This post was originally published on this site

European stocks were headed for a second day of losses Friday, with the euro also under pressure as Austria announced a national lockdown to fight COVID spread, and Germany’s health minister didn’t rule out its own lockdown measures.

The Stoxx Europe 600 index

SXXP,

traded around 0.2% to 486.66, and was poised for a 0.3% drop for the week. The German DAX

DAX,

was off 0.2%, France’s CAC

PX1,

traded 0.4% lower and Italy’s FTSE MIB

I945,

tumbled 1.3%. All of the benchmarks were off session lows. The euro

EURUSD,

meanwhile, weakened against the U.S. dollar, off 0.6%, changing hands at $1.1309, and British pound, down 0.2%. But Europe’s currency bounced back after putting in steeper intrasession declines that brought it to levels against the buck not seen since June 2020.

After battling record COVID-19 cases and a week ago imposing restrictions on the unvaccinated, Austrian Chancellor Alexander Schallenberg said Friday that a 10-day national lockdown begin Monday and could stretch to 20 days. Starting Feb. 1, the country will also make vaccinations mandatory, public broadcaster ORF reported.

Austria’s 65% vaccination rate is among the lowest in Western Europe, with many EU countries suffering a fresh resurgence of infections, including Germany. The vaccination rate in Germany is at 68%, while Portugal and Spain are at 87% and 80%, fully vaccinated, respectively.

Germany’s health minister Jens Spahn reportedly said in a news conference that with the situation growing more grave, he couldn’t rule out restrictions to mobility to limit the new spread of the disease. The government is poised to announce restrictions for unvaccinated people.

Prospects of a lockdown in the region’s biggest economy Germany, have rattled investors in the region.

Read: Head of Germany’s disease control agency declares ‘nationwide state of emergency’ over COVID

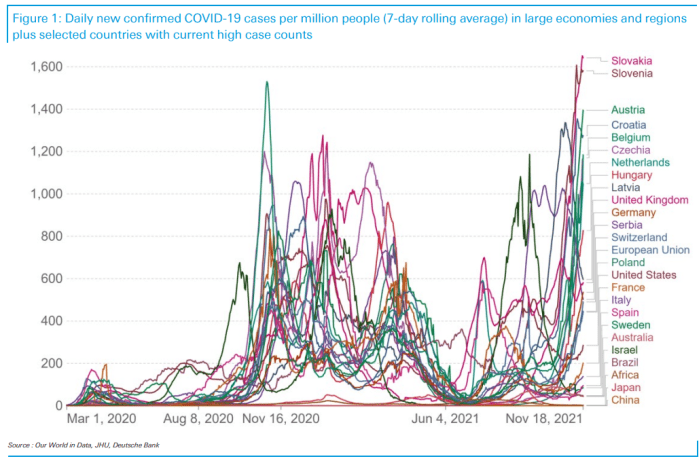

“The news is hitting European markets hard…as fears mount that the virus and restrictions will spread across the continent again,” said Deutsche Bank strategist Jim Reid, in a note. He provided the below chart showing where some of the biggest waves have been occurring in Europe, with Eastern Europe bearing the brunt.

Uncredited

“For most of the countries near the top, the spike in cases has occurred fairly rapidly over the last couple of weeks. The exception is the U.K. where cases have been high and steady since the summer as high vaccination rates plus high infection rates have seemingly provided some degree of herd immunity,” said Reid in a note, adding that the trend is higher.

“The major risk is that not only growth will be directly affected by government decisions, but also that consumer confidence will be strongly affected as well. And with private consumption expected to be the major contributor to growth next year, looming decisions on restrictions do not bode well for the European outlook,” said Nicola Nobile, chief Italian economist at Oxford Economics, in a note.

While it could take some time for countries such as Germany to figure out what measures to take and reach political consensus, “it is clear that the tide has turned, with some restrictions likely to be introduced sooner or later in some other eurozone countries,” Nobile said.

European Central Bank President Christine Lagarde said Friday that it was “unlikely” the bank will raise interest rates next year, even as other central banks are withdrawing stimulus. She also said high oil and gas prices should start to subside in coming months, but the bank wouldn’t rush into “premature” tightening when faced with passing or supply-driven inflation shocks.

Among stocks weighing on the downside, the energy sector was retreating on the back of tumbling oil

CL00,

BRN00,

which was sinking on fears of slower demand from Europe amid COVID-19 restrictions. BP shares fell 3% and Royal Dutch Shell

RDSA,

RDS.A,

dropped 2.6%.

Banks were also under pressure, with Deutsche Bank

DB,

DBK,

down nearly 5%, Commerzbank

CBK,

off over 4% and UniCredit

UCG,

losing 6%.

Travel stocks were also hit hard, with Wizz Air Holdings

WIZZ,

International Consolidated Airlines

IAG,

falling 3.8%, Deutsche Lufthansa

LHA,

and Carnival

CCL,

down over 3% each.