This post was originally published on this site

Fear of a fast-spreading new variant of the coronavirus is causing the U.S. stock market to become unhinged to end the holiday-shortened week of trade, with the drop setting the stage for possibly the worst performance for the Dow Jones Industrial Average and the S&P 500 since the 1950s on the traditional Black Friday shopping day.

At last check early Friday, the Dow

DJIA,

was down over 900 points, or 2.6%, and the S&P 500 index was down 95 points or around 2%, putting the closely followed equity benchmarks on track for the worst day since Oct. 28, 2020, but the tumble was also at risk of becoming the worst Black Friday trading session for the index since the post-Thanksgiving shopping trend began more than seven decades ago, according to Dow Jones Market Data.

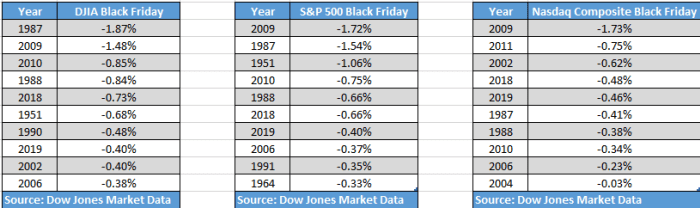

Here are the worst Black Friday trading days for the main stock indexes, dating back to 1950, since the retail-buying day is believed to have started during that period.

Dow Jones Market Data

Meanwhile, the Nasdaq Composite Index was down 1.8%, at last check, which also would mark the worst Black Friday session for the index since its inception in 1971.

According to History.com, what has come to be known as Black Friday, a popular shopping day in the lead-up to Christmas, is associated with shopping chaos in Philadelphia in the 1950s with shoppers crowding “the city, creating mobs of people, some of them breaking in and stealing merchandise.” Since then the day has been referred to as “Black Friday.”

The term, however, goes back to the idea that the wave of buying would push retailers to finish the year in the black, or with strong profit, rather than their accounts being in the red.

One of the likely reasons for Friday’s outsize move for stocks is the fact that Black Friday is a traditionally a low trading volume day in financial markets and the news of a new coronavirus strain, which was being assessed by the World Health Organization on Friday, has caught investors flat-footed.

It may take weeks to understand the full impact of the variant called B.1.1.529 for now, which has become dominant in South Africa and has reached 90% of cases in Gauteng, which is the smallest province in the country, with more than 1,000 cases a day being estimated.