This post was originally published on this site

Tech stocks just got pounded as bad as the New York Times restaurant review of Eleven Madison Park. (Sample: the beet dish “tastes like Lemon Pledge and smells like a burning joint.”) The 2.8% downturn for the Nasdaq Composite

COMP,

was the largest one-day percentage drop in six months.

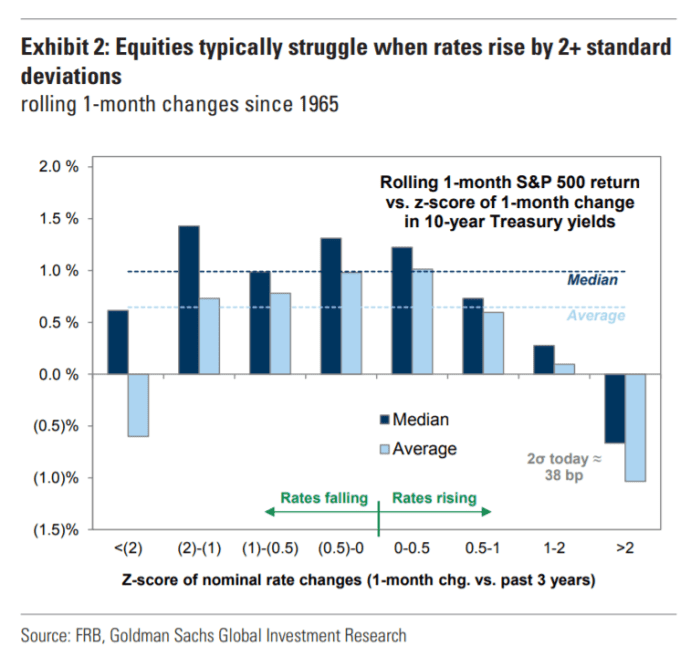

The sharp rise in interest rates over the last two weeks appears to be the main culprit. According to Goldman Sachs, the 26 basis points rise in the 10-year Treasury yield since Sept. 14 represented a 1.4 standard deviation event, and the 20 basis point rise in the 10-year TIPS yield represents a 1.7 standard deviation event.

Since 1965, they note, stocks struggle when rates rise by two or more standard deviations. With the long-duration information technology and communication services sector now accounting for 40% of the S&P 500 market cap, the index is even more sensitive to rate shocks.

Another issue, say strategists led by Ryan Hammond, is that the backdrop for stocks isn’t as favorable as when interest rates initially jumped at the beginning of the year. “That move largely reflected the ongoing improvement in the economic growth outlook following the vaccine announcements in early November. Today, economic growth is decelerating, the FOMC [Federal Open Market Committee] is expected to announce the start of tapering at its November meeting, and our economists have downgraded China’s economic growth forecasts,” say the economists.

So what to look at now? Focus on the speed of the rate moves more than the level. The 10-year yield would have to rise above 2.3% for relative valuations — the difference between the earnings yield and the bond yield — to rank above the long-term average.

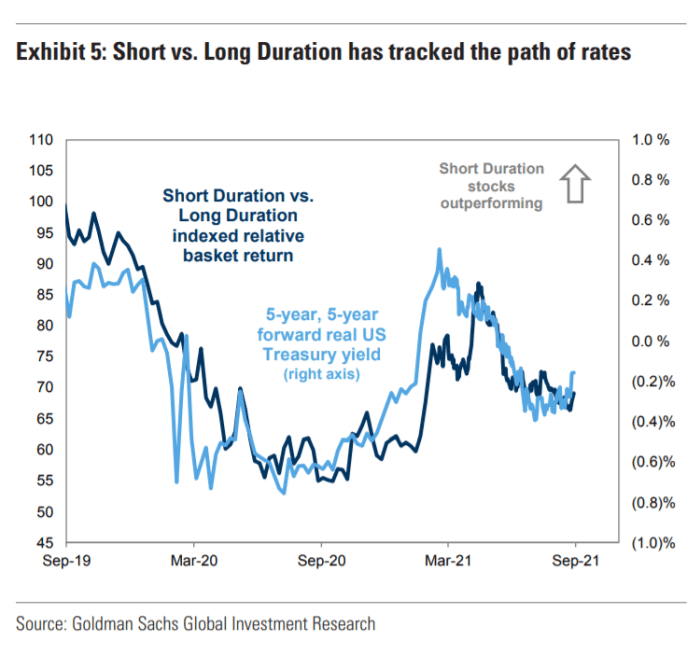

The Goldman strategists also aren’t as bullish toward short-duration value stocks as they were earlier in the year. “We expect the magnitude of outperformance for short-duration value stocks will be more muted in today’s environment than in the early 2021 experience, given the less favorable current economic backdrop of decelerating growth,” they say. Maintain longer-term positions in high-quality secular growth stocks, they add.

The buzz

Federal Reserve Chair Jerome Powell is set to hit the tape for a second day, this time facing friendlier questions from a central bank panel at a European Central Bank event. Three regional Fed presidents also are due to speak throughout the day.

Congress was still debating how to move forward on spending priorities as the impasse between progressives in the House, and centrist Democrats in the Senate, continues.

Memory-chip maker Micron Technology

MU,

issued a worse-than-forecast revenue outlook for its fiscal first quarter.

Electric-vehicle maker Lucid Group

LCID,

showed off the first cars rolling off its production line.

Netflix acquired its first videogame studio.

Embattled property developer China Evergrande

3333,

sold a nearly 20% stake in Shengjing Bank

2066,

for $1.5 billion to a state-owned asset management arm, with the proceeds going to that bank to settle financial liabilities.

Fumio Kishida, a former foreign minister, is set to become Japan’s next prime minister after being elected party leader.

The market

Stock futures

ES00,

NQ00,

were pointing higher as the yield on the 10-year Treasury

TMUBMUSD10Y,

edged back to 1.51%. The Stoxx Europe 600 rose, with every sector trading higher.

Random reads

Big tech companies are splurging on commercial real estate.

The new James Bond film gets rave reviews, but bring a cushion, for its 163-minute running time.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.