This post was originally published on this site

Kevin “KAYR” Robinson moved around so much growing up in Philadelphia, he says he “got a Ph.D. in being a tenant.”

Ultimately, he worked his way out of poverty to a net worth of several million dollars through a mix of ambition, frugality and an education that includes a bachelor’s degree and an MBA.

Robinson, who goes by “KAYR” (pronounced Kay-R), told MarketWatch he grew up with his mother and six siblings on public assistance, moving “from landlord’s house to landlord’s house,” sometimes lacking electricity or heat.

From an early age, he decided he would chart a different course and become a landlord or business owner. Without anyone in his family to show him the ropes, he recalled spending hours at the University of Pennsylvania bookstore on weekends, reading books about economics, business management, wealth creation and real estate.

“I said, I have to stay focused and put on that tunnel vision in order to live out my dream of financial freedom,” he said.

It would be years before he heard about the FIRE movement, but his goals already included financial independence and early retirement. Not to stop working, but to control how he spent his time.

Now 38, he considers himself retired as of August 2020, when he left his job in investment banking to focus on his own businesses. These include a property-management company and a portfolio of 100-plus rental units he owns or co-owns in the Philadelphia metro area and Harrisburg, Pa.

KAYR started his real-estate career in 2009, buying a foreclosed home for $84,800 cash in the Cobbs Creek neighborhood, a predominantly African-American community in gentrifying West Philadelphia with attractive homes, a sizable park, an environmental center, tennis courts and a creekside trail.

“I knew early on, as a young person in my 20s, if I could get my hands on a couple of these properties, their value would shoot to the moon,” he said.

Zillow data show the value of a single-family home in the ZIP code, which includes neighborhoods to the south and east, has more than doubled in the last five years.

One of his tenants, Beatrice Sessoms, said renting from his company for the last three years has been a “beautiful experience.”

“The best thing is to be somewhere where you’re paying and you feel secure. And I feel very secure here and safe,” she said.

A family business

He works alongside a select group of family members, including two brothers, a sister-in-law, his stepmother, two nephews and a niece. He aims to create not only generational wealth, which he recognized among some of his white classmates during college, but “transformational wealth, taking place today, not necessarily 50 years from now,” for his family and the Black community.

One example is his brother Christian Washington, a key part of his real-estate team. After Washington got a real-estate license, he earned a commission that he put toward his first home in a prestigious Philadelphia neighborhood. Washington went on to help his in-laws with a down payment on their own home, continuing the chain of wealth creation.

In the years since KAYR’s first purchase, which he made with savings from his finance jobs, he bought eight more single-family homes, some in cash and others with mortgages, before branching out to apartment buildings. He has tried to buy properties in close proximity, to streamline resources and commuting time for his team. On some of the larger buildings, he added a banner that says “KAYR Apartments.”

He emphasizes the importance of saving, saying it doesn’t have to be a lot.

“I tell people, if you save $500 per month for the first 12 months, you have $6,000 saved,” he said. “Think about it, if you bought your first rental property for $40,000, you went to a credit union, you put 20% down, that’s only $8,000.”

Another of his strategies has been to hang on to cash so he can keep building his business instead of paying off his student debt. He said he received a full scholarship to Bowdoin College in Maine but has nearly $170,000 in debt from his MBA program at Dartmouth’s Tuck School of Business, which he’s whittling down one $1,200 monthly payment at a time.

The rentals he bought during the pandemic, some of them with investors, helped him reach his goal of a 100-unit portfolio. With his stocks, real-estate equity and income from his rentals and management company, he felt he could afford to stop working for someone else.

Joann Robinson, his stepmom, was already working in real estate, in licensing and inspection, before she joined the KAYR Management team. She is now a senior property manager in an arrangement that has rewarded them both.

“It’s just easier when you can just go day by day without worrying about a lot of little things that I used to have to worry about,” she said. “I can sit and enjoy a cup of tea. It feels good.”

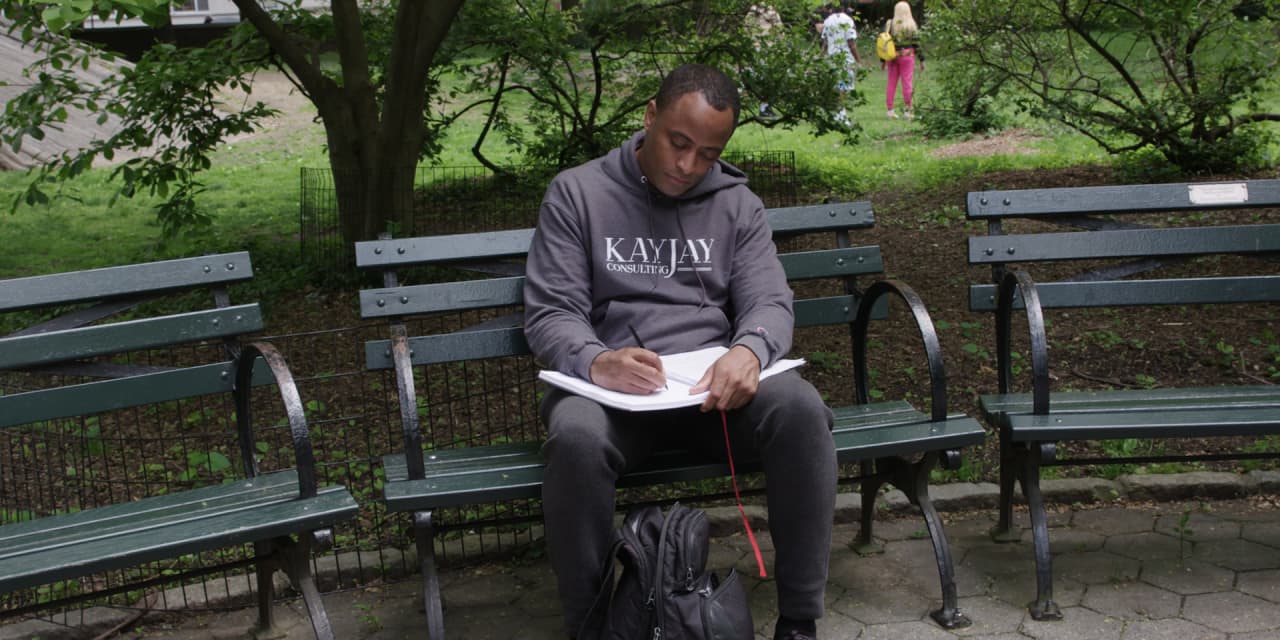

These days, he’s a millionaire who takes Megabus, his favorite mode of transportation for travel to Philadelphia. He works, thinks and daydreams from benches in Central Park when it’s nice out, and rents a studio apartment with amenities and a view in the Bronx for $1,499 a month, about half the median monthly rent for Manhattan as of July, according to StreetEasy. He doesn’t own a car, rarely eats out, and has been known to haggle with the local fruit vendor.

“It’s not the money you make,” he said. “It’s the money you keep.”