This post was originally published on this site

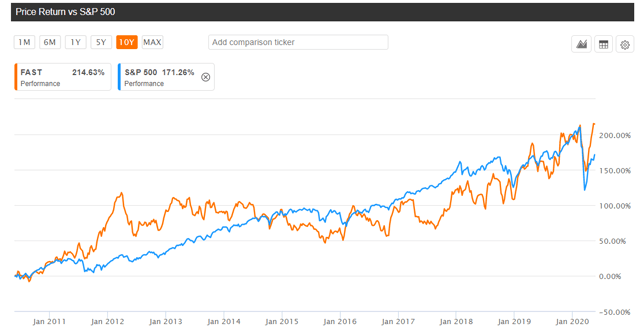

Fastenal Company (FAST) has outperformed the S&P 500, returning 214% compared to the S&P’s 171% over the past 10 years. This is driven by the company’s high returns on invested capital and steady growth over the years. High returns have been driven by the company’s scale advantages, which also contribute to high operating margins. The company’s growth has been led by its focus on better customer service, which has led the company to grow its on-site location footprint. The company appears to be overvalued due to better expected financial results relative to its peers.

(Source: Seeking Alpha Data)

Steady revenue growth has been driven by increasing on-site locations

Fastenal started with a single commodity product, fasteners. Over time, the company has expanded its offering to nine broad product lines. A focus on customer service, along with their expansion of product lines, has allowed the company to grow its revenue steadily. Revenue has grown from $2.2B in 2010 to $5.3B in 2019 at an annual rate of 9.2%. Growth in the past 3 years has been roughly 10% on average.

Fastenal has supply chain partnerships with many of its customers. The company currently has 3,228 in-market selling locations across 25 countries. With a large customer base, Fastenal is able to increase its supplier base and product selection. This allows Fastenal to negotiate volume discounts with its suppliers, which Fastenal can pass to its customers along with a larger selection.

No matter what approach we ultimately take, we strive to change the customer mindset. Don’t just think of our products as an expense in your business. Think of the total cost and the total value. Think of how your employees use the product – is it the best product for the application? Is there a more efficient way to bring that product to the point of use? Don’t just have a fulfillment partner; have a supply chain partner. When we engage with each other, when we truly form a supply chain partnership, we will wear you out with ideas. We will help your business succeed.

(Source: 10-K)

Fastenal has also adopted onsite models to improve service levels. The company grew from 200 onsite locations in 2014 to over 1,100 in 2019. The on-site model carries a lower gross-margin profile, which might reduce operating margins in the short run. However, Fastenal has a lower break-even point than competitors for each location and these locations help to drive future incremental sales. Customers prefer this model because it provides a quick and convenient way of getting the products while reducing their shipping costs.

Fastenal has scale advantages and higher retention than competitors

Due to its partnership model, Fastenal has embedded itself into the customers’ purchasing process. This helps to improve retention rates as customers would not switch providers if Fastenal has been providing a strong value proposition. Unless competitors provide a hugely differentiated offering at a lower cost, Fastenal should continue to enjoy high loyalty with its existing customers

Fastenal’s scale also contributes to its loyalty due to the company’s ability to price competitively from its lower cost structure. Being one of the larger industrial distributors allows Fastenal to source products at a lower price. Smaller competitors cannot buy at similar volumes as Fastenal so they would not enjoy the same level of volume discounts.

With 3,228 locations, Fastenal also places the inventory closer to customers. Fastenal also has an efficient distribution network with trucks and vehicles to move inventory across the United States. This network makes it difficult for smaller competitors to replicate and allows Fastenal to provide a higher level of service and convenience for customers.

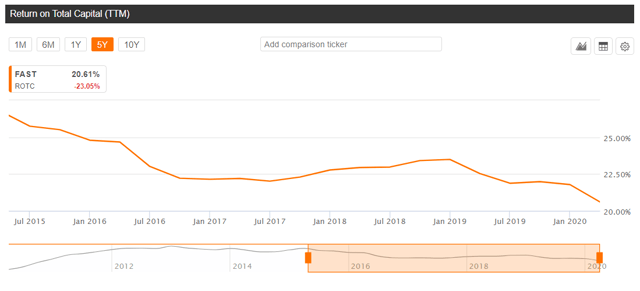

With its cost advantages, Fastenal has enjoyed high operating margins of roughly 20% in the past 10 years. Fastenal’s return on total capital has also exceeded for the past 5 years. With its cost of capital at 7.7%, Fastenal’s management has been exhibiting skill in investing in smart growth while optimizing on the highest return opportunities for its shareholders.

(Source: Seeking Alpha Data)

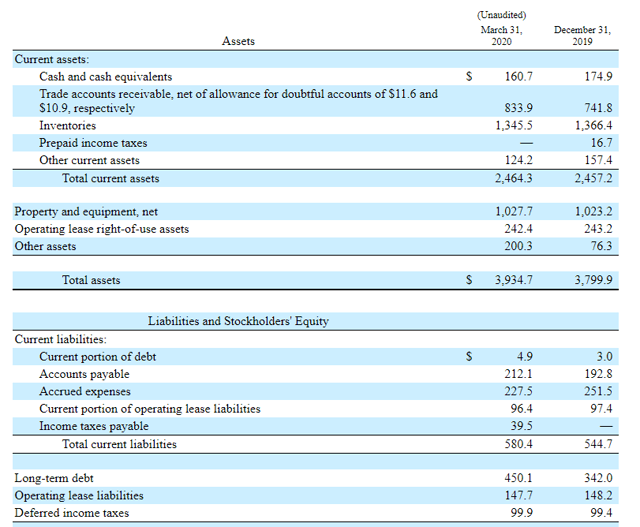

Balance Sheet

Fastenal has roughly $160M of cash, $5M of short-term debt and $450M of long-term debt. Most of its debt comes from an unsecured revolving credit facility that will be due only in 2023. With a free cash flow of $500M in the last fiscal year, Fastenal has sufficient liquidity to invest in expanding its on-site locations and growing revenues. With an expected downturn in 2020, the company’s strong liquidity position also helps Fastenal tide through any difficulties in the near term.

(Source: 10-Q)

Investment Risks

Fastenal is likely to be negatively impacted by the COVID-19 situation in the near term as mentioned in their quarterly report:

While the company’s facilities and in-market locations continue to operate, we did restrict public access to our branches and many of our Onsite locations were closed or operating at a meaningfully diminished capacity, which negatively impacted sales at the end of the quarter and may negatively impact sales until the COVID-19 pandemic moderates. The COVID-19 pandemic is also shifting demand patterns to favor our lower-margin products, which is producing a reduction in our gross margins.

However, Fastenal’s strength and brand loyalty should allow the company to bounce back quicker than smaller peers once the industry picks up.

Fastenal’s products are sometimes used in industries where a higher risk of injuries are present. If any of these events are linked to the use of Fastenal’s products, it might lead to legal liability and a loss of reputation. But Fastenal’s long operating history of 53 years and large customer base should provide the company with some operational expertise to reduce this risk.

Valuation

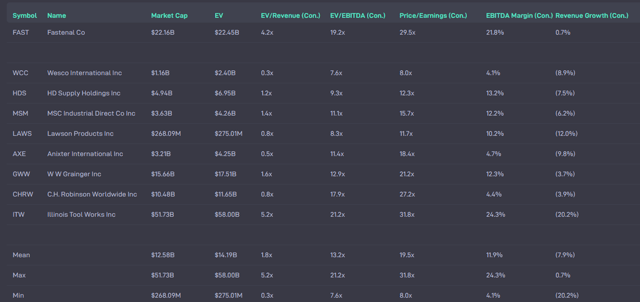

Peer analysis shows that Fastenal ranks more expensive based on average consensus EV/Revenue, EV/EBITDA and P/E ratios. This is due to the stronger consensus estimates for Fastenal. Its EBITDA margin is expected to be 21.8%, compared to the peer average of 11.9%. Its consensus revenue growth of 0.7% is also higher than the average of -7.9%. As such, potential investors are expected to pay a premium for better expected financial performance.

(Source: Atom Finance)

Takeaways

For Fastenal to continue outperforming, the company has to navigate the company through the current difficult economic climate. It also has to continue strengthening its moat around customer service and scale due to the commodity nature of its products. With strong free cash flow generation and a healthy balance sheet, the company’s management is in a position of strength to invest in the company’s future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.