This post was originally published on this site

Generation Z investors are experiencing their first bear market, and that’s a good thing.

I’m referring to investors who were born after 1996 and currently 26 or younger. They would have been no older than age 12 during the last major bear market, in 2008, and almost certainly weren’t paying attention to Wall Street. (I’m bracketing the waterfall decline in February and March 2020, in the initial weeks of the pandemic, which—at just 33 days in length—was hardly a normal bear market.)

Read: These simple, low-cost retirement portfolios are holding up well

This therefore means that, up until recently, Gen Z investors’ only experience of stock market investing was that stocks almost always go up. And that led to alarming levels of overconfidence, with dangerous consequences for both their own portfolios and the stock market as a whole.

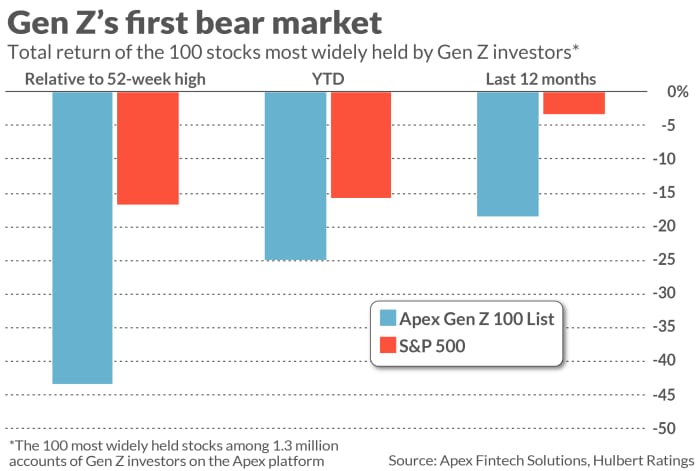

The stock market’s recent decline has certainly reduced that overconfidence, if not eliminated it altogether. Take a look at the accompanying chart, which reports the performance of the 100 stocks that are mostly widely held by Gen Z investors, according to an analysis conducted by Apex Fintech Solutions. On average, I calculate, these stocks are 43% below their 52-week highs, and are sporting a 25% loss for the year to date. (Performance data, per FactSet, are through May 10.) A bear market is traditionally defined as a loss of at least 20%.

Uncredited

I hasten to add that, in saying that it’s a good thing that Gen Z is experiencing its first bear market, I am not motivated by the condescending judgment of some retirees and near-retirees that these youthful investors are getting what they deserve. There’s no place for such an attitude since all of us, at one point or another, have gone through a similar and painful process of becoming older and wiser through experiencing a bear market. Can you say Internet bubble or, before that, 1987 Crash or, even before that, the Nifty Fifty and the 1973-74 bear market?

Instead, the reason that it’s a good thing to experience a bear market is that youthful investors’ overconfidence becomes ever more dangerous the longer it takes for them to experience their first bear market. If it takes too long, these investors’ arrogance will lead them to invest way more than they can afford to lose, and they therefore will lose intolerable amounts when the market eventually turns—as it inevitably will, sooner or later.

The same rationale is behind the hope expressed by casino veterans to those beginning to gamble for the first time—that the best thing would be for them to experience a big loss sooner rather than later. This is one reason why Josh Brown, of TheReformedBroker.com, said that Gen Z’s recent big losses will “prove to have been a good thing.” In the latest episode of his “What Are Your Thoughts?” broadcast, he said that, after experiencing their losses, Gen Zers “will not ever treat their money the way they treated it in 2021—ever again.”

That’s a good thing for another reason as well. Bear markets teach us an appreciation of valuations and risk, and that appreciation in turns supports the market being an efficient engine of economic growth, allocation of capital, and innovation. If the stock market were always to go up, then the riskiest, craziest, and most undeserving of new companies would gradually suck up the bulk of equity financing.

Kids markets

Adam Smith’s classic book from the 1960s, “The Money Game”, has one of the best descriptions of this recurring cycle in which each new generation, until it eventually lives through a bear market, makes fun of older investors for being risk averse and old-fashioned. You may recall that, in April 2020, Warren Buffett was prominently mocked as being “old” and “washed up”—that time had passed him by.

Smith used the phrase “kids’ markets” to describe environments in which this attitude is widespread among the youngest generation. He wrote about a friend of his on Wall Street called The Great Winfield, who during kids’ markets only hired investment managers who were not yet 30 years old: “The strength of my kids is that they are too young to remember anything bad, and they are making so much money that they feel invincible. Now you know and I know that one day the orchestra will stop playing and the wind will rattle through the broken window panes, and the anticipation of this freezes [the rest of] us” who are old enough to remember.

The Great Winfield adds that “memory can get in the way” of a kids market. When caution is being thrown to the winds, as it largely was in the latter part of 2020 and the first months of 2021, those who have lived through a bear market have a “malaise that comes with the instantly gone, flickering feeling of déjà vu: We have all been here before.”

Smith’s broader point: “There is no stopping the flow of the seasons.”

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.