This post was originally published on this site

A day after strong jobs data, hotter-than-expected U.K. inflation numbers were driving up the British pound, adding more weight to the case for an interest rate hike in December.

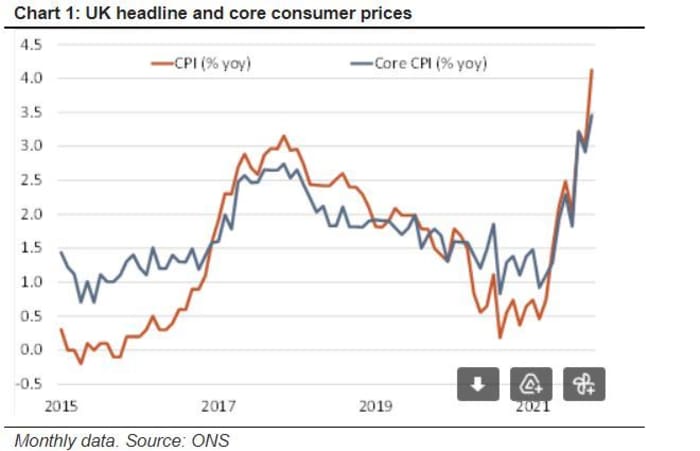

In October, consumer prices rose 4.2% annually, higher than the 3.9% expected by analysts and a sizable leap from 3.1% in September. It also marked the highest inflation level in a decade, driven largely by energy prices, though core inflation that excludes food and energy also jumped to 3.4% from 2.9%, above expectations.

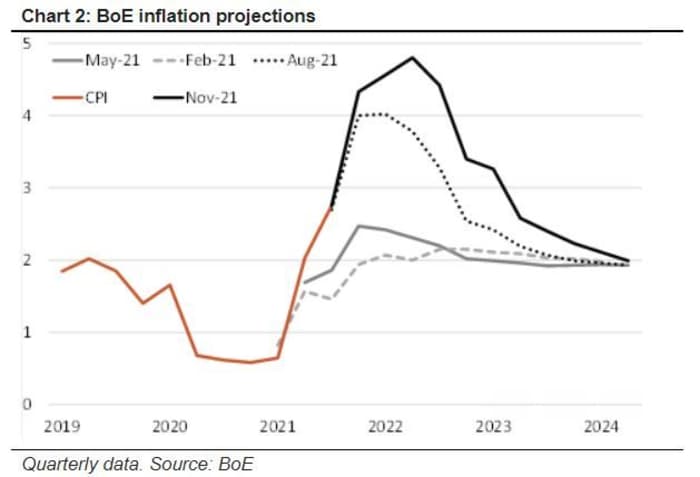

“Inflation is set to remain elevated and probably move even higher in the near term with the BoE forecasting a peak of around 5% in April next year,” though it’s expected to ease back from the second half of 2022 onward, said Hann-Ju Ho, senior economist at Lloyds Bank, in a note to clients.

“Nevertheless, an extended period of above-target inflation and indications that the labor market remained strong after the furlough scheme ended means that a Bank of England interest rate rise next month remains in play,” said the economist.

Inflationary pressures in the U.K. are growing more broad-based, said Kallum Pickering, senior economist at Berenberg. “They are driven by the combination of a rapid recovery in domestic demand, widespread global supply shortages as well as the U.K’s unique brand of Brexit challenges, which raise the cost of trade with the EU, the U.K.’s biggest trading partner,” he said in a note.

Berenberg/ONS

Pickering added that given further increases in coming months, inflation will likely blow through the BOE’s expectations.

Uncredited

The yield on the 2-year gilt

TMBMKGB-02Y,

edged up 2 basis points to 0.608%. The pound

GBPUSD,

rose 0.1% to $1.3443, but for November has lost 1.8% due to gains for the U.S. dollar.

The FTSE 100 index

UKX,

fell 0.2% to 7,309.11, with losses led by heavily weighted energy companies, such as a 1% loss for Royal Dutch Shell

RDSA,

RDS.A,

and household goods giant Unliever

UL,

ULVR,

down 1%.

Near the top of the losers list was SSE

SSE,

after the U.K. energy company unveiled a plan to cut its dividend and sell stakes in its electricity network units to speed up investment on energy infrastructure through fiscal 2026.