This post was originally published on this site

Experience may be the best teacher in other walks of life, but not when it comes to retirement investing.

In fact, according to a just-released study, experience counts for surprisingly little. When it comes to a working knowledge of finance, those with decades more experience are only slightly more literate than those in their 20s. Those with the most experience still are able to answer barely half of a couple dozen basic financial literacy questions.

That’s the finding of the new study from TIAA Institute and George Washington University’s Global Financial Literacy Excellence Center (GFLEC). The authors of the study are Paul Yakoboski, a senior economist with the TIAA Institute; Annamaria Lusardi, a professor economics and accountancy at GWU and the founder and director of GFLEC; and Andrea Hasler, a professor in financial literacy at GFLEC.

Take MarketWatch’s financial literacy quiz — will you get a 10/10?

The survey they conducted this year represents the sixth year in a row in which the researchers have measured U.S. adults’ financial literacy. They did so by sending respondents a detailed survey with 28 questions testing their working knowledge of common financial situations—on issues ranging from saving, investing and borrowing to insurance and comprehending risk. The researchers distilled the answers into a single index—which they refer to as the P-Fin Index—which reflects the average percentage of questions that are answered correctly.

The latest P-Fin Index is 50%, which means that, on average, U.S. adults were able to correctly answer only 50% of the index questions. The P-Fin Index has remained remarkably steady since 2017, when it was 49%. It got as high as 52% in 2020. In an interview, Professor Hasler said that these variations in the yearly values of the P-Fin Index are not statistically significant, which means that the average level of financial literacy today is indistinguishable from where it stood in 2017.

Can it really be true our financial literacy hasn’t improved over the last six years?

Experience a poor teacher

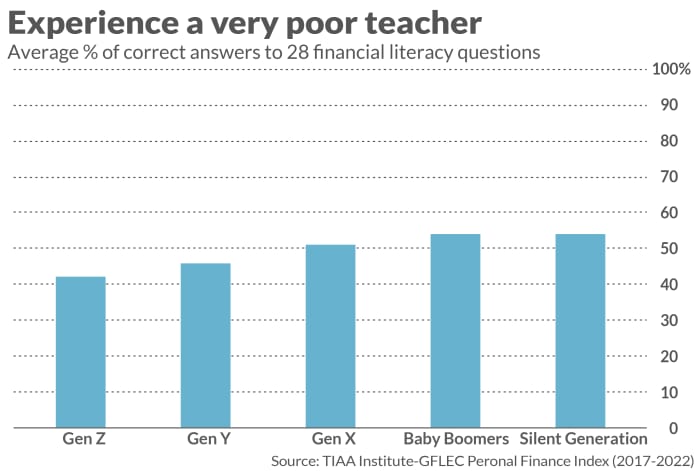

While this depressing result hints at the poor job that experience does in teaching financial literacy, another of the researchers’ results makes this conclusion even stronger. Upon calculating each generation’s average P-Fin Index values, they found that the oldest adults did only marginally better than the youngest ones.

These results are summarized in the accompanying chart. On average, those in Generation Z had P-Fin Index values of 42%. This number grows with each older generation, but for the oldest generation is still only 54%. Those with the most experience still were unable to answer nearly half of the financial literacy questions.

In other words, a lifetime of learning from financial missteps increases the number of correct answers on the test by just three, on average—from 12 to 15. And note that, even if the oldest generation were able to answer all of the 28 financial literacy questions, it’s still not clear that it would make much of a difference to their retirement financial security. That’s because they needed that literacy the most early in their careers.

If experience is such a poor and inadequate teacher, what is the solution?

Professor Hasler says there is “no way around financial education.” Indeed, she and her co-researchers consider their results to be a loud and clear “call to action.”

Understanding risk and uncertainty

The need for financial education is particularly acute when it comes to correctly assessing risk and uncertainty, she added. Such an understanding is crucial to making wise decisions that will impact your lifetime financial security—and especially your retirement. But the researchers found that not only was this the subject area in which the average U.S. adult had the least financial literacy, their literacy has gone down in recent years.

In the 2017 P-Fin Index survey, U.S. adults on average correctly answered just 39% of the questions relating to comprehending risk. In this latest survey, it had fallen to 36%–a statistically significant decline, Professor Hasler said.

(The survey questions are proprietary, but at the end of this column I reproduce a risk-and-uncertainty question the authors included in the 2021 survey. I’m sure all readers of this column will get the right answer.)

Though the researchers did not collect data on what might have caused this decline in the already-low financial literacy about risk and uncertainty, my suspicion is that a big culprit was the financial markets’ strength in the wake of the COVID-19 pandemic. It would have hardly been surprising for that pandemic and associated economic lockdowns to cause the stock market to enter an extended and punishing bear market. Yet far from causing that, the stock market enjoyed one of its strongest bull market runs in history.

No wonder investors are more confused than ever about risk!

The bottom line? Educate yourself. Consult with a qualified financial planner if you have to. Assume you don’t know all the answers, since you probably don’t.

Example of a risk-and-uncertainty question the P-Fin Index survey asked

Which of the following indicates the highest probability of getting a particular disease?

- There is a one-in-twenty chance of getting the disease

- 2% of the population will get the disease

- 25 out of every 1,000 people will get the disease

- Don’t know

The answer, of course, is the first option. Yet, according to the researchers, only 28% of respondents got it right. That’s sobering: If we can’t get this simple question right, it’s hard to imagine how we can make sound and wise financial decisions impacting our lifetime financial security.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.