This post was originally published on this site

MarketWatch’s petrocurrency index, which was rolled out on March 4, 2020, was on track to post a record close Monday as a further plunge by Russia’s ruble as a result of harsh new sanctions in response to its invasion of Ukraine outweighed gains for currencies of other major oil producers as crude prices rose.

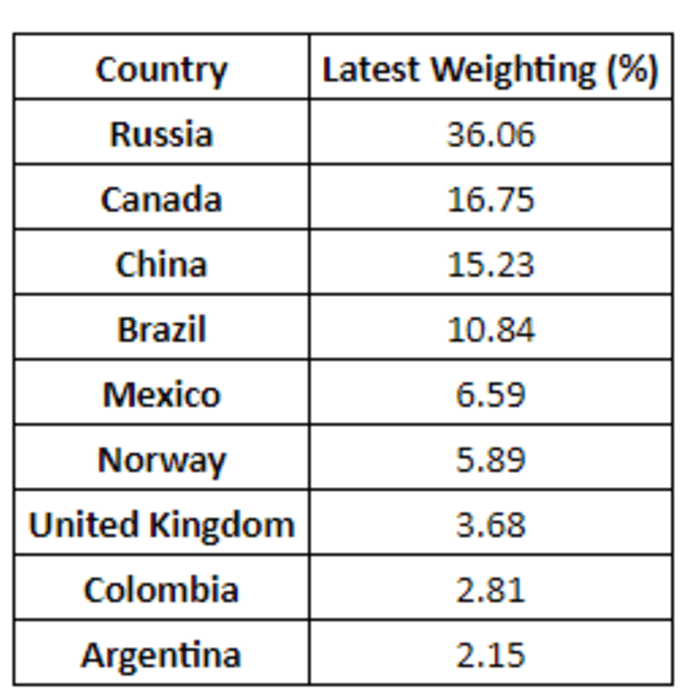

The index measures the U.S. dollar against a basket of currencies weighted according to their share of global oil output as compiled by the U.S. Energy Information Administration, with Russia holding the biggest weight.

Dow Jones Market Data

It is worth noting that some familiar Middle Eastern names, including Saudi Arabia, and others have been excluded because monetary authorities in those countries keep their currencies closely pegged to the dollar.

The index

MWPC,

was last up 5.1% at 247.20 and on track for a record close if it finishes above 243.91, which hit on March 23, 2020.

The ruble

USDRUB,

hit an all-time low of 119.25 per dollar on Monday, according to FactSet. In volatile, sporadic trade, it was last down 13% to 96.67, as Russia’s central bank more than doubled its official interest rate to 20% on Monday, following further sanctions by Western powers.

Meanwhile, global benchmark April Brent crude

BRN00,

was up 3.4%, to $97.36 a barrel, after topping $101 at its session high, and West Texas Intermediate crude for April delivery

CL.1,

on the New York Mercantile Exchange was up 3.9% at $95.17 a barrel.

Away from the ruble, most other components of the index were higher Monday, with the U.S. dollar losing ground versus its Canadian counterpart

USDCAD,

the Brazilian real

USDBRL,

the Norwegian krone

USDNOK,

and the Chilean peso

USDCLP,

The Wall Street Journal reported that the U.S. and other major oil-consuming countries were weighing the release of 70 million barrels of oil from emergency stockpiles in response to surging crude prices.

The rise of MarketWatch’s petrocurrency index underlines the pain in emerging market and petroleum-dependent economies as the Eastern European conflict unfolds.