This post was originally published on this site

Empty city streets, a hallmark of the pandemic, won’t last forever for these cities, according to a new report.

Instead, San Jose, Boston, San Francisco, New York and other urban hubs long known for fostering talent and innovation, rank among the top global destinations poised for a quicker economic and commercial property rebound as the threat of the pandemic recedes, according to a new report from Jones Lang Lasalle, a real-estate and investment firm.

“City centers — including the associated office, retail and leisure sectors — have taken a significant hit during the pandemic,” a JLL

JLL,

team led by researchers Carol Hodgson and Jeremy Kelly wrote.

“However, a resurgence will take place as people continue to be drawn to the opportunities, amenities and lifestyle offered in these locations, and cities with the strongest innovation and talent credentials are best placed to support a solid recovery.”

The study looked at more than 100 cities globally, examining each for innovation and talent attributes, including whether they have anchor universities to keep a talent pipeline coming, if capital has been pouring in and how localities are planning for climate change.

Familiar U.S. tech hubs like San Jose and San Francisco ranked in the top five for both the innovation and talent concentration categories, but Tokyo, Seoul, Paris, Beijing and London also held top 10 spots for cities shaping the future.

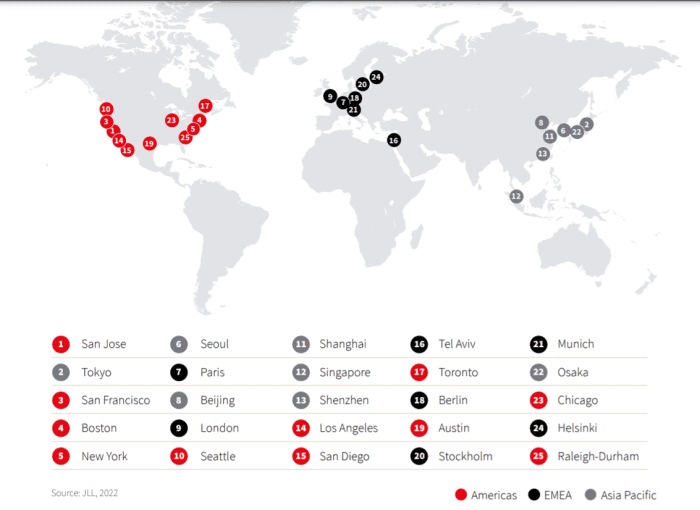

Here’s JLL’s chart for top 25 global cities for innovation:

Top 25 global cities for innovation.

Jones Lang Lasalle

What the numbers say

Office occupancy averaged 30.1% in 10 major U.S. cities, according to Kastle System’s most recent weekly back-to-work barometer. But while it was above 40% in Austin, occupancy was only 18% in San Francisco.

While sparse office use remains common two years into the pandemic, the report found “existing innovation districts have recovered quicker than surrounding areas in demand and pricing,” a trend the researchers expect to continue.

What has surprised is how well property markets have held up in the months since the first wave of pandemic lockdowns upended the work-life dynamic nearly two years ago. What’s more, U.S. commercial property prices climbed 24% to a fresh peak in 2021 from a year before, dipping only briefly in the early part of the COVID crisis, according to the Green Street Commercial Property Price Index.

Price gains have been most acute in suburban areas, and on industrial properties and apartment buildings, while office buildings in central business districts lagged with only a 3.3% growth rate in December from a year ago, according to Real Capital Analytics’ most recent property price index.

Eye on the future

How people think about work — and where they want to live — was in flux before the pandemic, particularly with the affordability crisis bearing down even harder in recent months.

Adding to that, home mortgage costs are expected to increase as the Federal Reserve looks to raise rates this year to stem 7% annual inflation, while also cutting the size of its nearly $9 trillion balance sheet.

Many top costal cities also have been reeling from more extreme, frequent and financially costly droughts, flooding, wildfires and other disasters as the planet warms.

Cities offering “amenities, mixed-use development and liveability will be well positioned for growth,” the JLL report said, while also pointing to buildings and urban centers that will be key to addressing climate change, with the built environment contributing to 40% of global emission.

“Cities which can leverage their strengths in technology will be able to revolutionize urban digital ecosystems and harvest vast amounts of real-time data on energy efficiency, waste management, health, mobility and space usage as buildings gradually become smarter,” the report said.

Still, another factor will be how much big corporations are willing to spend on office space in pricey gateway cities. The cost of living, versus appeal, of certain cities for workers also could be a significant challenge, as acute labor shortages result in a “war for talent,” according to the report.

To that end, it pegged Raleigh-Durham, Melbourne and Helsinki as among the “relatively affordable,” small-to-mid sized “talent rich” cities that could entice employees with an appealing quality of life and lower costs.