This post was originally published on this site

Golar LNG Partners LP, 8.75% Series A Cumulative Redeemable Preferred Units (GMLPP) are trading at a 30% discount to their $25.00 call value due to several concerns:

-COVID-19 has pressured LNG demand and created uncertainty as to how quickly demand will return. LNG prices have continued to fall due to oncoming supply.

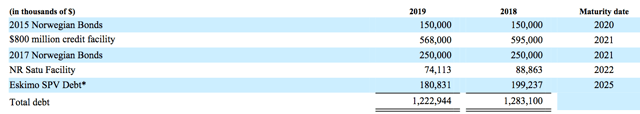

-Golar had two bond maturities due in May 2020 and May 2021, which management hadn’t been able to refinance yet, due to the freezing of the credit markets during the pandemic.

-LNG shipping common units’ prices have been falling over the last few years, with some carriers experiencing lower earnings from reduced long term contract rates.

Unlike the common units of Golar LNG Partners LP (GMLP), these preferred units had been maintaining their price near their $25.00 call value, until the COVID-19 crash in February:

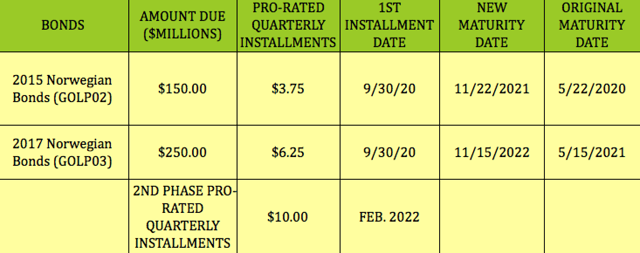

Fortunately, management was able to amend the terms of its two bonds that were set to mature in 2020-2021. They were both extended by 18 months, with a pro-rated quarterly redemption schedule of $40M per year. In addition, the company cannot increase its common dividend past the reduced $.0202/quarter until both bonds are redeemed.

The 2015 $150M bond’s new maturity date is 11/22/2021, and will start having $3.75M quarterly redemptions in September 2020. That should leave ~$135M to be redeemed, at 105% of their value, $141.75M, on 11/22/2021.

The 2017 $250M bond’s new maturity date is 11/22/2022, and will start having $6.25M quarterly redemptions in September 2020, which will then step up to $10M in February 2022, after the 2015 bond is fully redeemed. The 105% of the remaining unredeemed value, to be redeemed in November 2022 should be ~$188 – $198M:

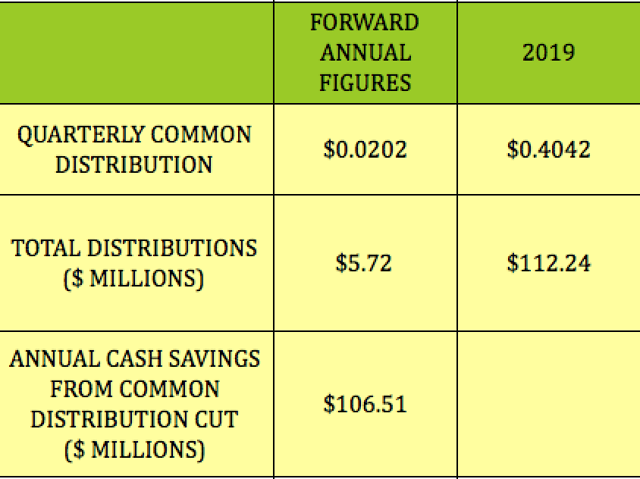

In order to help fund the annual $40M in redemptions, management decided to cut the common distribution all the way to $.0202, from the previous $.4042. This move will free up ~$106M in additional cash/year.

In order to help fund the annual $40M in redemptions, management decided to cut the common distribution all the way to $.0202, from the previous $.4042. This move will free up ~$106M in additional cash/year.

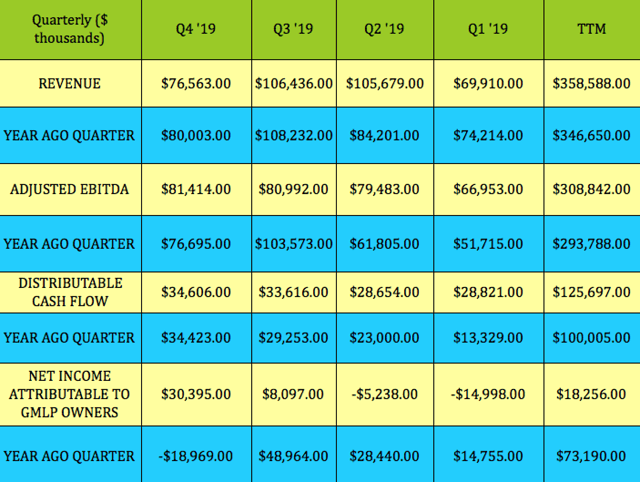

Golar generated ~$81M in adjusted EBITDA per quarter in Q3-4 ’19, which would total $384M over a one-year period, and ~$486M over an 18-month period. This should give the company more than enough of a cushion to redeem the two bonds in full upon their extended maturity dates.

Golar generated ~$81M in adjusted EBITDA per quarter in Q3-4 ’19, which would total $384M over a one-year period, and ~$486M over an 18-month period. This should give the company more than enough of a cushion to redeem the two bonds in full upon their extended maturity dates.

The good news for preferred unitholders is that the common distribution cut makes strengthens GMLP’s cash flow. Saving over $105M/year is = to over 33% of GMLP’s trailing annual EBITDA.

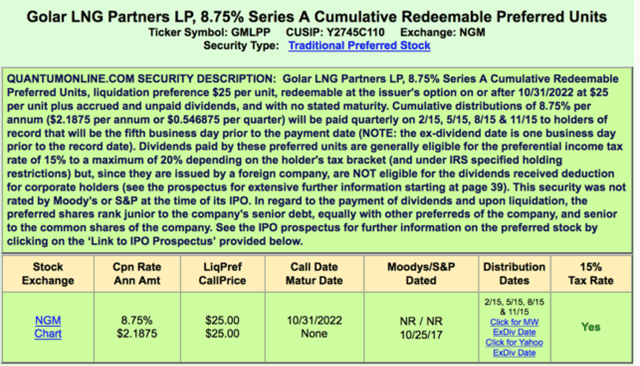

These are cumulative units, which offers you the added protection of knowing that management must pay you any skipped distributions BEFORE it pays the common units. Of course, that’s a bit of a moot point, since management already is constrained by the bond amendments from paying more than the current $.0202 quarterly common payout.

These units also rank senior to the common units, in the event of a liquidation.

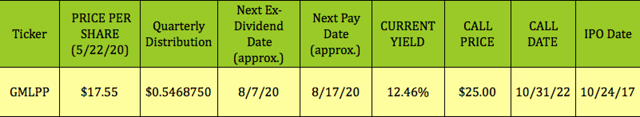

At $17.55, GMLPP yields 12.46%. They go ex-dividend and pay in a Feb/May/Aug./Nov. schedule, and unitholders receive a 1099, not a K-1, at tax time.

At $17.55, GMLPP yields 12.46%. They go ex-dividend and pay in a Feb/May/Aug./Nov. schedule, and unitholders receive a 1099, not a K-1, at tax time.

The call date is 10/31/22, just before the extended maturity date for the $250M bond issue. Unless management is able to refinance enough debt to redeem the $250M bond before the new November 2022 maturity date, it’s unlikely that they’d also redeem these preferreds, which have a total redemption value of $138M.

The call date is 10/31/22, just before the extended maturity date for the $250M bond issue. Unless management is able to refinance enough debt to redeem the $250M bond before the new November 2022 maturity date, it’s unlikely that they’d also redeem these preferreds, which have a total redemption value of $138M.

However, “never say never” – the credit markets will eventually ease up, and lower rates could mean a substantial savings for GMLP vs. the 8.75% rate that these preferreds pay.

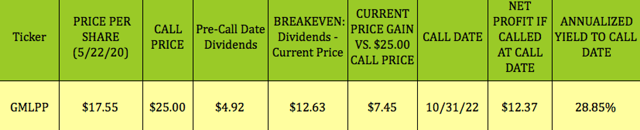

Here’s a look at that possible, if not probable, scenario: There would be a $7.45 capital gain, (the $25 call value less the current $17.55 price), plus $4.92 in distributions, for a total potential profit of $12.37. That’s a 70% profit in ~2.4 years, or 28.85% annualized.

None of these ruminations would be that interesting if it wasn’t for the very strong coverage for these preferred units.

None of these ruminations would be that interesting if it wasn’t for the very strong coverage for these preferred units.

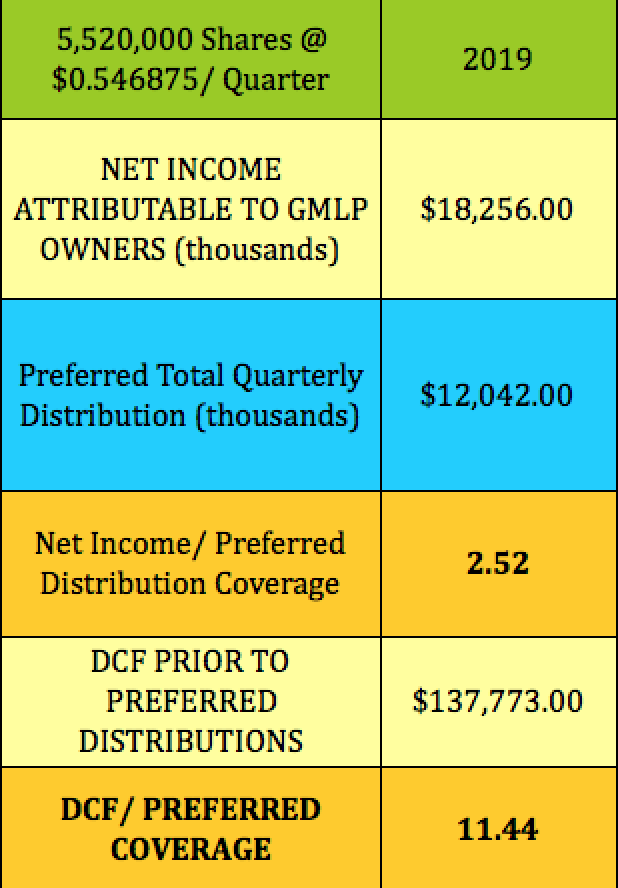

We looked at it from two angles: GMLP earned $18.25M in net income attributable to GMLP owners in 2019, which already had the $12.04M in preferred distributions deducted. Adding the $12.04M back to net income gives us 2.52X in preferred coverage.

However, net income isn’t the most meaningful coverage metric for a shipping stock like Golar, because it includes a large amount of non-cash depreciation and amortization. Using distributable cash flow, which adds back the non-cash D&A, but subtracts maintenance capex, gives us a very strong preferred coverage ratio of 11.44X:

Financials:

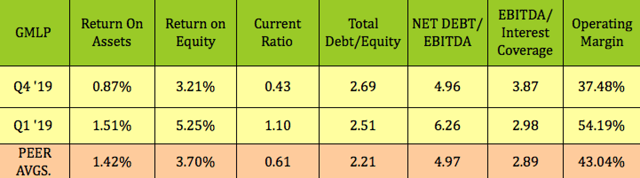

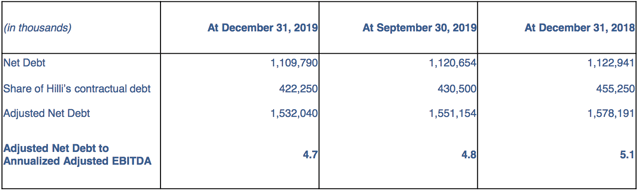

Golar’s higher EBITDA and management’s paying down of some of the company’s debt led to an improved net debt/EBITDA leverage ratio of 4.96X as of 12/31/19, vs. 6.26X, as of 3/31/19. (management shows a lower ratio of 4.7X, using Q4 ’19 Adjusted EBITDA, which makes sense, given the higher level that GMLP hit in Q3 & Q4 ’19.)

The 4.96X trailing figure is in line with other LNG shippers’ leverage, while Golar’s total debt/equity of 2.69X is a bit higher. EBITDA/Interest coverage improved quite a bit, going from 2.98X in Q1 ’19, to 3.87X in Q4 ’19:

Although GMLP’s management was able to successfully extend its bond maturities, it also has an $800 million credit facility, which matures in April 2021, that it must refinance.

They should be able to refinance the credit facility, given the new plan to eliminate a significant portion of the company’s debt over the next 2.5 years and the $100M+ in annual cash flow savings from the much lower common distribution.

GMLP also has a 50% interest in the Hilli Episeyo FLNG, for which it has a 50% share of debt, which amounted to $422.25M, as of 12/31/19.

(Source: GMLP Q4 presentation)

(Source: GMLP Q4 presentation)

Fleet:

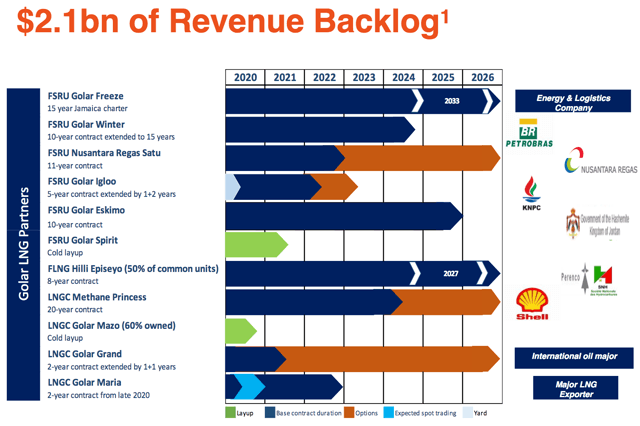

Further strengthening Golar’s case as an investment, and for assessing its ability to refinance its credit facility is its strong revenue backlog, which stood at $2.1B, as of 12/31/19. They also have to re-contract the Spirit and the Mazo, which will bring in additional revenue. The Golar Spirit is a smaller vessel, with smaller capacity at FSRU, which might be attractive for small scale projects which are becoming more frequent. With LNG so cheap, there’s increasing interest from more countries that see it as a good way to save on energy costs.

FSRUs, Floating Storage Regasification Units, comprise 60% of GMLP’s revenue backlog, followed by FLNG units, Floating Liquefied Natural Gas production units, at 32%, and LNG vessels, at 8%.

Summary:

We continue to rate the GMLPP preferred units as a buy based upon their very attractive yield, strong coverage, and Golar’s improved cash flow position from the bond extensions/common payout cut. Golar will report its Q1 ’20 earnings next week, and will have a new CEO on the call.

All tables by Hidden Dividend Stocks Plus, except where noted.

Our Marketplace service, Hidden Dividend Stocks Plus, focuses on undercovered, undervalued income vehicles, and special high yield situations.

We scour the US and world markets to find solid income opportunities with dividend yields ranging from 5% to 10%-plus, backed by strong earnings.

We publish exclusive articles each week with investing ideas for the HDS+ site that you won’t see anywhere else.

We offer a wide range of income vehicles, some of which are holding up much better than the market in this latest pullback, while many others are bouncing back from their lows.

Disclosure: I am/we are long GMLPP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our DoubleDividendStocks.com service features options selling for dividend stocks.

It’s a separate service from our Seeking Alpha Hidden Dividend Stocks Plus service.

Disclaimer: This article was written for informational purposes only, and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.