This post was originally published on this site

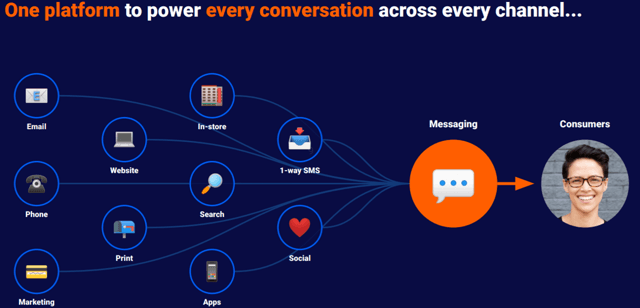

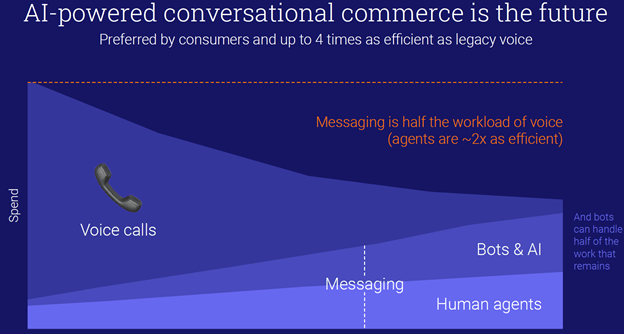

LivePerson (LPSN) provides conversational AI-powered messaging services to business that enables customers to connect through the preferred conversational interfaces, including Facebook Messenger, SMS, WhatsApp, Apple Business Chat, Google Rich Business Messenger and Alexa.

LiveEngage, LPSN’s enterprise-class cloud-based platform, enables businesses to become conversational by securely deploying messaging, coupled with bots and AI, at scale for brands with tens of millions of customers and many thousands of customer care agents. LiveEngage powers conversations across each of a brand’s primary digital channels, including mobile apps, mobile and desktop web browsers, short message service (SMS), social media and third-party consumer messaging platforms.

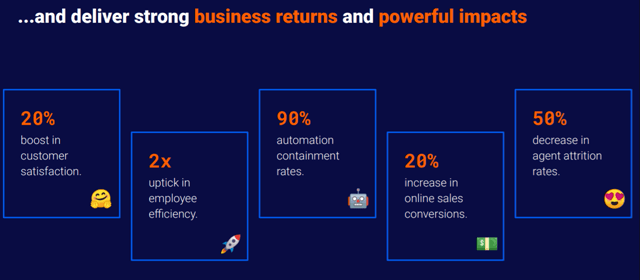

The benefits to its customers include:

The Good

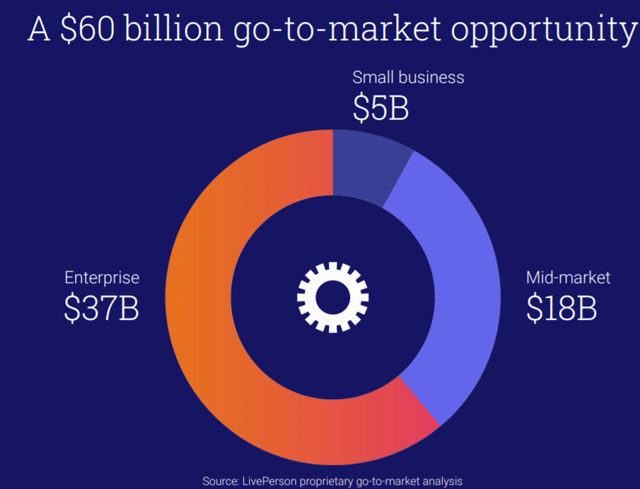

- As mentioned earlier, we are in a secular trend of communication through messaging platforms as opposed to in-person or through a 1-800 number. In fact, the company believes that it offers services into a $60 billion market.

Source: May 2019 Investor Presentation

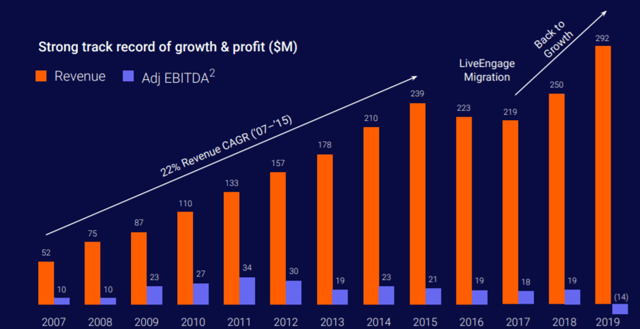

- LPSN has experienced strong growth over the last few years despite hiccups between 2017 and 2018 due to the shifting of customers to its LiveEngage platform from its legacy products. Revenue is estimated to grow by 17-22% in full year 2020. This is based on the size of the market, its leadership position in the market, the adoption rate of messaging services by its customers having increased from 20% of its enterprise customers in early 2018 to 40% by the end of the year, and acceleration in the adoption of LiveEngage by existing customers engaged with legacy products.

- The COVID-19 pandemic could be a net positive for the business.

Company CEO Robert Locascio stated in the 1Q20 conference call:

As shelter-in-place was called in March, conversations on LiveEngage surged by approximately 20% month-over-month. And we’re continuing to see growth off that new base. Put that into context, in all of 2019, our conversations, including both messaging and chat, were up about 21% year-over-year, with messaging bonds being up at a far greater rate.

This is in part as it reduces the need for actual agents to be in the office. Due to the shelter-in-place orders, some workers do not have the capability or ability to work from home, and LiveEngage has the ability to be a viable option.

- Growth in revenue has been the goal of the company, and profitability is something that has left a lot to be desired. John Collins was recently hired as CFO with the goal to improve profitability. Mr. Collins is already making strides to reduce expenses and cash burn, which will support revenue growth and product development.

CFO John Collins stated in the 1Q20 conference call:

In total, we are on track to reduce our 2020 expenses by $7.5 million to $16.5 million. Where we fall on the expense savings range will align closely with where we land within our revenue range for the year. Approximately 1/3 of the savings will be from lower T&E and marketing spend as travel was halted and events turned digital. Approximately 2/3 of the savings are tied to lower planned head count, which has two primary dimensions. First, we slowed recruiting in nongrowth areas like G&A, deferred some innovation spend and consolidated overlapping marketing and professional services teams.

We are also targeting a total cash burn of less than $50 million in 2020, which would have us end the year with at least $130 million of cash on hand.

Alright, there are some items to unpack there. The goal is to improve cash flow and generate positive EBITDA for the first time since 2018. The second item is to reduce cash burn. Traditionally, funds have been raised through equity, and in 1Q20, the balance sheet was utilized (improvement in AR collections) to generate cash flow. I would prefer the company generate cash flow through profitability and not AR turns. However, becoming EBITDA positive once again and growing cash flow will pique the interest of investors.

The Bad

- Actual revenue generation has been below expectations. LivePerson cannot hire salespeople and supporting staff quick enough, let alone build a book of business. Over the last two years, growth has been slower as new salespeople join and learn the ropes. This is expected to turn around later in 2020.

- All of the hiring of new salespeople and staff to support growth has increased the cost of revenue, as well as sales and marketing expenses. This has led to significant decline in adjusted operating profit ($4.9 million to $(30 million)) and EBITDA ($19.1 million to $(13.6 million)). The losses are financed through convertible senior notes. The good news is, the shift in focus to profitable growth should begin to turn the ship. We saw some evidence of this in 1Q20, and management has spoken about this change.

Competition

LivePerson has many competitors, from business units in large conglomerates (Oracle (ORCL), Salesforce (CRM), Twilio (TWLO)) to more direct competitors such as Zendesk (ZEN) and eGain (EGAN).

LPSN’s advantage is that it is the leader in the conversational space. As an example, it is estimated that LivePerson held an approximate 33% share of Apple Business Chat deployments in 2018, and that the company at least maintained that position in 2019.

The main competition comes from providers that offer customer relationship management and contact center solutions. To battle this, LivePerson’s goal is to drive further engagement with its customers by providing more services, leading to more sticky relationships.

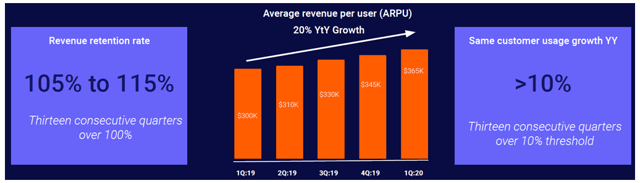

In fact, the company has maintained a strong revenue retention rate and has increased the average revenue per user.

Source: 1Q20 Earnings Presentation

Competition is always a concern, but LPSN has proven to be a strong revenue generator and has increased the wallet share of its clients. While growth is important, the new mantra to profitable growth is a favorable development that will improve cash flow and the balance sheet. This will be a selling point to both customers and investors.

Valuation

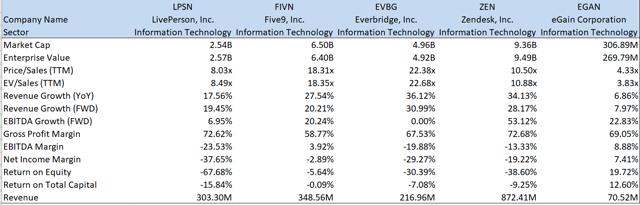

The table below outlines several metrics of peers in the same sector and its two main competitors, Zendesk and eGain.

Like LPSN, many of its peers have solid revenue growth but are not profitable. LPSN is largely at the lower portion of the spectrum. Much of this has to do with its relative size and recent performance.

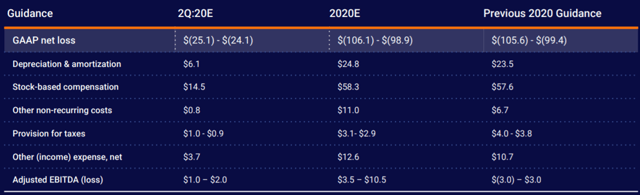

Overall, the latest quarter was seen as a negative. But as I have taken a closer look, it appears like a good quarter, and the outlook looks solid in the near term. Due to COVID-19, the lower end of the revenue outlook for 2020 was guided lower. I get that and why some people are nervous, because it is largely valued by future revenue growth. What I like seeing is the shift to profitable growth and the fact that EBITDA has been revised upwards twice, most recently in the company’s May 2020 Investor Presentation.

Just look at the change in the adjusted EBITDA outlook. It is a thing of beauty. I would imagine a portion of the increase is due to cost cutting and severance add-backs. But still, it is impressive.

Now to everyone’s favorite part, the price target. If we look at price targets based on price-to-sales and EV-to-sales, I think the stock can get to ~$55 per share based on my projected FY21 revenue of $395 million (based on a very manageable 15% revenue growth over the next two years). I think this is revenue target is feasible due to the historical performance, the market opportunity, the technology and the return on investment on the recent hiring of salespeople. The P/S is based on a 9.2x multiple and EV/Sales is based on a 9.7x multiple, both of which are in the median of its peer group.

The 2Q20 conference call and earnings results will be important to gauge whether the company is on target to meet its profitability, revenue and EBITDA goals. If that happens, I think it can go past its recent highs. If that doesn’t happen, my thesis will have to be reexamined.

Conclusion

LivePerson has had its ups and downs over the last few years. The company has been plagued by underperformance in revenue versus its expectations, and profitability has been a concern. It has hired more salespeople over the last two years, and the ROI has not been there. That hurdle should be cleared in the near term, and growth should begin to hit publicly stated targets. The shift to profitable growth is refreshing and should make current and potential investors happy. If the company can hit metrics and become profitable, I believe its multiples can expand, leading to a higher stock price.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The article is for informational purposes only.