This post was originally published on this site

Gold futures on Wednesday were on the decline, headed for the sharpest daily drop in more than two weeks, as investors drove equity values to records and the U.S. dollar strengthened, weighing on dollar-priced precious metals.

Gold and silver prices were trading “on routine downside corrections after recent gains,” said Jim Wyckoff, senior analyst at Kitco.com. “Keener risk” sentiment recently is a bearish element for the safe-haven metals,” he said.

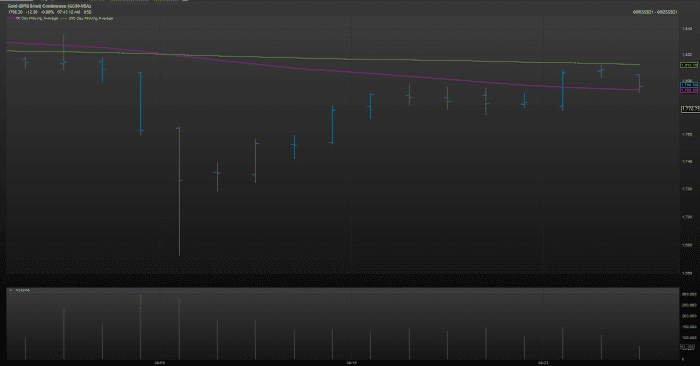

December gold

GCZ21,

fell $18.50, or 1%, to trade at $1,790 an ounce, losing its grip on the level of $1,800, after rising 0.1% on Tuesday. Prices for the most active contract are set to post their biggest one-day percentage decline since Aug. 9, FactSet data show.

Silver for September delivery

SIU21,

SI00,

was trading 12.4 cents, or 0.5%, lower at $23.77 an ounce, following a 1% rise on Tuesday.

Metals traders await the annual Jackson Hole central bankers monetary-policy symposium where Federal Reserve Chairman Jerome Powell on Friday may indicate that the central bank will slow monthly purchases of Treasurys and mortgage-backed securities, which could influence gold buying.

The meeting is “critical for the precious metal because it will provide investors with some guidance on how the Fed will likely approach stimulus tapering and interest rate hikes,” said Naeem Aslam, chief market analyst, in a market update.

The recent surge in gold prices is “due to a downturn in economic activity, which has led traders to believe that the central bank’s stimulus tapering may be delayed in order to provide more support to the U.S. economy,” said Aslam.

The U.S. government on Tuesday reported that orders for long-lasting goods fell 0.1% last month, for the second time in 15 months.

For now, commodity experts said that gold may be wedged in between a short-term moving average at $1,793.33 an ounce and its 200-day MA at $1,812.59, with the latter serving as resistance, as investors see more opportunity in stocks rather than safe-haven assets like gold and bonds.

FactSet

Indeed, the Nasdaq Composite

COMP,

and the S&P 500 index

SPX,

finished at record closing highs on Tuesday, and mostly moved higher moved higher in Wednesday dealings.

“And that’s exactly what prevents gold from gaining above the $1800 per ounce. Stocks are too appetizing, too prosperous for investors to sit on gold,” wrote Ipek Ozkardeskaya, senior analyst at Swissquote, in a daily note.

“The topside in gold should remain limited, as long as we see the US equities claiming new records,” the analyst wrote.

The slump for bullion also comes as the dollar, as gauged by the ICE U.S. Dollar Index, was up 0.2%, though it is on track for a weekly retreat of 0.4%. On top of that, the 10-year Treasury note BX:TMUBMUSD10Y was at around 1.31%, representing a roughly two-week high.

A stronger dollar can make dollar-pegged bullion relatively expensive to overseas buyers, while rising yields can make government debt more appealing to those seeking assets perceived as havens.

Among other Comex metals, September copper

HGU21,

tacked on 0.6% to $4.28 a pound. October platinum

PLV21,

fell 1.6% to $994.10 an ounce, while September palladium

PAU21,

traded at $2,459 an ounce, up 0.7%.