This post was originally published on this site

As U.S. inflation roars to 40-year highs, putting the squeeze on consumer sentiment, it has rarely been this cheap to borrow on Wall Street.

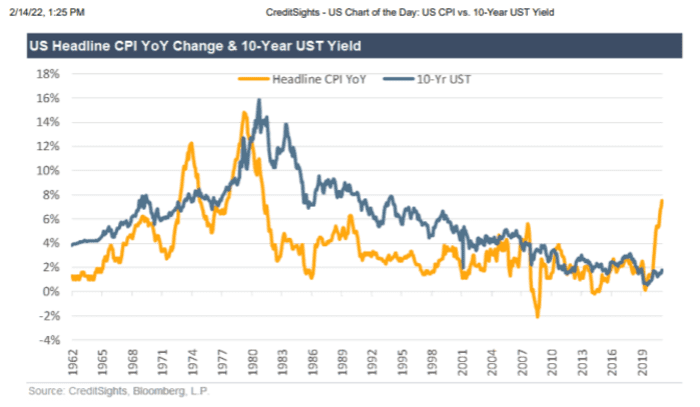

That’s chiefly because the sharp climb in consumer prices to early 1980s levels during the pandemic hasn’t led to a similar spike in the benchmark 10-year Treasury rate — used to price trillions worth of longer-term assets from corporate bonds to real estate debt.

The consumer-price index hit 7.5% in January from a year before, its biggest gain since February 1982. However, the 10-year rate has come nowhere near its 14% yield from four decades ago (see chart).

Consumer prices may be surging, but borrowing costs on Wall Street clearly aren’t

CreditSights

Cheap financing has been a fixture of Wall Street in the decade since the 2008 global financial crisis, a stretch that also stirred concerns about U.S. companies and other parts of financial markets potentially piling on too much debt, with the help of yield-starved investors.

When the pandemic hit, borrowing costs plunged again as the Federal Reserve and other central banks rolled out expansive policies to keep credit flowing, including by slashing global policy rates to near zero and many restarting large-scale asset purchases.

Even with the jump in 10-year Treasury rates to kick off 2022, CreditSights analyst Winnie Cisar, global head of strategy, pegged the 10-year Treasury yield

TMUBMUSD10Y,

of February 1982 as about 1,200 basis points above current levels.

The disparity illustrates “how much central bank policies in the U.S. and abroad have impacted the UST market, especially for the longer-end of the curve,” Cisar said, in a Monday note.

U.S. stocks, bonds and other financial assets had a rough January as investors focused on the shift among central bankers to fight inflation globally, with an eye to raising rates and shrinking their balance sheets.

That’s significantly cut down the pile of global debt trading at negative yields as investors brace for tighter financial conditions, and has contributed to the widening of U.S. speculative-grade, or “junk-bond,” spreads to around 3.7%, near the highest in a year. Spreads are the level bond investors can earn above a risk-free rate, often Treasurys, to help compensate for a security’s default risks.

Adding to market jitters, tensions between the U.S. and Russia over Ukraine have grown, with a potential invasion by Moscow looming over markets. On Monday, that helped crude oil futures

CL00,

push closer to $100 a barrel and the Dow Jones Industrial Average

DJIA,

and S&P 500 index

SPX,

both trade lower.