This post was originally published on this site

It’s easy to feel queasy about bonds after a stunningly bad first quarter.

A sharp rise in Treasury rates this year has been a massive drag on fixed income, with losses feeling even more acute when coupled with a stock-market rout that landed the S&P 500 index

SPX,

back in correction territory on Friday for the second time this year.

“Investors aren’t used to seeing dramatic losses in their bond portfolios, particularly when equity markets are also declining sharply,” Saria Malik, chief investment officer at Nuveen, the asset manager of TIAA, in a Monday client note.

How bad has 2022 been? The investment-grade corporate bond market’s total return was negative-12.3% on the year through April 29, compared with minus-8% for high-yield, negative-12.1% for convertibles and negative-12.9% from the S&P 500, according to CreditSights.

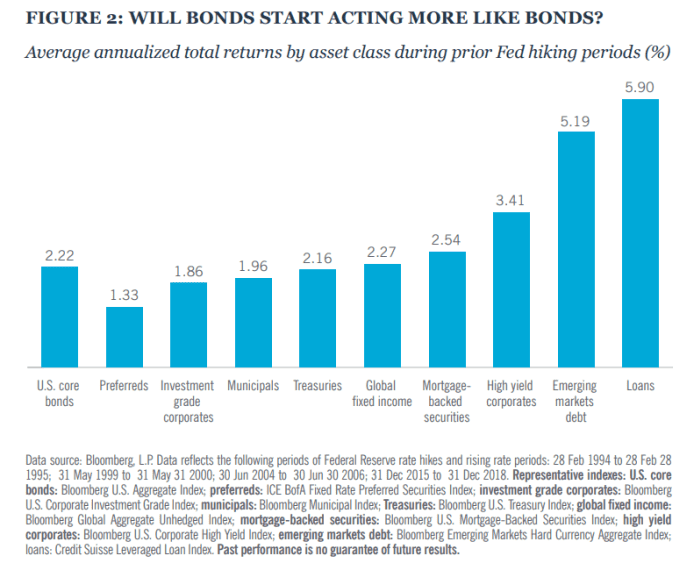

The good news is that Malik thinks sharp bond-market losses likely won’t continue, particularly since debt markets held up in past rate-hiking cycles (see chart), starting in 1994 through 2018.

Debt has held up in past hiking cycles

Nuveen, Bloomberg, Credit Suisse Leveraged Loan Index

Loans, often underwritten as floating-rate debt, were a top performer with annualized total returns of 5.9% through past hiking cycles, while U.S. core bonds produced about a 2.2% total annual return.

Many individual investors gain exposure to bonds and debt through exchange-traded funds. The largest U.S. investment-grade corporate bond exchange-traded fund

LQD,

is down almost 16% on the year so far; its counterparts in high-yield

HYG,

or “junk bonds

JNK,

” are off closer to 10%; and the iShares Core U.S. Aggregate Bond ETF

AGG,

is 10.5% lower, according to FactSet.

Looking ahead, Malik’s team sees “value emerging from the bond-market wreckage,” including potentially in longer-duration assets.

Rates serving as a key component of bond prices have climbed dramatically this year, with the benchmark 10-year Treasury yield

TMUBMUSD10Y,

at 2.995% on Monday, its highest level since Nov. 30, 2018, which was near the end of the Federal Reserve’s last rate-hiking cycle.

“A similar rate shock looks unlikely in the near term for a number of reasons,” Malik wrote, pointing to much of the “bad news (Fed hikes, inflation)” as likely being priced into bonds already, as well as fairly decent fixed-income fundamentals and the resilience of bonds after previous selloffs during Fed hiking periods.

Read next: Why aiming for a ‘soft landing’ for the economy doesn’t guarantee one for Wall Street