This post was originally published on this site

Source: Fortune

L Brands (LB) reported revenue of $1.65 billion, non-GAAP EPS of -$0.99, and GAAP EPS of -$1.07. The company missed on revenue and earnings, yet the stock was over 15% in afternoon trading. I had the following takeaways on the quarter.

L Brands Is Shutting Down 250 Victoria’s Secret Stores

L Brands has been sort of a tale of two brands. Bath & Body Works (“BBW”) has been a star, while Victoria’s Secret has dragged down the company. L Brands appeared to have fobbed off its problems onto Sycamore Partners by selling a majority stake in Victoria’s Secret. The deal was terminated earlier this month amid uncertainty caused by the pandemic. L Brands decided to cut some of its losses by closing about 250 Victoria’s Secret stores:

L Brands plans to permanently close about 250 Victoria’s Secret stores in the U.S. and Canada in a highly-anticipated move.

The brand has been seen as off-message with its focus on fashion shows and models, while the inability to drive strong e-commerce sales has hurt during the pandemic.

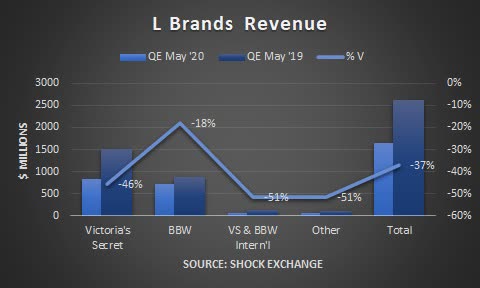

This quarter, Victoria’s Secret continued to sag, with a 46% decline in revenue; comparable sales were down 13%.

Revenue from BBW was off 18%, while total revenue fell 37%. Revenue from Victoria’s Secret was 50% of total revenue, down from 57% in the year-earlier period. The brand has been hurt by competition from Rihanna’s Savage X Fenty and American Eagle’s (AEO) Aerie brand, which celebrates women of all shapes and sizes.

Savage X Fenty and Aerie also have enjoyed more success online, which may have negated anything Victoria’s Secret may have had by selling through physical locations. Whether Victoria’s Secret can compete online remains to be seen. The brand is expected to have over 680 total stores at the end of the year. This means the brand is still reliant upon physical locations for its sale; it is also exposed to lease payments from those locations, which could remain a drag on earnings.

Though BBW’s revenue fell by double digits, there was a silver lining. Its comparable sales rose over 40% and sales through BBW Direct rose over 80% Y/Y. When the economy reopens, BBW’s sales online and via physical locations could continue to outperform. As L Brands reduces exposure to the Victoria’s Secret brand, BBW will be forced to carry more of the weight.

Shrinking Margins

Margins for L Brands also fell hard, as expected. The decline in scale alone was enough to crimp margins. Gross margin was 17.4%, down from 35.5% in the year-earlier period. Gross profit on a dollar basis was $289 million, down 69%. The decline was driven by declining scale and occupancy deleverage. General and administrative and store expenses declined 22% to $606 million; they were 36.7% of total revenue, up 700 basis points versus that of the year-earlier period.

The fallout was that operating income was -$318 million, a $471 million decline versus the year-earlier period. Operating income at BBW was $69 million, implying the other segments (including Victoria’s Secret) reported an operating loss of about $387 million. EBITDA was -$179 million, down about $478 million versus the year-earlier period. The knock-on effects of the pandemic may linger. This could portend more EBITDA declines next quarter.

Paltry Liquidity

It is paramount that L Brands maintain liquidity amid free falling revenue. Prior to the pandemic, Victoria’s Secret was already a drain on capital. It could take several quarters to rightsize the brand, if at all. L Brands ended the quarter with $957 million in cash, down from $1.1 billion in the year-earlier period. Working capital was $165 million, down from $749 million in the year-earlier period. Accounts payable increased over $25 million, despite the sharp fall in revenue. Its working capital is paltry, and the company may not be able to stretch its payables much further.

Capital expenditures were $55 million, down from $123 million in the year-earlier period. Management will likely look for more ways to cut costs; cost cutting may not fully-offset operating losses. L Brands still has a $5.5 billion debt load at 4.0x EBITDA. Its credit metrics deteriorated from 3.0x debt/EBITDA last quarter. Debt is already considered below investment grade, and the company’s recent performance did not help matters. Another potential ratings downgrade could hamper the company’s capital raising ability.

Conclusion

LB trades at just over 6x LTM EBITDA. Its paltry liquidity could come back to haunt the company. Sell LB.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year – a 33% discount.

Disclosure: I am/we are short LB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.