This post was originally published on this site

The Federal Reserve’s policy pivots are consistently a day late and a dollar short.

Just take the last four decades: In the case of each of the recessions over this period, the economy started contracting several months after the Federal Reserve stopped raising rates and began to cut them. Even though their policy reversals came well advance, the economy nevertheless slipped into a recession.

What gives the bulls confidence that the Fed will react quickly enough this time around?

It’s always possible that the Fed might have learned its lesson. But we shouldn’t forget that “this time is different” are the four most dangerous words on Wall Street.

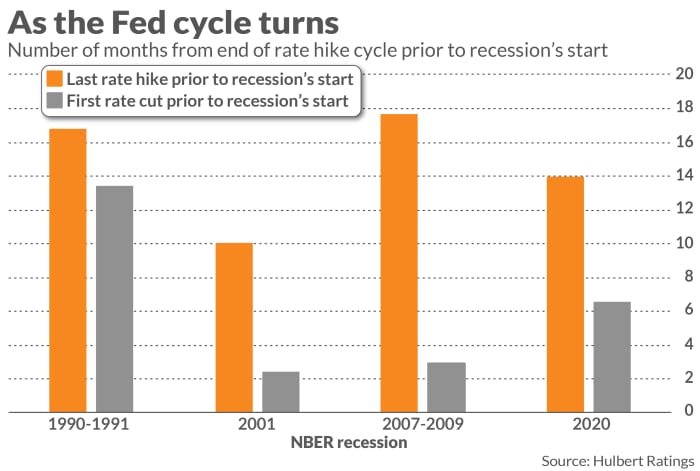

Consider the four recessions that have occurred since the Fed began targeting the fed-funds rate, in the mid-1980s. On average, the Fed stopped its rate-hike cycle 15 months in advance of when those recessions began. The shortest lead time was 10 months, in the case of the recession that began in March 2001. The longest lead time, at nearly 18 months, came prior to the Global Financial Crisis.

(In calculating these lead times, I am focusing on when the National Bureau of Economic Research—the semiofficial keeper of the recession calendar—said the recessions actually began. I am not focusing on the dates on which the NBER publicly announced those start dates, which came much later.)

Note carefully that on these dates when the Fed stopped raising rates, it wasn’t necessarily obvious that the rate hike cycle had come to an end. So I next focused on the dates when, following the last rate hike in the cycle, the Fed actually started cutting. On average, this first-cut date occurred six months in advance of the ensuing recession—with the lead times ranging from as short as two months to as long as 13 months. These results are summarized in the accompanying chart.

Since there have only been four recessions since the early 1980s, there is very limited statistical significance to these lead times’ magnitudes. But, at a minimum, these results put the burden of proof squarely on the bulls to convince the rest of us that the Fed won’t—once again—wait until it’s too late to bring its current rate-hike cycle to an end.

The broader investment lesson here is that predicting when a recession will begin is notoriously difficult. If the Fed, with all the enormous resources and expertise at its disposal, gets it wrong so often, what makes you think you’ll do any better?

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.