This post was originally published on this site

A widely followed part of the Treasury curve is at risk of inverting by the third quarter as Federal Reserve policy makers undertake the process of raising interest rates, economists say.

The risk is “definite” given the “fairly aggressive path of rate hikes that policy makers seem pretty convinced they’ll do this year,” Derek Tang, an economist at Monetary Policy Analytics in Washington, said via phone Wednesday. He cited the three rate increases that policy makers have penciled in for this year, as part of their updated forecasts in December.

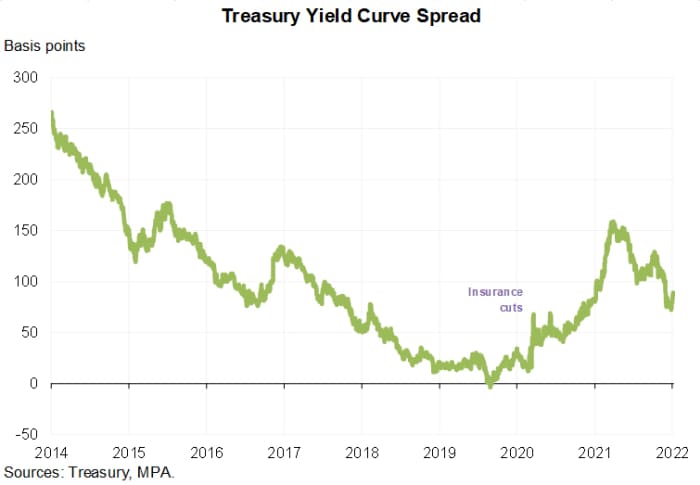

The spread between two- and 10-year Treasury yields — already hovering near some of the lowest levels in a year, at 88 basis points — is flattening at a faster pace than it did in the years leading up to 2019, the last time the curve inverted. During that time, the Fed delivered a trio of preemptive rate cuts in 2019 to ensure the U.S. economy wouldn’t go into a recession. An inverted curve, which occurs when the difference between short- and long-term yields shrinks below zero, is often regarded as a sign of an impending downturn.

Treasury, Monetary Policy Analytics

The aggressive flattening of the curve since early last year reflects an assessment by the bond market “that the economy could be subject to exogenous shocks,” Tang said. “We don’t know what they might be, but we know that the Fed would have to bring the fed funds rate back down to zero in that scenario. The market is expecting, on average, a very short and rapid rate hike cycle that’s likely to reverse.”

Though there’s no consensus take just yet, Tang’s view about the risk that the Fed could invert the Treasury curve by the third quarter is shared by John E. Silvia, the former chief economist at Wells Fargo Securities. Meanwhile, Societe Generale’s head of U.S. rates strategy, Subadra Rajappa, says the broad flattening trend in the Treasury yield curve is likely here to stay.

On Wednesday, the 2s10s curve continued to flatten as the 2-year yield

TMUBMUSD02Y,

rose at a faster pace than the 10-year rate

TMUBMUSD10Y,

while the S&P 500

SPX,

and Nasdaq Composite indexes

COMP,

struggled to gain traction ahead of the 2 p.m. Eastern time release of the Fed’s December meeting minutes.