This post was originally published on this site

Geraldine Weiss, the founding editor of the respected stock newsletter Investment Quality Trends, died on Apr. 25 at the age of 96.

I will leave to others the chronicling of her remarkable career, other than to note that she overcame obstacles most of us today can’t imagine. Sexism was so rampant when she started her newsletter in the 1960s that she identified herself only as “G. Weiss,” in order to conceal her gender. (You can access the Wall Street Journal obituary of Weiss here, and the New York Times obit here.)

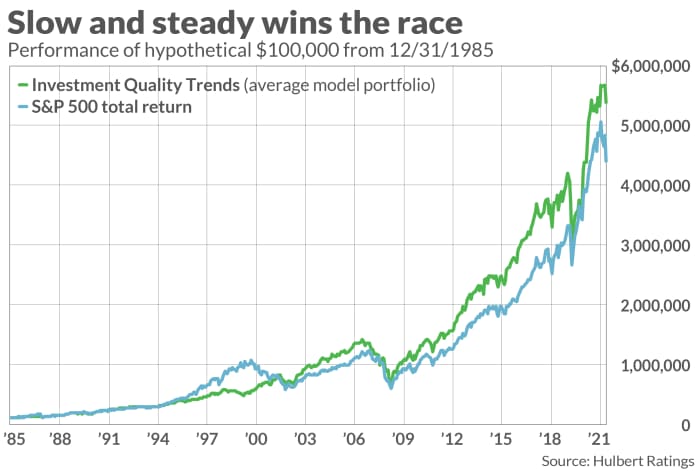

In this column I want to review the effective stockpicking strategy that she codified into an easily-understood and easily-followed system. My Hulbert Financial Digest began tracking Weiss’ newsletter in 1986. From then until her retirement in 2002, according to my firm’s calculations, her newsletter’s average model portfolio beat the S&P 500’s

SPX,

total return, 12.3% annualized versus 11.5%, while incurring 26% less volatility, or risk.

It’s rare to beat the market at all, and especially with that much less volatility, which helps to explain why over this period Weiss’ newsletter was No. 1 for risk-adjusted performance.

Unlike almost all other strategies that at some point have beaten the market, but which have eventually been discovered and discounted away, Weiss’ approach continues to work. Her handpicked successor Kelley Wright continues to publish the newsletter. From 2003 through Apr. 30, my firm calculates, the newsletter beat the S&P 500’s total return by the margin of 10.9% annualized to 10.5%.

I am privy to this information because my firm, Hulbert Ratings, has since 2016 been auditing (for a flat fee) the performance of Investment Quality Trends. Over this six-year period, my firm calculates that the newsletter has produced a 14.3% annualized total return, versus 15.0% for the S&P 500.

Simple method

The method Weiss codified is simple: Focus only on blue-chip stocks with strong financials that keep paying dividends through thick and thin, and buy only those in this select subset whose dividend yields are at or near the high end of their historical ranges.

That’s it. To implement this strategy you wouldn’t need anything more complicated than a calculator. (Weiss’ preferred technology was a slide rule.)

To be sure, I’m glossing over some crucial details. To determine which blue-chips are eligible to be considered, the Weiss approach requires that a company meet at least five of the following six criteria.

- Dividend increases five times in the last 12 years

- S&P Quality Ranking in the “A” category or above

- At least 5 million shares outstanding

- At least 80 institutional investors

- At least 25 years of uninterrupted annual dividends

- Earnings improved in at least seven of the past 12 years

Stocks meeting these criteria will be financially secure blue-chips, unlikely to cut their dividends. For such companies, a high yield is less likely to indicate that a dividend cut is imminent and instead suggests undervaluation.

One crucial aspect of this approach that differentiates it from other dividend-based strategies is that stocks with the highest yields aren’t automatically considered good values. This is for two reasons. One is that many of the highest-yielding stocks don’t meet these financial criteria to be considered. The second is that different stocks have different historical ranges between their lowest and highest yields, and a stock is considered undervalued only when its yield is at the high end of its particular historical range.

Weiss’ innovation, in other words, was to focus on relative dividend yield rather than absolute yield. An illustration can help to make this distinction clearer. Currently, according to the latest newsletter issue from Wright, TJX Companies

TJX,

is undervalued and Glaxo SmithKline PLC ADR

GSK,

is overvalued — even though the latter earlier this week sported a higher dividend yield (4.6%) than the former (2.0%). This is because the historical range of TJX’s yields has been much lower than Glaxo’s; 2.0% is the high end of its range, while 4.6% is the lower end of Glaxo’s.

Patience and discipline

Another key component of Weiss’ approach is patience and discipline. Despite the newsletter’s long-term market-beating record, it hasn’t beaten the market during every sub-period — as is illustrated by Wright’s slightly lagging the S&P 500 over the past six years. Indeed, over the nearly four decades my firm has tracked the newsletter, its most sustained period of S&P 500-lagging performance came in the late 1990s, during the go-go years in which the internet bubble was inflating. (See chart below.)

After the internet bubble burst, the performance of Investment Quality Trends came roaring back, more than making up for its market-lagging returns during the late 1990s. Only time will tell whether the same will happen now, but the newsletter’s long-term record suggests it’s a good bet.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters , including Investment Quality Trends, that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: Stocks are falling fast but that doesn’t mean the worst will be over soon