This post was originally published on this site

For those who track financial markets on a daily basis, the story of red-hot inflation driving a rotation between assets may seem like an old story. But it’s still in the early stages, according to David Groman, a London-based strategist at Citi.

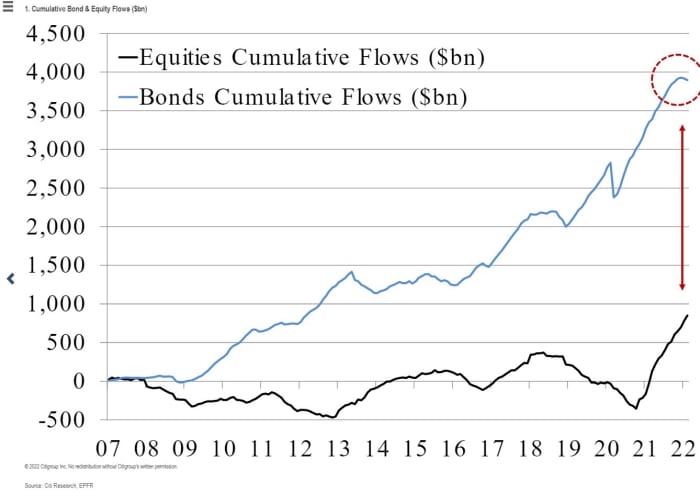

The fund flows from bonds to equities, the U.S. to the rest of the world, and growth to value, remain fairly small. And valuations still support further rotation, he says. “Global equities still look cheap against bonds. Rest of World indices look attractive against the U.S. Value is still lowly rated versus Growth,” Groman said.

He notes that even as investors piled a record $913 billion of flows into equities last year, the cumulative $750 billion switch into equities since 2007 still looks low, at least compared to $4 trillion poured into bond funds. “Bitter experience means that we are wary of calling a multi-decade switch back to equities, but the data do suggest scope for further rotation over the shorter term,” said Groman, who previously was a financial economist at the U.S. Treasury.

As for regional preferences, flows into ex-U.S. funds have outpaced U.S.-inclusive funds for seven of the last eight months as a percent of assets under management. “Investors do seem to be diversifying outside the U.S. but were already doing so before this year’s underperformance. The shift in flows still seems small compared to the prior preference for the U.S.-inclusive funds, so maybe there is more to come,” said Groman.

Value funds have seen seven consecutive weeks of inflows, compared to six straight weeks of growth outflows. But the magnitude of those flows are small. Cumulative flows into value funds last year when there was a rotation reached $70 billion, compared to this year’s $23 billion inflow.

“The flow drivers behind recent market rotations remain relatively modest. As further capital chases the recent winning trades, they could move further. Although [the first quarter 2021] rotation soon fizzled out, we suspect that its [first quarter 2022] counterpart could run further,” he said.

The buzz

The retail sales report for January is due for release, with economists expecting an improvement in seasonally adjusted terms, while the minutes from the last Federal Open Market Committee meeting will be released in the afternoon. Inflation in the U.K. reached a 30-year high of 5.5% in January.

Developments between Russia and Ukraine still hang over the market. U.S. President Joe Biden says the U.S. has not verified Russia’s claim about a partial troop withdrawal, and NATO secretary general Jens Stoltenberg said Russia has actually increased the number of troops, and that more troops are on their way. Ukraine’s defense ministry says it was battling a cyberattack.

Shopify

SHOP,

and Kraft Heinz

KHC,

are among the companies scheduled to report results before the open of trading, while Nvidia

NVDA,

and Cisco

CSCO,

headline the reports after the close.

ViacomCBS

VIAC,

slumped as the company, which is changing its name to Paramount Global, reported worse-than-forecast earnings and revenue. Roblox

RBLX,

fell after reporting a wider-than-forecast loss. Airbnb

ABNB,

gained on a strong outlook and better-than-forecast fourth-quarter earnings.

Digital World Acquisition Corp.

DWAC,

the special purpose acquisition vehicle that has agreed to buy Trump Media and Technology, may attract attention after Donald Trump Jr. posted a screenshot of his father’s first post on the Twitter-like social-media platform called Truth Social.

The market

U.S. stock futures

ES00,

NQ00,

slipped, after the 1.6% jump in the S&P 500

SPX,

on Tuesday when Russia said it was withdrawing some troops from Ukraine’s border.

The yield on the 10-year Treasury

TMUBMUSD10Y,

was 2.04%.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

Random reads

With a tiger and a photo of CEO Jamie Dimon, JPMorgan enters the metaverse.

Here’s a piece from the humorist P.J. O’Rourke, who died on Tuesday, on the Enron fraud.

This skier cost himself a gold medal by going the wrong way.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.