This post was originally published on this site

Corporate insiders don’t think a bear market has begun.

That’s good news, since executives presumably know more about their companies’ prospects than the rest of us do. And they collectively are behaving as though they believe their companies’ shares will be significantly higher in 12 months’ time.

Notice that this is an intermediate-term forecast. The stock market could very well perform poorly over the short term — such as in reaction to further Russian aggression in Ukraine. But if the forecast is right, the stock market will soon recover from any near-term weakness and be higher one year from today.

The insider data on which I base this upbeat assessment comes from Nejat Seyhun, a finance professor at the University of Michigan, who is one of academia’s leading experts on the behavior of corporate insiders. I periodically report on what his data are telling him, and over this past weekend he shared the latest information with me.

To understand what Seyhun’s data are saying, it’s helpful to step back and review the different types of corporate insiders. There are three categories, and only two are important for investors to follow, according to Seyhun: Corporate directors and officers. Right now, according to his latest data, insiders in these two categories collectively are buying their companies’ shares at almost precisely their historical average rate.

That’s bullish, Seyhun told me, because it means that insiders are not selling into the market’s decline. It would be particularly bearish if they were to do that, since it would indicate that they have little confidence that their companies’ shares would recover anytime soon.

Not only have they not sold into the decline, Seyhun’s data indicate that insiders in these two categories on balance have moderately picked up the pace of their buying. Last November, you may recall, Seyhun’s insider indicator was moderately below its long-term average. That suggested that the market’s outlook over the subsequent 12 months was “modestly positive.”

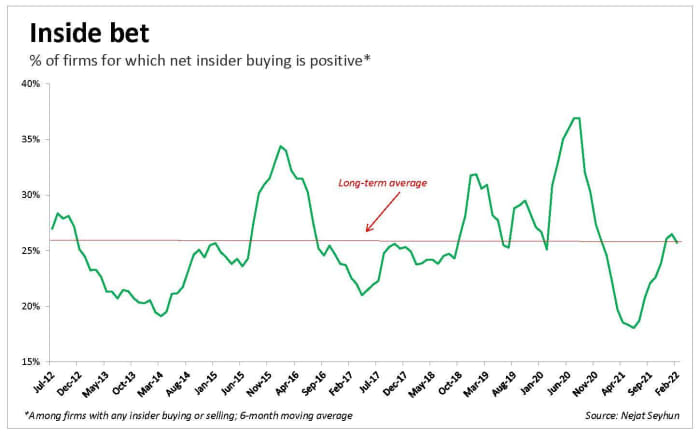

Today, in contrast, Seyhun’s indicator is equal to that average, as you can see from the accompanying chart, below. That translates into a projected 12-month return that is higher than it was in November, in line with the market’s historical average of around 10%.

Seyhun’s indicator is based on the six-month moving average of the percentage of publicly traded companies for which there is net buying from officers and directors. Companies for which there is no insider buying or selling are ignored for purposes of calculating this statistic. In November, this indicator stood at 18%, relative to a long-term average of 26%, which is where the indicator stands today.

Given this increase over the last couple of months, Seyhun characterizes the insiders collectively as “guardedly optimistic.”

The industry that one year ago was experiencing the greatest amount of net insider buying from corporate officers and directors was integrated oil & gas. Since then, the S&P 1500 Integrated Oil & Gas index has produced a 44.5% gain, versus 12.8% for the S&P 500

SPX,

One industry that currently is experiencing heavy net insider buying is banking, and especially small-cap stocks in that sector. The easiest way to gain a diversified exposure to stocks in this sector is via an exchange traded fund, such as the iShares U.S. Regional Banks ETF

IAT,

Examples of individual stocks in this sector with heavy net insider buying include PennyMac Financial Services

PFSI,

loanDepot

LDI,

and Five Star Bancorp

FSBC,

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.