This post was originally published on this site

A sharp Treasury selloff that’s driven the yield on the 10-year note above 2.8% for the first time in more than three years now “offers an attractive level to buy,” according to B. of A. strategists.

In a research report released Wednesday, strategists Ralph Axel, Mark Cabana and others said they’ve entered a long 10-year U.S. Treasury

TMUBMUSD10Y,

position at 2.83%, targeting 2.25% and with a stop at 3.10%.

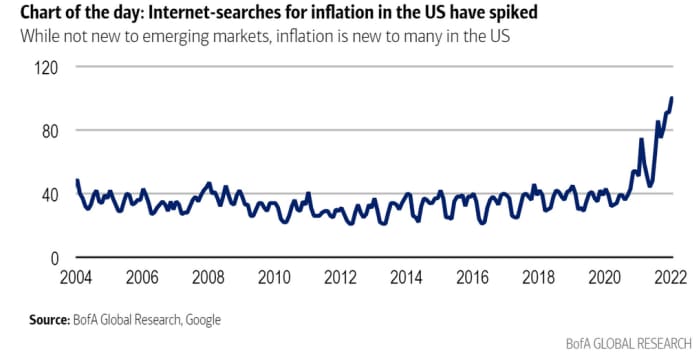

Part of their thinking is that markets may be overly focused on inflation risks, which have reached “mania or panic” levels judging by Google trends showing a spike in online searches about the topic.

BofA Global Research

The team at B. of A. foresees inflation peaking in the current quarter and falling steadily into 2023, which should “reduce the panic level around inflation and allow rates to decline.” The annual headline inflation rate stood at 8.5% as of March, based on the consumer price index, the highest since 1981.

Yields and government bond prices move in opposite directions. So when yields are climbing, the price of the underlying government bond is falling — making it more attractive for a potential buyer. Conversely, the same is true: When yields are dropping, the underlying bond price is rising and therefore less attractive to buyers.

Now around its highest levels in more than three years, the 10-year rate is at a level that makes for a “compelling location to go long for a 3-month horizon,” the strategists wrote.

On Wednesday, Treasury yields moved mostly lower as the 10-year yield backed away from 2.9%, the level it reached on Tuesday for the first time since December 2018.

Also see: The 10-year Treasury real yield briefly went above zero. Here’s what it means for markets.

Stocks were mostly higher Wednesday as Treasury yields pulled back, with the Dow Jones Industrial Average

DJIA,

up around 330 points, or 0.9%, while the S&P 500

SPX,

gained 0.3%.