This post was originally published on this site

Since the middle of March, Jack In The Box (JACK) has bounced off strongly, from $18.60 per share to $65.40 per share, delivering shareholders return of more than 250%. The market sentiment is good for Jack. However, because of the declining same-store sales, and high valuation, we do not think Jack is cheap anymore.

Declining second-quarter operating performance

Jack In The Box is the operator and franchisor of 2,243 fast-food restaurants across the U.S. Most of its restaurants are franchised. It is quite a sufficient strategy for rapid expansion as the company could rely on franchisees’ capital to open restaurants under its brand. Besides, it would have a better operating margin as most of the restaurants’ overheads would be shifted to franchisees’ operations. Jack has kept growing its franchised restaurants while reducing company-operated restaurants. In the past five years, the ratio of franchised restaurants/total restaurants has risen from 82% to 94%. As a result, Jack’s operating margin has grown from 12.8% to 21.3% in the same period.

Like any other restaurant in the U.S., Jack’s operating performance has been declining due to COVID-19’s negative impact. Before COVID-19 lockdown, Jack’s same-store sales had increased by 5.2% in the first seven weeks ended March 8. When everybody was staying at home, its same-store sales decreased by as much as 17% in the next five weeks. As a result, the second-quarter same-store sales were down by 4.2%.

In year-over-year terms, Jack’s total sales rose around 0.2%, driven mainly by 14% growth in franchise rental revenue. In contrast, other revenue streams, including company restaurant sales, franchise royalties and franchise contributions for advertising and other services declined in the recent second quarter. Its net earnings dropped by more than 54% to only $11.46 million, or $0.50 per share. We would expect Jack’s operating performance would continue to be negatively affected because of the U.S. lockdown and low level of economic activity. The fast-food chain should keep focusing on growing drive-thru, third party delivery, and carry-out, as most of its restaurants’ dining rooms are currently closed.

Because of the COVID-19 uncertainty, the company has withdrawn its 2020 guidance. If we assume a 20% decline in revenue, Jack’s full-year 2020 revenue would come in at $760 million. A 5.3% net margin would translate into $40.3 million in net income, or $1.76 per share.

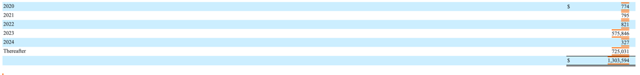

High leverage but spreading out in many years

What worries investors is the company’s high leverage level. As of April 2020, it had more than $132 million in cash, but the total debt was 10x higher, at more than $1.38 billion. However, the debt maturities spread out many years. From now until 2022, the average annual debt principals, which would have to be repaid was roughly $800,000. The most significant amount of debt, around $575.9 million, will mature in 2023 and an additional $725 million after 2024.

Source: Jack’s 10-Q filing

According to Jack’s primary debt covenant, its debt service coverage ratio should be at least 1.75x. Jack’s current debt service coverage ratio is around 2x, leaving some cushion for the company. However, if the COVID-19 situation continues to have more substantial adverse impact in the economy for the rest of the year, Jack’s operating income might drop further. An additional 15% drop in net operating income would push the debt service coverage ratio below the debt covenant minimum ratio.

Jack is not cheap now

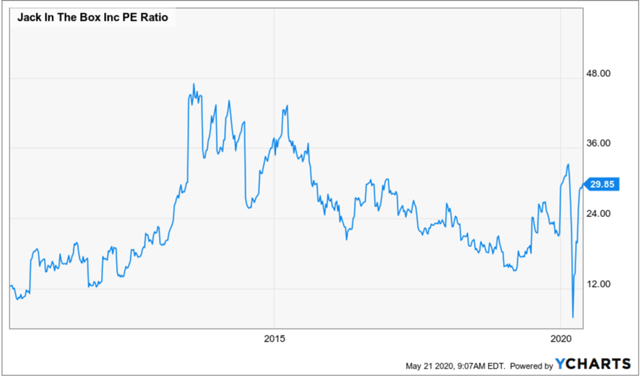

Jack In The Box is not cheap compared to its historical valuation. In the past ten years, its earnings multiples have fluctuated in the wide range between 7x to 47x. At the current moment, its trailing P/E is as high as nearly 30x.

In the past five years, its average price-to-earnings ratio is also quite high, at around 24x. As we expect, Jack could generate $1.76 in earnings per share, and a 24x earnings multiple could value Jack at around $42.24 per share.

Conclusions

We expect that Jack would experience lower operating results in the next several quarters, when the business is absorbed with the full negative impact of the COVID-19 lockdown. We do not know when the virus situation will end. Thus, we could not time the turnaround of Jack’s operating performance. We do not think Jack is cheap at the moment, given no margin of safety for investors at the current price.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.