This post was originally published on this site

In the second quarter of fiscal 2020, Hillenbrand, Inc. (HI), a diversified industrial equipment company, fared much better than Wall Street expected. Its adjusted earnings per share and revenue were well above the level analysts forecasted even despite softness in a few end-markets inclusive of the automotive and oil & gas industries.

In the previous article, I concluded HI did not receive the appreciation it deserves. In March, after the steep price decline amid the coronavirus-induced sell-off, the share price plummeted but then rebounded together with the overall market. At the moment, the stock is a bit expensive, as its EV/EBITDA is above the five-year average.

Now let’s take a more in-depth look at the Q2 results.

The top line

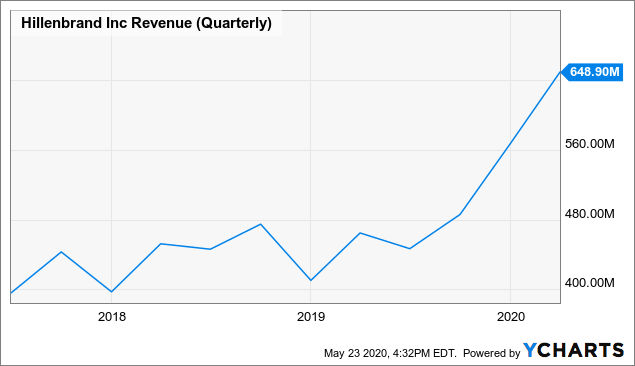

In Q2, Hillenbrand delivered revenue of $649 million, 40% above the Q2 FY 2019 result.

Obviously, this phenomenal growth was inorganic. The top line was propped up by the Milacron acquisition completed in November 2019. Adjusted for the Milacron impact, organic total revenue was down 3%.

While Batesville, the company’s death care segment, delivered a 1% increase in sales, Process Equipment Group, HI flagship division regarding revenue, posted sales of $311.1 million vs. $326.7 million a year ago. A 5% decline was caused by two issues: foreign exchange headwinds and sapping demand for capital equipment. Adjusted for the FX impact, the segmental revenue was down 3%.

As it was clarified in the news release, among the headwinds the segment faced was lower demand for “screening and separating equipment used to process proppants for hydraulic fracturing.” A reader might guess that the oil price war and the COVID-19 pandemic were the principal culprits. However, the issue is that the historic oil market meltdown happened in March, but HI Q2 revenue was impacted by the trends that had already been observable in 2019 and did not reflect the repercussions of single-digit WTI price. So, the worst is perhaps yet to come.

Now let’s delve a bit deeper. As it was said in Form 10-K (see page 4), HI sells screening and separating equipment under the Rotex® and BM&M® brands. Frac sand companies use the Rotex separators to purify the proppant required to open up cracks in hydrocarbon-bearing rock formations (see an application bulletin). It is intuitively evident that demand for proppant and, hence, liquidity of frac sand companies depend on the capital allocation priorities of the U.S. shale players and drilling activity, which, in turn, hibernates when oil prices are lingering well below $40 a barrel. Last year, E&P companies had already been revising their capex down, as West Texas Intermediate was not expensive enough. In this case, sand companies had to make tough decisions: slash opex and capex and defer or cancel purchases of new capital equipment. In 2019, the struggling industry had already faced bankruptcies. So, it’s fully explainable why the demand for screeners and separators slumped.

This year, the trend has been exacerbated by the single-digit crude oil prices. For a broader context, to address the unprecedented downturn, Smart Sand (SND) had decided to reduce its 2020 capital expenditures “by up to $20 million” anticipating the budget to range from $5 million to $10 million.

This May, North American benchmark oil prices have been climbing higher spurred by a decline in supply and slowly rebounding demand, but I am highly skeptical that OFSE companies will rush to revise their capital spending plans up. It will take at least a few quarters before demand recovers.

As frac sand companies are in dire straits because of the oil price slump and clobbered drilling activity, I anticipate revenue from sales of screeners to remain under pressure for the rest of the calendar 2020 and in early 2021. Fortunately, Minerals & Mining (including frac sand) is not the key end-market Hillebrand relies on; in Q2 FY20, it brought only 2.7% of sales. HI has a well-diversified portfolio, and positive developments in a few other end-markets (e.g., Food and pharmaceuticals) can slightly offset lackluster demand from the energy sector.

Another issue that took a toll on Hillebrand’s Q2 sales was a softness in the automotive industry that, in turn, led to lower demand for injection molding equipment and hot runner systems produced and sold by the newly established Milacron segment. The segmental sales were down 20% mostly because of softness in the automotive industry, which had already been battered by the trade confrontation in 2019 and then faced a perfect storm amid the pandemic. I anticipate the demand for capital equipment from the car industry (both OEMs and parts suppliers) to remain distressed in 2020.

Sub-zero profits

Now I should touch upon the company’s profitability. Unfortunately, HI failed to turn an accounting profit in the March quarter despite surged total revenue boosted by the Milacron acquisition. Moreover, it even failed to deliver positive GAAP operating income, and impairment was the principal culprit. Of course, this non-cash charge made no harm to net cash from operations and free cash flow. But still, it should not be ignored. As it was clarified on page 19 of Form 10-Q, HI reduced the amount of goodwill on the balance sheet by $72.3 million, while trade names (mostly related to the Milacron segment) were downgraded by $8.6 million; a few Milacron’s technologies (including patents) also failed the impairment test. Among the culprits of the impairment, Hillebrand mentioned the “recent macroeconomic conditions primarily driven by the COVID-19 pandemic.”

Cash flows and capital efficiency

While GAAP operating income and net earnings were sub-zero, Hillebrand’s cash flow remained robust. $27.5 million fully covered capital expenditures of $8.7 million. Free Cash Flow to Equity left after investments also more than adequately covered dividends paid of $15.9 million. The divestment of Cimcool brought an inflow of $222.4 million. On a negative side, LTM Cash Return on Total Capital, one of the metrics I use to assess capital efficiency, was only 8.8%. The figure was bleak mostly because of capital structure changes, as the total debt significantly increased because of the Milacron acquisition.

Remarks on the financial position

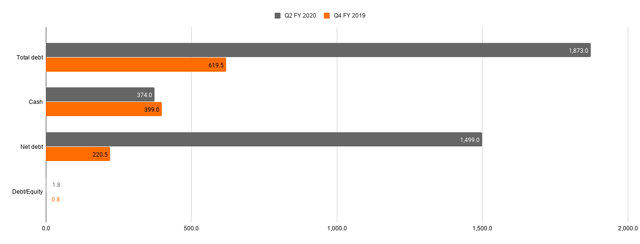

Since the consolidation of Milacron, Hillenbrand’s financial position has weakened substantially as its total debt almost tripled because of term loan and revolving credit facilities (see page 21 of Form 10-Q for details).

Net debt-to-adjusted EBITDA stood at 3.5x as of end-March; that level is obviously not perfect. I prefer to see close to 2x or below. I would not say the company is on the cusp of insolvency; however, I hope in the short-term, HI will undertake measures to reduce leverage and allocate free cash flows to debt reduction and capital structure optimization.

Also, if we take a closer look at the Q2 statement of operations, we will notice that interest expense changed drastically. While in the Q2 FY 2019 HI’s accrued interest amounted to only $5.4 million, in the Q2 FY 2020, it rose almost 4x to $20.9 million. Of course, a sharp increase in finance costs has taken a toll on operating cash flow and FCF attributable to shareholders, while EPS was relatively protected as interest is, in most cases, tax-deductible.

Final thoughts

HI has a versatile and multifaceted portfolio; some of its businesses are almost immune to the repercussions of the economic recession. One of the possibly worrisome matters is the company’s exposure to the ailing automotive and frac sand industries that suffer from the consequences of the pandemic.

In sum, Hillebrand remains a resilient industrial equipment company worth considering for long-term holding. The issue is that its valuation has become a bit inflated.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.