This post was originally published on this site

There’s always something to do at InterActiveCorp (IAC), and with the upcoming Match spin set to leave Barry Diller with a sizable cash position and a clean balance sheet to boot, IAC certainly warrants investor attention. By owning IAC stock, shareholders get to invest with Diller in a post-COVID environment that should surface plenty of value-accretive opportunities. On the other hand, IAC pre-Match Group (MTCH) spin also presents a compelling play on the IAC “stub,” which currently trades at negative valuations. The pending MTCH spin should unlock some of that value, in my view.

Cautious Optimism After a Below-Consensus 1Q20

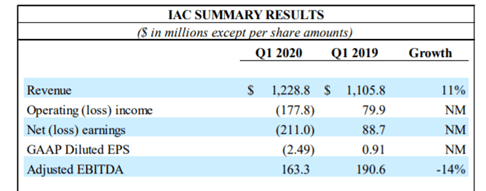

IAC’s 1Q20 ex-Angi Homeservices (ANGI) and MTCH EBITDA losses widened to a below-consensus -$43m off above-consensus revenue of $341m. On a consolidated basis, revenue stood at $1.2bn (+11% YoY), while adjusted EBITDA declined 14% YoY to $ 163m. Here’s a snapshot of the headline numbers:

Source: Earnings Release

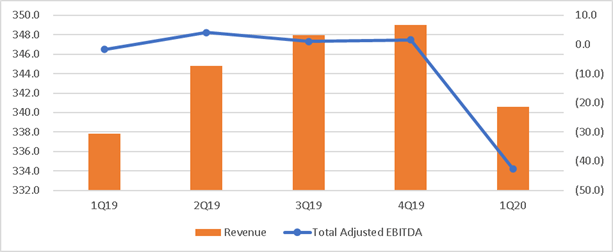

And here’s an overview of how the “stub” (i.e., IAC ex-MTCH/ANGI) has trended in recent quarters:

Source: Company Filings

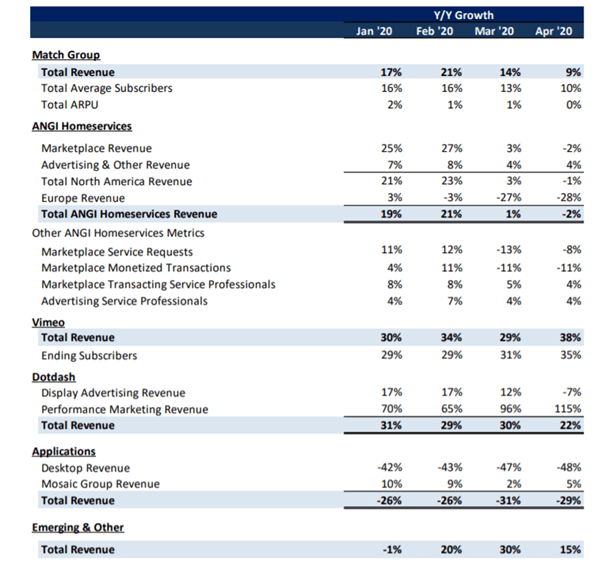

No surprise that April is set to worsen relative to 1Q numbers, but I did draw some comfort from management’s cautiously optimistic tone, as several businesses are showing signs of recovery off COVID-driven lows.

ANGI has seen metrics decline in the back half of March and the beginning of April, but per management, demand has returned over the past few weeks, likely due to shifting spend to Home projects (vs. Travel, Social, etc.) on the shelter-at-home tailwind and improving weather, among others. Specifically, April revenue is down 2% YoY.

Vimeo is seeing even more impressive traction, as subs, bookings, & revenue have all begun to accelerate in April (e.g., revenue is up 38% YoY), as the longer-term streaming opportunity at small businesses and Enterprise remains intact.

Similarly, Dotdash’s revenue has risen at a +22% pace in April, as performance-based advertising offset Display weakness. Within the Apps segment, Mosaic was the bright spot, seeing revenues rise +5% in April, although Desktop continues to decline (-48% YoY).

Source: Shareholder Letter

Emerging Recovery at ANGI is a Key Positive

As the second-largest EBITDA contributor (after MTCH), I’d like to dig into ANGI’s 1Q performance for a bit. Now, given many of its smaller competitors were seeing COVID-driven demand declines in the 40-50% range, I think ANGI’s performance this quarter was particularly impressive. Further, with service requests declining ~500bps MoM slower than March’s rate at -8%, things are looking up for ANGI. While indoor discretionary projects have suffered, most non-discretionary services and outdoor projects are leading the recovery. Longer-term, the current stay-in-place orders could even drive a structurally accelerated online penetration within the home service space, which would benefit ANGI as the market leader.

“You can postulate that it is delayed demand or pent-up demand from the sort of period of shock in late March. On the other hand, it could be the beginning of a sort of secular boom in home services from people being in their home much more than they were before and with much more focus on spending time in the home and in a world where you can’t go to restaurants, having people over to dinner in their home and so on and so forth.” – 1Q20 Transcript

The IAC Stub Remains Compelling

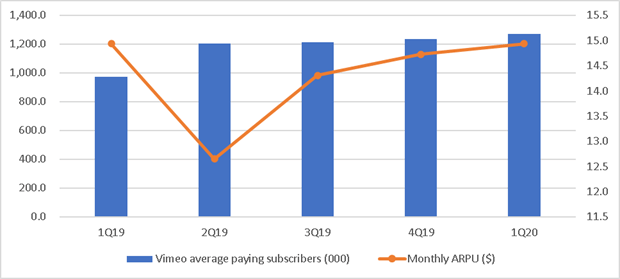

The key highlight from the quarter was Vimeo, which appears to be capitalizing on the work from home shift, as highlighted by 1Q gross bookings rising 59% YoY, as well as the continued acceleration in April. Further, these trends could prove relatively sticky as video communication becomes increasingly integrated into all aspects of work.

Source: Company FIlings

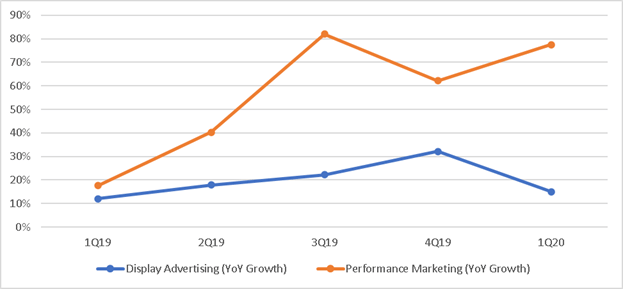

Dotdash has also seen an acceleration on the back of IAC’s efforts to diversify revenue to transactions (i.e., performance-advertising) from ad impressions. Performance marketing revenue growth accelerated to 115% YoY in April (vs. +96% YoY in March), as Dotdash’s shift allows it to leverage a high purchase-intent audience. The long growth runway offered by performance marketing should continue to offset increasingly challenged display advertising revenue trends from here.

Source: Company Filings

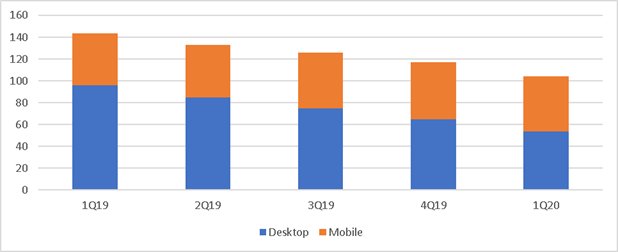

On the applications side, IAC’s desktop business remains under pressure amid the COVID-driven downturn and should continue to see challenges long-term as well. However, the key here is not growth but rather cash generation, that can then be reinvested into Mosaic (mobile), to capitalize on the longer-term opportunity. Though overall applications revenue has been in decline in recent quarters, I expect eventual stabilization at >$100m, as we lap the adverse monetization impact from browser policy changes.

Source: Company Filings

MTCH Separation on Track

Following the S-4 filing in late-April outlining the proposed MTCH separation, the spin appears to be on track. Key deal terms include a shift of ~$1.7bn of exchangeable notes to MTCH (from IAC) in return for fewer shares of MTCH in the exchange, an ~$840m special dividend by MTCH, and a ~$500m debt raise by MTCH to fund the special dividend. In return, IAC shareholders will receive shares of the “new” MTCH in proportion to their indirect ownership interest.

Key dates from here include the shareholder vote on June 25th, with closing expected by end-2Q. In conjunction, IAC also intends to pursue the $1.5bn MTCH equity sale as part of the transaction, which should leave the company with ~$2.4bn cash & no debt post-separation. Post-MTCH spin, the “new” IAC presents investors with a collection of compelling consumer Internet businesses trading at a substantial discount to NAV despite a long runway of growth opportunities ahead.

Using the public valuations of its MTCH and ANGI stakes at the time of writing, the IAC stub appears to be trading at a negative EV. Given the firm catalyst for value unlocking and the inherent growth opportunities within the existing mix of businesses, I do not think the market is fairly valuing IAC at current levels. The cash-rich balance sheet post-spin, also adds optionality as investors get a compelling opportunity to invest alongside Barry Diller at a discount in a post-COVID environment ripe for M&A.

|

Stub Valuation |

|

|

Current IAC Price |

$256.66 |

|

x fully diluted shares |

90 |

|

= Equity Value |

23,176 |

|

Current MTCH Price |

$84.00 |

|

x IAC stake |

228 |

|

= MTCH Stake |

19,160 |

|

Current ANGI Price |

$10.38 |

|

x IAC stake |

422 |

|

= ANGI Stake |

4,376 |

|

(-) Stub Net Cash |

(510) |

|

Implied IAC Stub EV |

(869) |

Source: Company Filings, Author’s Est

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.