This post was originally published on this site

I was recently asked about Snap (SNAP). Having no articles on the subject, I figured I’d make my thoughts public now. Let’s get into the business itself, discussing a potential trading plan afterward.

Let’s start with one recent other aspect of Snap that has been of interest to me due to the news coming out of France (link in the next paragraph): its use in independent businesses. Illicit business, such as those selling counterfeit goods or illegal drugs, have found success in advertising their products via Snapchat. Unlike text-based social media apps, Snapchat is image-focused, and thus screening via something like a text filter is impossible, and machine-learning algorithms are yet unsuccessful in adequate image screening.

(Source: Pranay Pathole, Twitter)

With social media companies becoming increasingly regulated, the difficulty in scanning for these illicit sales (or hate speech in France) becomes a costly problem, as compared to a company such as Facebook (FB) that could simply run a text algorithm. In addition, while Snap says it does not retain all user data or stories, governments might be walking the path of forcing Snap into the expensive task of data retention and organization. It only takes one Snap-centered scandal to cause law enforcement to take an interest in Snap’s data management, and that’s a strong potential headwind for the company. I’ll skip a similar discussion on the potential risks related to the company appearing to embrace deepfakes and the company’s reliance on augmented reality as its unique selling proposition.

Elon Musk joined our Zoom call | Avatarify

(Deepfake circa 2020; keep Moore’s law in mind)

Stepping back for a minute to look at Snap on a longer timeframe, the company is often seen as a more modern version of something like Twitter (TWTR), with an emphasis on images instead of text. Naturally, this makes the company feel more youthful, appealing to a younger generation of social media users. TikTok is close to the Chinese equivalent of Snapchat, and it too focuses on appealing to the younger generation.

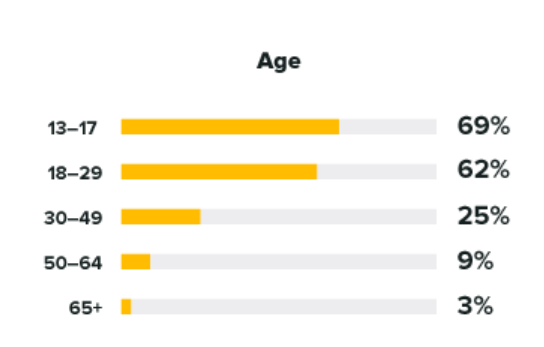

Like TikTok, Snap is not yet profitable. The young demographics and the lack of profitability are positively correlated, just as youth and liquid net worth are correlated. Younger demographics bring in fewer and poorer advertisers.

When Evan Spiegel, CEO of Snap, stated that the app is only for rich people, he was reflecting Snap’s reliance on its younger demographics. He was against expanding to “India and Spain” because these are not rich countries – but more importantly, the youth in these countries have comparatively little expendable cash. Snap’s reliance on the younger generations makes profitability a more difficult goal than it does for, say, Instagram, who has an older (and thus richer) demographic base.

Snapchat’s usage rate, by age categories:

(Source: SproutSocial)

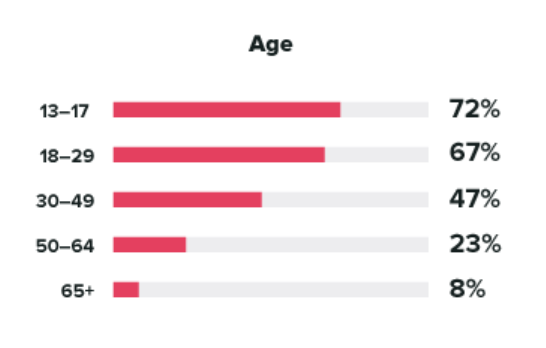

Instragram’s demographics, for comparison.

(Source: SproutSocial)

Snap does not win in any category and loses the biggest in the categories with the biggest spending power. The plurality of Snapchat users have an income of under $30k per year; the plurality of Instagram users have an income of over $75k per year. This shows the power of marketing to boomers, not zoomers.

In light of the “only for rich people comment,” these numbers look funny. Clearly, Instagram is the image-focused social media app for rich people here; Snapchat looks to be more for poor people. Snapchat was successful in attracting its userbase despite the strong competition, but that demographic has yet to give way to success in the company’s path to profitability.

What’s the meaning of being a social media staple if you cannot turn a profit? This is question all SNAP investors should be asking themselves, especially during coronatimes (I coined this phrase). With SARS-CoV-2 stressing the economy, how can anyone feel content in bidding up this unprofitable alternative to FB (the owner of Instragram)?

I’d love to hear a good short/medium-term bullish thesis, as I’ve yet to read one that seems rational. If you have one, leave it in the comments section below.

For now, I’m going to recommend shorting SNAP. With the economy in the dumps and without changes in its profit-seeking ventures, this company is headed downward. For investors, I’d say avoid this stock until 2022, and only then pick it up – and only if at near-low prices.

Here’s the short-term short play:

- Buy Jan19 $20 put

- Sell Jun19 $16 put

- Cost: $240, as of May 18

This is a limited risk/reward strategy – your downside reward is limited, as is your upside risk. Your max profit is reached once SNAP falls to $16. If SNAP falls below $16, you will see no extra profits and should thus buy back the short put if you expect SNAP to fall more than 6% before Jun 19.

Happy trading!

Exposing Earnings is an earnings-trading newsletter (with live chat). We base our predictions on statistics, probability, and backtests. Trades are recommended with option strategies for the sake of creating high-reward, low-risk plays. We have 89% accuracy for our predictions in 2019.

-Upcoming Earnings Plays: AZO, ORCL, MU, CAMP, LQDT

Check out my methodologies in these four videos.

If you want:

- A definitive answer on which way a stock will go on earnings…

- The probability of the prediction paying off…

- The risk/reward of the play…

- A well-designed options strategy for the play…

…click here to see what Exposing Earnings members are saying.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in SNAP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.