This post was originally published on this site

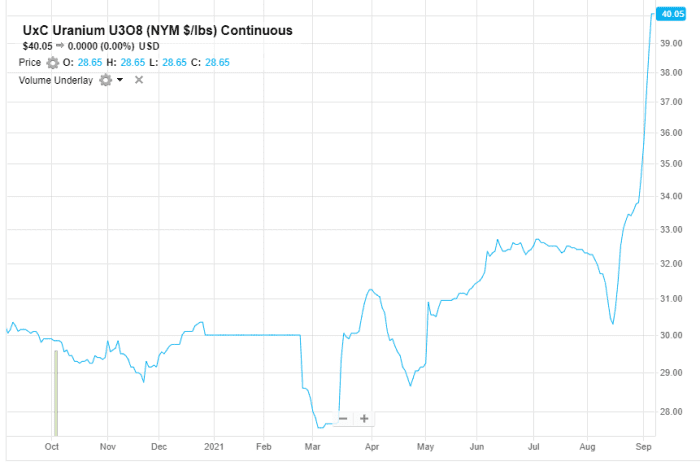

We’ll take a break from the is-bad-news-on-economy-good-news-for-the-stock market discussion, to take a look at a commodities market skyrocketing in recent weeks — uranium.

Uranium futures topped $40 per pound on Tuesday for the first time in six years, and have surged 33% since mid-August. That’s propelled other uranium plays, such as Canadian producer Cameco

CCJ,

and the Global X Uranium ETF

URA,

which invests in uranium miners and other nuclear component producers.

Uranium futures have surged since mid-August.

FactSet

Harris Kupperman, the president of hedge fund Praetorian Capital, said what’s happening is that one exchange-traded fund, the Sprott Physical Uranium Trust , is now buying uranium to store it — basically, to keep it out of the hands of the nuclear power plant operators who need it. “It’s just going Pac-Man on all the physical uranium,” Kupperman told the financial website RealVision. He likened what’s happened with uranium with what has happened to bitcoin

BTCUSD,

after the Grayscale Bitcoin Trust

GBTC,

started buying the virtual currency.

“It’s this reflexive feedback loop, it feels Soros reflexivity, where the other trust raises capital, it has to buy more uranium, the price of uranium goes up, it brings in more speculators, issues more shares to buy more uranium, just keeps going in a good way,” he said.

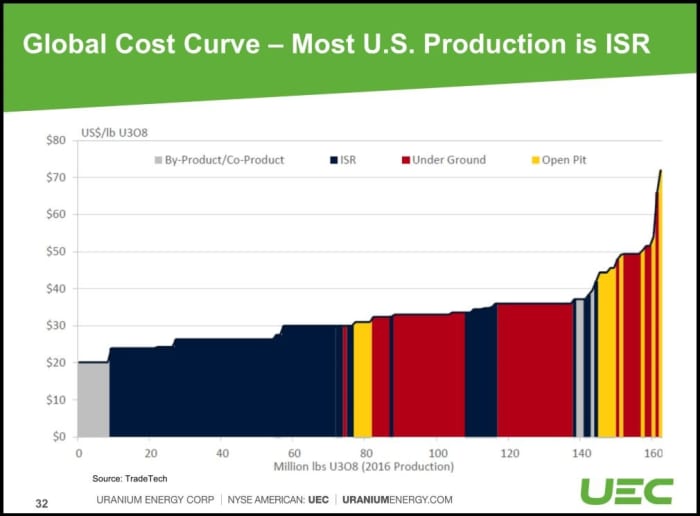

Can’t the producers just produce more? The Doomberg blog unearthed this global cost curve, from Uranium Energy Corp.

UEC,

that suggests that, as of mid-August, nearly half of producers weren’t making any money.

Prices still have a way to go to change the investment decisions made by the producers. Kupperman said the marginal cost to produce uranium is as high as $70 per pound. “They’re not going to turn the mines back on anytime soon,” he said.

Sometimes squeezes work out, and sometimes they don’t, as one observer on Twitter colorfully put it.

The buzz

Speaking of short squeezes, videogame retailer GameStop

GME,

reports results after the closing bell.

Job openings, the Federal Reserve’s Beige Book of economic anecdotes and consumer credit data are due for release.

St. Louis Fed President James Bullard says he wants the central bank to reduce bond buying despite the slowdown in U.S. jobs growth.

Dallas Fed President Robert Kaplan was an active buyer and seller of stocks last year, The Wall Street Journal reported, citing a financial disclosure form.

Activist hedge fund Elliott Management has taken a more than $1 billion stake in Citrix Systems

CTXS,

and is pressing for changes, according to a report in The Wall Street Journal.

French pharmaceutical Sanofi

SNY,

agreed to buy biopharmaceutical Kadmon Holdings

KDMN,

for $1.9 billion, or $9.50 per share.

Chinese electric-car maker NIO

NIO,

announced plans to issue up to $2 billion in shares.

The market

U.S. stock futures

ES00,

NQ00,

were pointing lower after a mixed end to Tuesday’s trade. The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.35%, and gold

GC00,

was trading right around $1,800 per ounce.

The tweet

John Hempton, the founder of hedge fund Bronte Capital, was unsparing in his criticism of Coinbase

COIN,

CEO Brian Armstrong, who tweeted his surprise that allowing crypto customers to lend their assets, in return for yield, would be considered a security by the Securities and Exchange Commission.

Random reads

From emerging to submerging — Pakistan has been downgraded to frontier market.

Animals are shapeshifting in response to climate change.

The BBC examines the science behind frozen ramen.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.