-catch demonstrated excellent price performance, and with a 22% growth in volumes, it generated substantial revenue for Austevoll.

(Source: Q1 2020 Austevoll Presentation)

(Source: Q1 2020 Austevoll Presentation)

However, because of the high prices of whitefish, the processing business has suffered due to higher input prices. So although the wild-catch segment has benefited from price resilience, those benefits become lost in the processing business further downstream.

In pelagic, although there are substantial increases in volume with the more successful fishing operations like with associate company Pelagia AS, the significant exposure to pelagic fishing in LatAm, where Covid-19 restrictions are impacting labor prices and availability, means Austevoll trawlers are struggling to generate high incomes. In Peru, where there was the problem of volume overhang from a previous bad fishing season, income has fallen dramatically to a 9% margin, where margins in excess of 40% have been possible in the past. Due to the uncertainties around quota utilisations, this is an unfortunate eventuality that hopefully doesn’t indicate a pattern. But with the more structural issue of labor availability for trawlers due to harsh LatAm lockdown measures, pelagic performed worse than we had hoped, despite strength in meal markets among other companies like Darling Ingredients (NYSE:DAR).

(Source: Q1 2020 Austevoll Presentation)

(Source: Q1 2020 Austevoll Presentation)

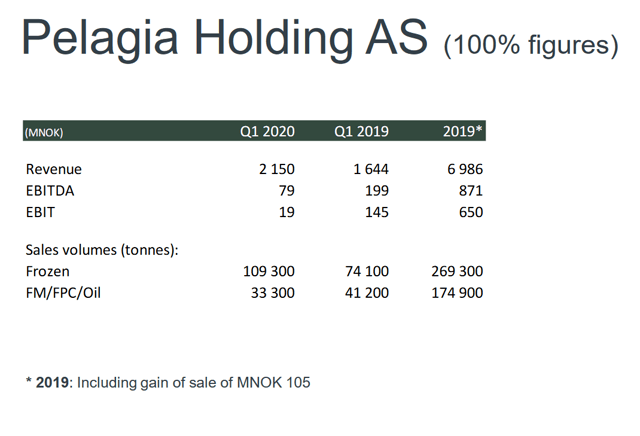

Pelagia performed well in terms of volumes both for fishmeal and fish oil. However, fishmeal prices made an 11% decline in the quarter, with a 20% increase in fish prices as an incomplete mitigant. Most of the EBITDA decline however was due to a forex impact from the sharp depreciation of the NOK. Since the extent of this impact is undisclosed, we cannot be sure how impactful oil prices and labor inputs were on the margins of the pelagic business. This would indicate that using Pelagia, rather than the beleaguered LatAm operations as a barometer, the pelagic market is rather strong, although we expected more resilience in fishmeal price. Nonetheless, volumes offset the pricing effect for high revenues enough where a 30% YoY growth was achieved.

Risks and Concluding Remarks

Overall, it seems that the salmon market is more recession resistant than we would have expected, even though Lerøy salmon is a premium product and restaurants have been shut down for a while. There is a risk that the prices cannot hold, and that because of the particular nature of this crisis, causing massive damage to the restaurant business, the same recession resistance evident in 2008-2009 might not materialise now. Nonetheless, we can be sure that due to the favourable industry structure, lack of discipline and new capacity in the markets is unlikely and would not impact pricing.

For the Pelagic business, we were not expecting such overhang from last year’s weak fishing season, but more concerning is that fishmeal and frozen product prices fell. Nonetheless, the massive uptick in volumes that was expected from greater activity in agriculture and in frozen fish consumption more than offset this pricing deterioration leading to revenue increases in Pelagia. However, marginality in the pelagic business is being impacted by lack of labor availability due to Covid-19.

To analyse the levels Austevoll is trading at, we’ve done an analysis of its business’s implied multiples.

(Source: Mare E-Lab Research Database)

Assuming a valuation of the associates around 5.5 billion NOK, we get an implied multiple for the Pelagic business of 11.96x EV/EBITDA when using 2018 data (where the one-off weak season impact does not factor in). With animal feed businesses at historical multiples of around 14 EV/EBITDA, we still think that there is some upside in pelagic.

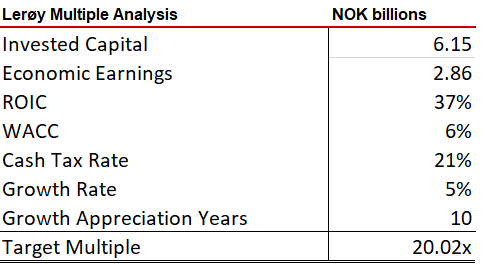

However, because of margin strife due to Covid-19 in pelagic margins, what’s more compelling is the multiple on the salmon business, almost entirely responsible for by Lerøy. An 8.24 EV/EBITDA multiple is very low for a business with substantial margins and great industry structure. Based on Lerøy TTM data, and using target multiple analysis model, a much higher multiple could be justified for Lerøy for a fair value implied return. We used 10 years as a reasonable growth appreciation period for an industry structure like aquaculture.

(Source: Mare E-Lab Research Database)

This is a more reasonable multiple that we could expect in a private equity setting for assets like Lerøy’s. Considering the stark difference between the implied and actual multiple, as nice as pelagic exposure might be with its discounted nature being more attractive in a prolonged recession, Lerøy might be a better pick. Especially since 20% of Lerøy’s markets are Norwegian, a country characterised by a robust welfare state with many automatic stabilisers in place, a prescient Covid-19 response and a patriotic people. So although we continue to see Austevoll as attractive, Lerøy might be even better.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.