This post was originally published on this site

Stocks are down with investors still reeling from unpleasant CPI surprise that took a fresh bite out of markets on Wednesday. The tech sector was hardest hit, with Apple

AAPL,

losing 5% and surrendering its world’s biggest company crown to Saudi Aramco.

Big techs “need to recover to lead the market,” said Markets.com’s chief analyst Neil Wilson, who sees bulls putting up a fight if the S&P 500

SPX,

drops to 3,800. That’s “when things start to look very oversold…risk is the slow grind lower of the bear market, the exact momentum we saw in the bull market but in reverse.”

Our call of the day comes from Citigroup strategists, who offered a global equity portfolio to hedge against another equity downturn.

“It is long Value and short Growth. It favors the UK and EM over the US and Continental Europe. It prefers cheap Financials and commodity stocks to more expensive Tech-related trades,” said a team led by chief global equity strategist Robet Buckland.

The macro equity portfolio “minimizes exposure to a further real-yield driven derating across global equity markets, shorting trades where valuations are most sensitive to U.S. 10-year TIPS yields, and long those that are least sensitive,” the team said. The portfolio is wary of growth sectors, notably in the U.S.

As the team explained, the global equity market still isn’t that cheap vs. history.

They note the MSCI AC World benchmark

ACWI,

is off 17% year to date, trading on its long-term median of 15 times 12-month forward price/earnings — down from last year’s 20 times peak. Dropping to a 10-times multiple seen during the 2011-12 eurozone crisis would imply another ~33% derating, they said.

The MSCI AC World Growth index, meanwhile, is off 25%, while energy and U.K. health care are the only sectors bucking a “developing bear market,” said the strategists.

The relationship with real yields and equity valuations is key to determining more equity weakness, Citi reminded us.

“Monetary easing in 2019-2020 helped to drive down real yields and rerate equities. Monetary tightening in 2022 is driving up real yields and derating equities,” they wrote, adding that valuations for more rate-sensitive growth stocks probably have further to fall.

How much? The MSCI AC World Growth index hit a PE of 29 times towards the end of 2021 and now trades on 22 times, consistent with the current real yield of +0.3%.

Should that real yield head back down to -0.5%, the derating of growth stocks should reverse, but Citi’s global strategist Matt King saw real yields at risk of heading to 1%, which is bearish for equities and thinks stocks remain vulnerable even if 10-year TIPs stop climbing.

Their hawkish outcome on real yields would send the MSCI AC World benchmark to trade at forward price/earnings of 14 times from the current 15, and the MSCI U.S. to 16 times from 18 times. We’re almost there, they said, but the World Growth Index stands to drop to 17 times, down from the current 22 times.

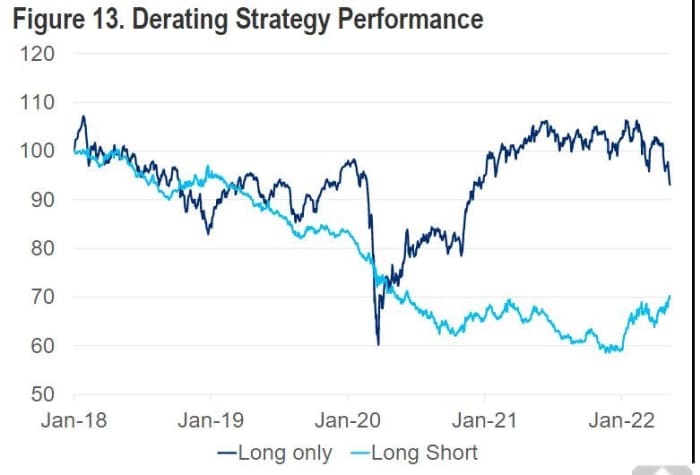

As for how this de-rating strategy has performed so far in 2022, here’s a chart:

Citigroup

“The long-only strategy is down this year, but much less than the overall market,” said Buckland and the team.

The buzz

Disney stock

DIS,

is down after the entertainment giant said it added more streaming subscribers than expected in the wake of Netflix’ s

NFLX,

rout, but warned of weakness ahead.

AppLovin

APP,

is rallying after the app-monetization group’s executives said their software business is revving up, and they could put the app unit up for sale.

EV maker Rivian Automotive

RIVN,

is up after sticking to its 2022 production outlook. And Lordstown Motors

RIDE,

surged more than 30% after saying deal to sell its factory to Foxconn went through.

Beyond Meat’s

BYND,

stock is headed below its IPO price for the first time after disappointing results. Grocery-delivery group Instacart has filed for a long-awaited IPO.

WeWork

WE,

and Squarespace

SQSP,

are both up on well-received results, while US Foods

USFD,

is tumbling on earnings disappointment.

April producer prices rose 0.5%, which met some economists forecasts, with annual inflation easing jut a bit. Weekly jobless claims crept up by 1,000 to 203,000.

The crypto bloodbath continues. Following the collapse of algorithmic stablecoin TerraUSD, mega stablecoin, Tether

USDTUSD,

announced a $1 billion swap as it hit a low of 95 cents. Bitcoin

BTCUSD,

is down about 5%.

President Joe Biden urged Americans not to “grow numb to such sorrow” as he announced 1 million COVID deaths in the country.

Finnish leaders are backing NATO membership in response to Russia’s war in Ukraine, and Moscow has threatened retailiation. Former Russian president Dmitry Medvedev warned that the West’s steady weapons supply and support for Ukraine risks “full-fledged nuclear war.”

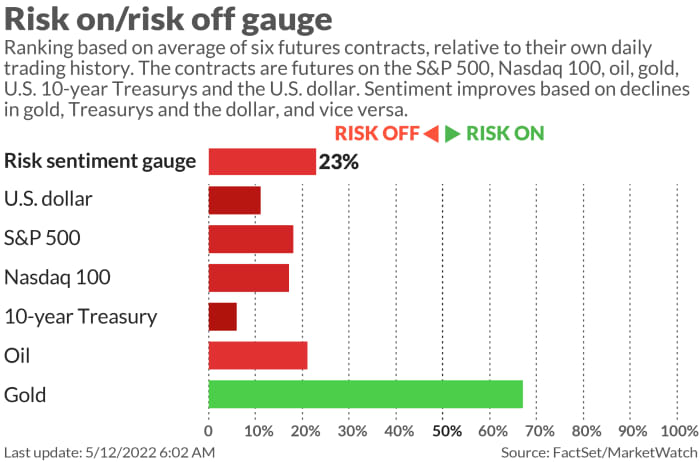

The markets

Uncredited

Stocks

DJIA,

COMP,

are under pressure, along with Treasury yields

TMUBMUSD10Y,

TMUBMUSD02Y,

as the dollar climbs

DXY,

Commodities are also sliding, with oil

CL00,

BRN00,

down over 2% and gold

GC00,

down nearly 0.5%.

The chart

Here’s a look at how Apple’s market cap eventually ceded to Saudi Aramco’s.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

Random reads

This tough root crop could break the world’s dependence on wheat.

Spain expected to be the first country in the world to offer “menstrual leave.”

Passenger with no training lands a small plane in Florida.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.