This post was originally published on this site

Earnings of Independent Bank Corp. (NASDAQ:INDB) plunged by 43% in the first quarter, on a linked-quarter basis, to $0.78 per share. The earnings decline was mostly attributable to a surge in provision expense amid the COVID-19 pandemic. Earnings will likely improve from the first quarter in the remainder of the year but remain below the 2019 level. Economic factors have deteriorated to a level beyond that incorporated in the first quarter’s loan loss reserves; therefore, I’m expecting high provision expense in the second quarter. Additionally, net interest margin contraction will likely pressurize earnings this year following the interest rate cuts in March. On the other hand, loan growth under the Paycheck Protection Program will likely support earnings. Overall, I’m expecting earnings per share to decline by 28% year over year to $3.60 in 2020. There is a chance of a negative earnings surprise this year due to the uncertain economic environment. The December 2020 target price suggests a high upside from the current market price, but due to the risks and uncertainties, I’m adopting a neutral rating on INDB.

Worsening of Economic Forecasts, Perceived Loss Exposure to Drive Provision Expense

INDB’s earnings plunged in the first quarter due to a hike in provision expense to $25 million from $4 million in the last quarter of 2019. The management used Moody’s scenario 4, a severe economic scenario, to determine the level of provisions for loan losses. The assumptions under the scenario included the unemployment rate peaking at 16.9% in the second quarter and no sustained economic recovery until the last quarter of 2021, as mentioned in the earnings release.

INDB’s provision for loan losses in the remainder of the year will depend on further deterioration of economic forecasts in excess of those incorporated in the first quarter’s reserves. I’m expecting unemployment to surpass the assumption because total jobless filings during the COVID-19 pandemic now stand at 38.6 million, which is around 25% of the civilian labor force. As a result, it is highly probable that the unemployment rate will peak above the management’s assumption of 16.9%.

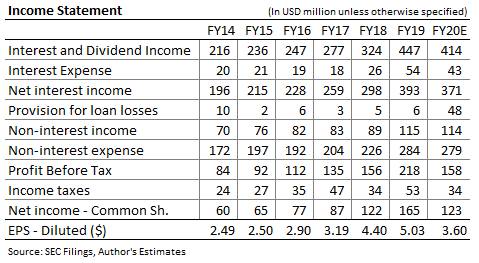

Furthermore, the management’s perceived loss exposure inherent in the portfolio will drive provision expense in the remainder of the year. I’m expecting some issues in risky sectors due to the pandemic. As mentioned in the earnings release, high-impact sectors made up 18.8% of total loans as of March 31, 2020. These high-impact sectors included accommodation, food services, and retail trade. Considering these factors, I’m expecting INDB’s provision expense to increase to $48 million in 2020, or 53bps of gross loans, compared to 7bps of gross loans in 2019.

Fees from Paycheck Protection Program to Counter Interest Rate Decline

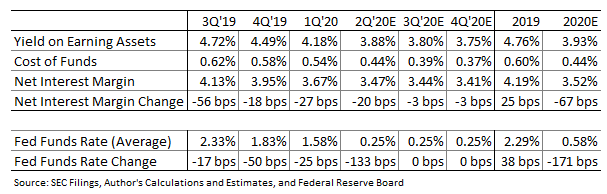

INDB’s net interest margin, NIM, dipped by 27bps in the first quarter, on a linked-quarter basis. I’m expecting NIM to decline further in the second quarter due to the full effect of the 150bps federal funds rate cuts in March. Moreover, a decline in LIBOR, which remained downward sticky in March, will likely pressurize NIM. On the other hand, the management expects further deposit cost compression that will ease the pressure on NIM in the remainder of the year. As mentioned in the first quarter’s conference call, a 25bps rate cut can reduce NIM by 6bps. Considering the management’s guidance, I’m expecting NIM to decline by 20bps in the second quarter, and by 67bps in the full-year. The following table shows my estimates for yield, cost, and NIM.

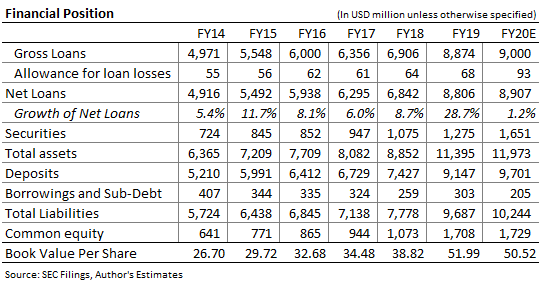

INDB’s participation in the Paycheck Protection Program, PPP, will likely drive loans in the second quarter. The management expects to earn $20 million in processing fees over the life of the loans. I’m expecting most of the PPP loans to get forgiven in the third quarter; therefore, I’ve incorporated most of the PPP fees in my estimates for 2020. Apart from PPP, I’m expecting little loan growth due to stalled business activity across several industries. Overall, I’m expecting INDB’s net loans to increase by 1.2% year over year in 2020, as shown below.

Expecting Earnings per Share of $3.6 in 2020

The surge in provision expense and NIM contraction will likely pressurize earnings, while loan growth will support earnings this year. Overall, I’m expecting INDB’s earnings per share to decrease by 28% year over year to $3.60 in 2020. The following table shows my income statement estimates.

The probability of an earnings miss is higher than usual this year because of the COVID-19 related uncertainties. If economic variables worsen more than expected, then provision expense can surpass its estimate. Additionally, if PPP loans have a longer than expected life, then PPP fees for 2020 can miss expectations. These uncertainties make INDB a risky investment.

I’m expecting INDB to maintain its quarterly dividend at the current level of $0.46 per share in the remainder of 2020. I’m not expecting a dividend cut because the earnings and dividend estimates suggest a payout ratio of 51%, which is sustainable. Moreover, there is little pressure on dividends from regulatory requirements because INDB is currently well-capitalized. The company’s common equity tier I ratio was reported at 11.95% as of March 31, 2020, which is well above the minimum requirement of 7.0%. The dividend estimate for 2020 implies a low and unattractive dividend yield of 2.8%.

Risks Mar Opportunity for Capital Appreciation

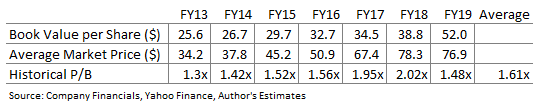

I’m using the historical price to book value multiple, P/B, to value INDB. The stock has traded at an average P/B multiple of 1.61 in the past, as shown below.

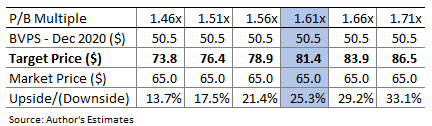

Multiplying the forecast book value per share of $50.5 with the average P/B multiple gives a December 2020 target price of $81.4. This target price implies an upside of 25% from INDB’s May 21 closing price. The following table shows the sensitivity of the target price to the P/B multiple.

The upside suggests that INDB is offering a good opportunity for capital appreciation. However, the uncertain economic environment poses risks to earnings, and consequently, to the valuation. As a result, I’m adopting a neutral rating on INDB.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: This article is not financial advice. Investors are expected to consider their investment objectives and constraints before investing in the stock(s) mentioned in the article.