This post was originally published on this site

An employee demonstrates the effects of carbonation on lime water during a presentation to visitors on carbon storage techniques in a laboratory, operated by De Beers, in Johannesburg, South Africa, on May 3, 2017.

Waldo Swiegers/Bloomberg News

It is hard to imagine a less-loved sector than energy.

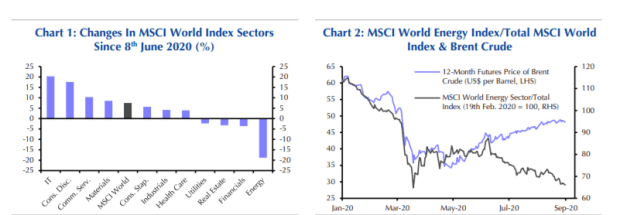

The energy members of the S&P 500 SP500.1010, -0.91% have dropped 42% this year, compared with the 37% advance for the index’s information technology components SP500.45, +1.85%. That is even worse than the 30% drop in front-month light sweet crude oil futures CL.1, +0.51% this year, and the bonds of energy companies also have performed better, which “suggest to us that investors think that they will be less profitable, even if they are less likely to go bust,” according to Oliver Allen, markets economist at Capital Economics.

There is a whole host of worries. In the short term, there is less of a need for energy of any sort, since economies are still running well below capacity due to the coronavirus pandemic. There is also the potential of higher taxes in a Joe Biden administration, and, bigger picture, climate change, which not only makes the sector unpopular to environmentally-focused investors but also is likely to prompt tougher regulation.

Which is where an interesting piece of research from Goldman Sachs comes in. Entitled “Reimaging Big Oil: The Age of Transformation,” the bank says a new European Commission rule kicking in by the end of next year can actually drive this shift. It will require companies to classify their activities with regard to sustainability.

“Big Oils have always been vertically integrated in oil, from production to downstream processing, trading and retail, and have been able over recent years to develop and manage complex energy supply chains in natural gas. We believe that they have the capability to transition from international oil companies to integrated energy companies and see them integrating vertically in low carbon power, leveraging their brand and trading capabilities to acquire power customers,” say the analysts, led by Michele Della Vigna.

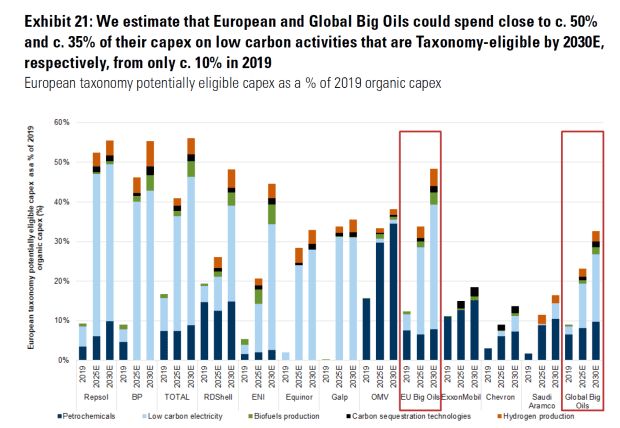

Under what is called the EU taxonomy, Goldman analysts see five categories that are eligible to be labeled as sustainable in which Big Oils have a material or growing presence: low-carbon electricity; petrochemicals manufacturing; biofuels manufacturing; clean hydrogen and carbon sequestration.

They estimate European big oil companies could increase their share of taxonomy-eligible revenue to 25% by 2030, from 7% now, and 50% of capital expenditure, from 10% today.

Repsol REP, -0.81% and BP BP, -0.76%, both with ambitious targets to expand their low-carbon business, could have 20% of their enterprise value made up of these activities by 2030, the Goldman analysts say. The report also analyzes Exxon Mobil XOM, -1.27%, Chevron CVX, -1.01% and Saudi Aramco 2222, -0.84%.

One issue: most of these low-carbon businesses aren’t consolidated and remain off balance sheet at the moment, the analysts say. “We therefore view that as the low carbon electricity business expands, it will become more important for these businesses to be consolidated and for sufficient visibility over these businesses to be provided by the companies,” say the Goldman team.

The buzz

Dr. Anthony Fauci, the nation’s top infectious disease official, said a COVID-19 vaccine could be available earlier than expected if ongoing clinical trials produce overwhelmingly positive results. The National Institutes of Health said there are insufficient data to recommend either for or against the use of convalescent plasma for the treatment of COVID-19 — approved on an emergency basis by the Food and Drug Administration after White House pressure — and should not be considered standard of care.

The Centers for Disease Control and Prevention issued an order forbidding evictions of tenants who can’t pay rent due to the coronavirus pandemic through the end of the year.

House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin are set to resume stimulus talks, though White House chief of staff Mark Meadows said aid to state and local governments remains a key stumbling block.

The ADP private-sector payrolls report is due at 8:15 a.m. Eastern, ahead of the Labor Department’s nonfarm payrolls report on Friday. At 2 p.m., the Federal Reserve’s collection of anecdotes on the economy, the Beige Book, will be unveiled. New York Fed President John Williams is among the list of central bank officials due to speak. Richmond Fed President Tom Barkin told The Wall Street Journal the central bank will need to continue providing significant support to the economy, as he flagged a slower-than-anticipated jobs market recovery.

Australian-listed companies offering buy now, pay later services, including Afterpay APT, -1.89% and Zip Co Z1P, -11.64%, fell for a second day since PayPal PYPL, +2.34% said it would enter the field.

Earnings are coming from department-store retailer Macy’s M, +0.57%, and, after the close, cybersecurity firm CrowdStrike CRWD, +14.28% and discount retailer Costco Wholesale COST, +1.07%.

Rep. Joe Kennedy became the first member of his famous family to lose an election in Massachusetts, after Sen. Ed Markey won the Democratic primary.

The market

After the 42nd record close for the Nasdaq Composite COMP, +1.39% on Tuesday, U.S. stock futures YM00, +0.68% NQ00, +0.92% ES00, +0.64% pointed to further gains on Wednesday.

The euro EURUSD, -0.44% was lower after the European Central Bank’s chief economist, Philip Lane, said the euro/dollar rate does matter.

Random reads

The Federal Bureau of Investigation is investigating the deaths of two former mining sector executives who could have been witnesses to a U.K. corruption probe.

Why Amazon drivers hang phones in trees.

Elon Musk’s SpaceX is working on boosters to power a trip to Mars.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.