This post was originally published on this site

Over the past week, the S&P 500 went up 3.37%, closing at its highest levels since the beginning of March. This strong bull rally is primarily caused by the Fed pumping unprecedented amounts of money in the market, which causes an inflation of asset prices such as stocks. Even if the economy will get hit hard, I believe it is important to keep putting cash into stocks cautiously given the Fed will do anything to increase asset prices.

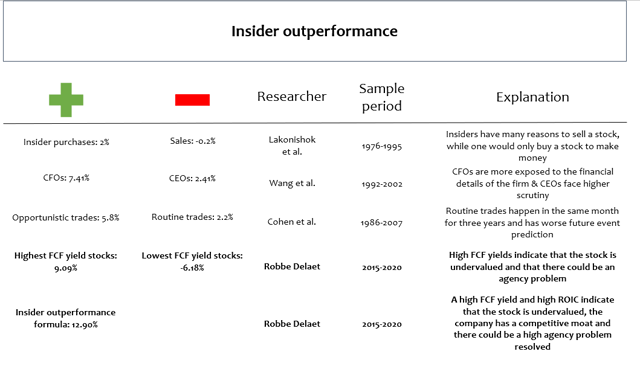

However, investors are currently in one of the hardest markets ever to find attractively valued stocks that will withstand this economic depression. Following insider purchases can be a very valuable strategy to help with that. Insiders trade based on undervaluation and/or superior insider information. Literature has proven (see list below for the most interesting findings) that insider purchases outperform the market significantly. Over the past months, I have worked hard on a formula which captures the most attractive stocks with insider trading activity. With this formula, which outperforms the S&P 500 by 12.90% annually, I pick out the best stocks out of the hundreds which see insider trading activity. In this weekly article, I will provide a list of the highest market cap purchases and discuss whether these stocks are likely to outperform or not, based on my formula.

Moreover, I will provide a list of all stocks picked by my Insider Outperformance Formula and discuss my favourite one more thoroughly. In this way, I hope to provide valuable information to investors who try to reach higher returns by following insider purchasing activity.

(Source: Robbe Delaet based on papers from Lakonishok et al., Wang et al., Cohen et al. and his own paper)

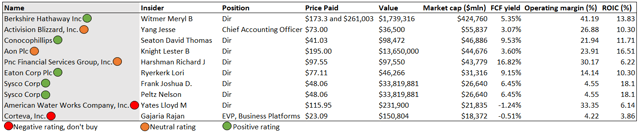

List of highest market cap insider purchases

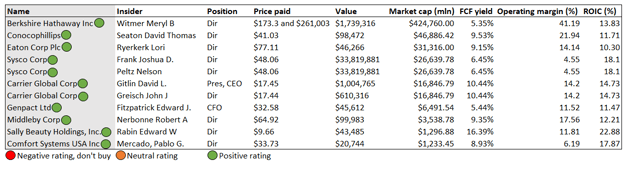

In this section, I will provide a list of the 10 insider purchases with the highest market capitalisation and discuss which purchases are informative for future superior returns:

- Berkshire Hathaway’s (BRK.B) (BRK.A) director Meryl B. Witmer purchased $1.7 million of shares last week. Berkshire is a well-known US conglomerate founded by Warren Buffett and split into three segments: Insurance and Others, Railroad, Utility and Energy and Investments. Its three biggest stakes are in Apple (AAPL) (30% of portfolio), Bank of America (NYSE:BAC.PK) (14% of portfolio) and Coca-Cola (KO) (9% of portfolio). Mss. Witmer is a well-respected asset manager, founder of Eagle Value Partners LLC and long-time colleague of Warren Buffett. Her significant purchases are remarkable and may be based on undervaluation (lowest book-to-market value in several years) or anticipation on higher buybacks/new investments which could drive the stock price higher. Berkshire gets a positive rating and I will write a separate article about this interesting insider purchase soon.

- Activision Blizzard’s (ATVI) Chief Accounting Officer Jesse Yang purchased $36.5K worth of shares last week. Activision Blizzard is the holding company of very famous games such as Candy Crush, Call of Duty and Overwatch. The firm is seeing strong demand due to the stay-at-home culture and saw an increase in bookings of 21% last quarter. The stock is rated neutral given the valuation at a free cash flow yield of 3.07%. Also, the low amount of shares purchased and other heavy insider selling makes this purchase less convincing.

- ConocoPhillips (COP) is a worldwide explorer and producer of oil and gas. Its director Davis Thomas Seaton purchased $98K worth of shares as the stock is still down 33% YTD. In my opinion, COP is one of the most interesting stocks in the oil industry given its strong balance sheet (leverage ratio of 0.4), consistent positive free cash flow generation and strong return on invested capital (“ROIC”). The company will be hit significantly by this crisis and its revenue was down 33% in the first quarter. However, it is one of the companies which will be able to come out of this crisis strongly, and meanwhile, the dividend yield increased to almost 4%. The stock is positively rated based on the Insider Outperformance Formula.

- Aon Plc’s (AON) director Lester B. Knight purchased $14 million worth of shares last week. Aon is a firm which provides a wide range of services such as reinsurance, health, retirement and risk solutions. The stock is rated neutral given its high valuation.

- PNC Financial Services Group’s (PNC) director Richard J. Harshman bought $98K worth of shares last week. This purchase follows three other director purchases over the past months. PNC offers a wide range of financial services such as retail banking, asset management and corporate & institutional banking. The stock is down 36% YTD and its dividend is yielding close to 5%. The stock is rated neutral, as the financial services sector has very low earnings visibility.

- Eaton Corp.’s (NYSE:ETN) director Lori Ryerkerk purchased $46K worth of shares last week. Eaton provides power management technologies and services for electrical products, hydraulics, aerospace, vehicles, eMobility, etc. The firm managed to grow profits considerably over the past years, but will be impacted significantly by the COVID-19 crisis. The stock is positively rated given its low valuation (FCF yield of 9.15%) and strong ROIC.

- Sysco Corp.’s (SYY) directors Joshua D. Frank and Nelson Peltz, also managers of Trian partners, both purchased $34 million worth of shares last week. Interestingly, they sold a similar amount last year at prices 30% above current prices. Sysco is engaged in selling, marketing and distributing food- and non-food products to restaurants, healthcare and other businesses worldwide. I see Sysco as a high-quality company, having increased operating income significantly over the past years and generating strong amounts of cash flows. The stock gets a positive rating given its high FCF yield and strong ROIC.

- American Water Works Company’s (AWK) director Lloyd M. Yates bought $232K worth of shares last week. AWK is the largest American water and wastewater services company. The company is negatively rated due to its negative free cash flow generation (primarily driven by higher CAPEX compared to D&A). Also, it is a solitary purchase and other insiders sold the stock over the past months, making it less informative.

- Corteva’s (CTVA) EVP Rajan Gajaria purchased $151K worth of shares last week. Corteva is a pure-play agricultural company, recently spun-off by DowDuPont. The stock is rated negatively due to its negative free cash flow generation.

(Source: Robbe Delaet; FCF yield = operating cash flow – CAPEX/ market cap; ROIC= NOPAT/total assets – current liabilities)

(Source: Robbe Delaet; FCF yield = operating cash flow – CAPEX/ market cap; ROIC= NOPAT/total assets – current liabilities)

List of positive-rated purchases

Next, a list of the stocks which are picked by the Insider Outperformance Formula is provided. On average, the stocks picked by this formula over the past five years generated an excess return of 12.90%. This week, 11 high-potential purchases are selected out of a basket of 412 insider purchases:

- As discussed above, Berkshire, ConocoPhillips, Eaton and Sysco are picked.

- Carrier Global Corp.’s (CARR) CEO David L. Gitlin and director John J. Greisch purchased $1 million and $610K worth of shares last week. Carrier is a former United Technologies company operating in three segments: Heating, Ventilation, and AC, Fire & Security and Refrigeration. The firm is generating income from new equipment and also from maintenance services. The management believes it will benefit strongly from multiple mega trends such as climate, a growing middle class and a significant increase in IoT devices. The company has a strong competitive moat given its leadership in several end-markets and best-in-industry operating margins. The stock is attractively valued at a FCF yield of 10.44%, but is only advisable for investors who are not shy of taking some risks given its high leverage ratio of >4.

- After several weeks of insider activity in the firm, Middleby’s (MIDD) director Robert A. Nerbonne purchased $100K worth of shares last week. Middleby is the largest manufacturer of cooking equipment and operates in three platforms: Commercial Foodservice (64% of revenues), Premium Residential (22% of revenues) and Food Processing (14% of revenues). These three platforms all have multiple leading brands and create strong synergies. Importantly, the firm has a wide blue-chip customer base with customers such as McDonald’s (MCD), Starbucks (SBUX) and Dunkin’ Brands (DNKN). After a huge surge, the stock struggled over the past years as pessimism kicked in about inorganic growth (all growth comes from acquisitions) and its high leverage ratio of 3x. However, its management team believes that it will be able to increase EBITDA margins to 30% over time. The company is positively rated as it has an interesting valuation (FCF yield of 10%), strong ROCE, very strong track record and its market leadership. In Q1, the firm reported a 1.4% decrease in revenues, but managed to grow net profits. It has $314 million in cash and $3.5 billion available in credit facilities.

- Sally Beauty Holdings (SBH) also appeared in last week’s list. Now, director Edward W. Rabin bought $43K worth of shares. This cluster purchasing activity may indicate that the stock is severely undervalued. Sally Beauty is an American retailer supplying hair color, hair care, nails, salon, and beauty products. As a retailer, it is certain that SBH will be hit significantly by the COVID-19 crisis. In fact, its Q1 revenues decreased by 7.1% and EPS went down 54.9%. However, its e-commerce sales grew by 353% in April, which could partially limit the impact of COVID-19. For sure, there are reasons for this stock to be down, being in the retail space and having a pretty high leverage ratio of 2.7. However, the stock is down 45% YTD, which incorporates a lot of bad news. At this moment, the stock is valued at a FCF yield of 21.41%, which indicates a lot of upside potential if things improve. Sally Beauty is positively rated, but be aware of the risks with this stock.

- Lastly, a stock which was chosen as a favourite pick two weeks ago, Comfort Systems (FIX) saw more insider buying activity as well, which could be a strong indicator for future returns. FIX is a US-based service provider for heating, ventilation and air conditioning. The stock was chosen for its consistent growth, low valuation and strong margin expansion.

(Source: Robbe Delaet; FCF yield= operating cash flow – CAPEX/market cap; ROIC= NOPAT/total assets – current liabilities)

Last favourite pick performances

To give an indication on the type of stocks that I prefer and their performance since my recommendation, I included a list below of my favourite picks during the last few weeks. Although we are still in the early stages of my insider coverage, I am very happy with the 7 out of 8 stocks seeing positive returns and an average excess return vs. the S&P 500 of 1.69%.

| Company name | Recommendation date | % change | vs. S&P 500 |

| Mastercard (MA) | 03/26/20 | +11.92% | 0.25% |

| Baxter (BAX) | 04/04/20 | +6.42% | -11.59% |

| Amazon (AMZN) | 04/10/20 | +19.79% | +14.51% |

| Huntington (HII) | 4/16/20 | -5.70% | -10.61% |

| Darden Restaurants (DRI) | 04/24/20 | +12.21% | -8.67% |

| AbbVie (ABBV) | 05/01/20 | +12.39% | +8.63% |

| Comfort Systems (FIX) | 05/08/20 | +1.90% | +1.66% |

| Medifast (MED) | 05/14/20 | +5.02% | +2.04% |

This week’s favourite pick: Middleby Corp.

Over the past few weeks, Middleby has been on the edge of being chosen as favourite pick; right now is the time to discuss the company. I like the stock for three main reasons: a strong leadership position, consistent growth and significant undervaluation.

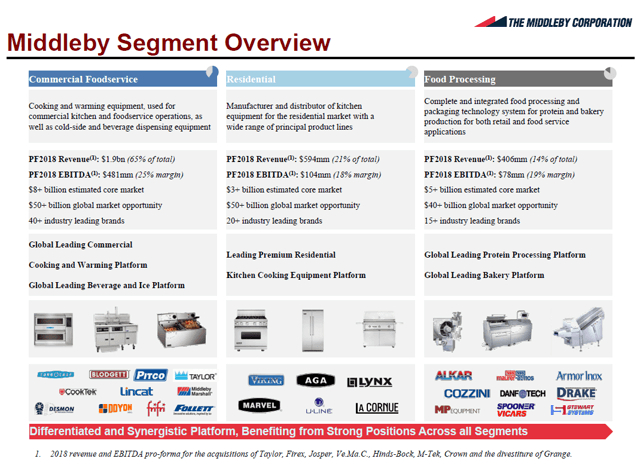

Company presentation

Middleby is a food equipment company which operates in three segments. First, Commercial Foodservice (65% of revenues, 25% EBITDA margin) includes cooking and warming equipment for restaurants. Second, Residential (21% of revenues, 18% margin) includes manufacturing and distributing kitchen equipment. Last, Food Processing (14% of revenues, 19% margin) includes food processing and packaging systems for protein and bakery production. Overall, the company is focused on driving growth via acquiring industry-leading brands. Over the past five years, the company acquired 30 companies. While this was very beneficial for top-line growth, it increased its leverage significantly and put some pressure on margins. For the coming years, lower acquisition spending is anticipated and the focus will lie on growing operating margins (the management team aims to grow Commercial Foodservice’s EBITDA margin by 500 bps).

(Source: Middleby investor presentation)

Leadership position

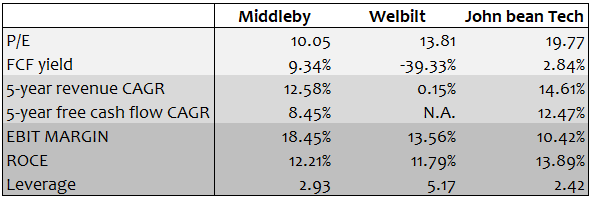

Middleby has a leading position in their market as they are focused on acquiring high-tech, leading brands which add strong competitive advantages and increases customer satisfaction. For example, they have been increasingly focusing on IoT over the past years. Their portfolio of strong brands led to long standing relationships with industry-leading companies such as McDonald’s, Dunkin’ Brands and Starbucks. The interesting part is that these customers are very likely to consistently drive a big part of future revenues, given the fact that 49% of Middleby’s sales consist of replacements and upgrades. Middleby’s strong competitive moat is also visible in its industry-leading operating margins of 18.45% vs. 13.56% and 10.42% for competitors Welbilt (WBT) and John Bean Technologies (JBT).

(Source: Middleby investor presentation)

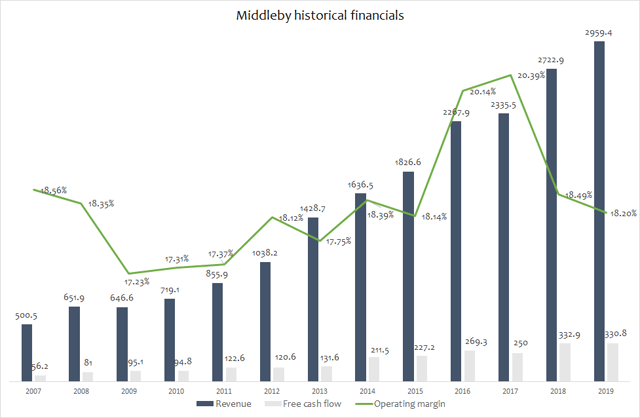

Consistent growth

What I like the most about Middleby is its very strong and consistent growth. In fact, revenues did not shrink one year since the Great Financial recession of 2009, when revenues declined by less than one percent. Over the past 10 years, revenue grew by a CAGR of 16.4%, primarily contributed by acquisitions. This revenue growth was accompanied with strongly growing margins, which eventually deteriorated in 2018, causing a decline in its share price. What I also like is its strong free cash flow generation, which is important for acquisition-intensive businesses. While the COVID-19 crisis and lower acquisition spending will probably put a pause on this revenue growth, I believe that the management team will keep this positive trajectory in the long term.

(Source: Robbe Delaet based on company SEC filings)

Low valuation

Middleby’s shares can get picked up at record low valuations as their shares plunged due to worries about the effect of the COVID-19 virus on the restaurant sector. Middleby is valued at a P/E of 10.05 and FCF yield of 9.34% (based on 2019 numbers), which is significantly lower compared to peers Welbilt and John Bean Technologies. When we look at the growth metrics, margins, ROCE and leverage ratio, this discount is not at all justifiable. While it is hard (impact of COVID-19 still largely unknown) to determine a fair valuation based on a DCF, I believe the stock is grossly undervalued at these metrics.

(Source: Robbe Delaet based on company SEC filings)

Impact of COVID-19

As many restaurants are closed or see less traffic due to social distancing rules, the sector got hit significantly by the virus. Consequently, Middleby’s numbers will also be severely impacted. While Q1 saw a limited impact (revenue -1.7%, EPS +7.2%) of the virus, the management guided that Q2 will be much worse. In fact, April orders were down 65% for Commercial Foodservice, 53% for Residential Kitchen and 28% of Food Processing. However, significant improvements in restaurant sales over the past weeks and a strong war chest of $314 million in cash should make this a short-term impact. I believe that much of the negatives is priced in already. Investors okay with taking more risks (high leverage ratio, COVID-19 uncertainties) can initiate a position at current prices.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.